Question: Can someone please explain how to get the answer? Thanks ! 10 PC, Inc., has a stamping machine which is 5 years old and which

Can someone please explain how to get the answer? Thanks !

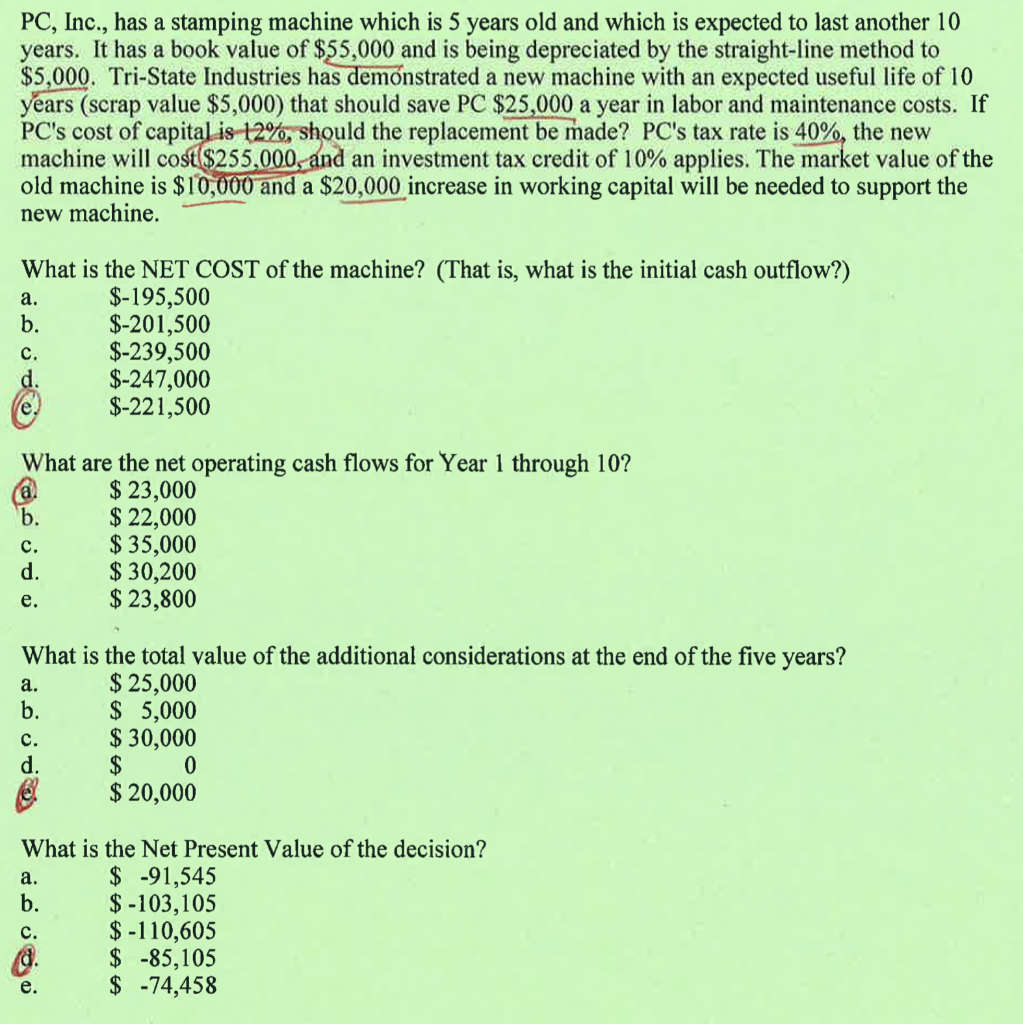

10 PC, Inc., has a stamping machine which is 5 years old and which is expected to last another 10 years. It has a book value of $55,000 and is being depreciated by the straight-line method to $5,000. Tri-State Industries has demonstrated a new machine with an expected useful life of 10 years (scrap value $5,000) that should save PC $25,000 a year in labor and maintenance costs. If PC's cost of capital is 12%, should the replacement be made? PC's tax rate is 40%, the new machine will cost $255,000, and an investment tax credit of 10% applies. The market value of the old machine is $10,000 and a $20,000 increase in working capital will be needed to support the new machine. soo What is the NET COST of the machine? (That is, what is the initial cash outflow?) $-195,500 $-201,500 c. $-239,500 $-247,000 $-221,500 What are the net operating cash flows for Year 1 through 10? $ 23,000 $ 22,000 $ 35,000 $ 30,200 e. $ 23,800 soov What is the total value of the additional considerations at the end of the five years? $ 25,000 $ 5,000 $ 30,000 $ 0 $ 20,000 co ooo What is the Net Present Value of the decision? $ -91,545 $-103,105 $-110,605 $ -85,105 $ -74,458

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts