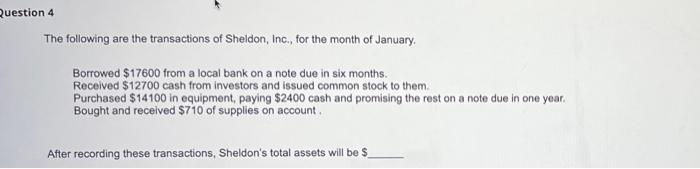

Question: can someone please explain how to do this? im confused The following are the transactions of Sheldon, Inc., for the month of January. Borrowed $17600

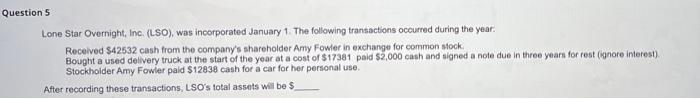

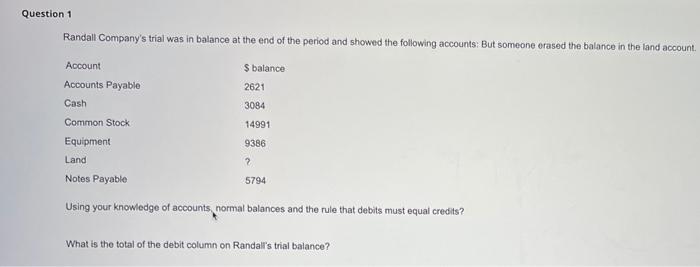

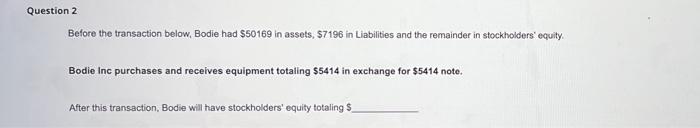

The following are the transactions of Sheldon, Inc., for the month of January. Borrowed $17600 from a local bank on a note due in six months. Received $12700 cash from investors and issued common stock to them. Purchased $14100 in equipment, paying $2400 cash and promising the rest on a note due in one year. Bought and recelved $710 of supplies on account . After recording these transactions, Sheldon's total assets will be $ Lone Star Overnight, Inc. (LSO), was incorporated January 1. The following transactions occurred during the year: Recelved $42532 cash from the company's shareholder Amy Fower in exchange for common stock. Bought a used delivery truck at the start of the year at a cost of $17381 paid $2,000 cash and signed a note due in three years for rest (ignore interest) Stockhoider Amy Fowler pald $12838 cash for a car for her personal use. After recording these transactions, LSO's total assets will be ? Randall Company's trial was in balance at the end of the period and showed the following accounts: But someone orased the balance in the land account Using your knowledge of accounts, normal balances and the rule that debits must equal credits? What is the total of the debit column on Randali's trial balance? Before the transaction below, Bodie had $50169 in assets, $7196 in Liabilities and the remainder in stockholders' equity. Bodie inc purchases and receives equipment totaling $5414 in exchange for $5414 note. After this transaction, Bodie will have stockholders' equity totaling

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts