Question: Part I Multiple Choices (5 points each) 1. If a firm decreases its dividend reinvestment rate (plowback ratio), then, all else equal, which of the

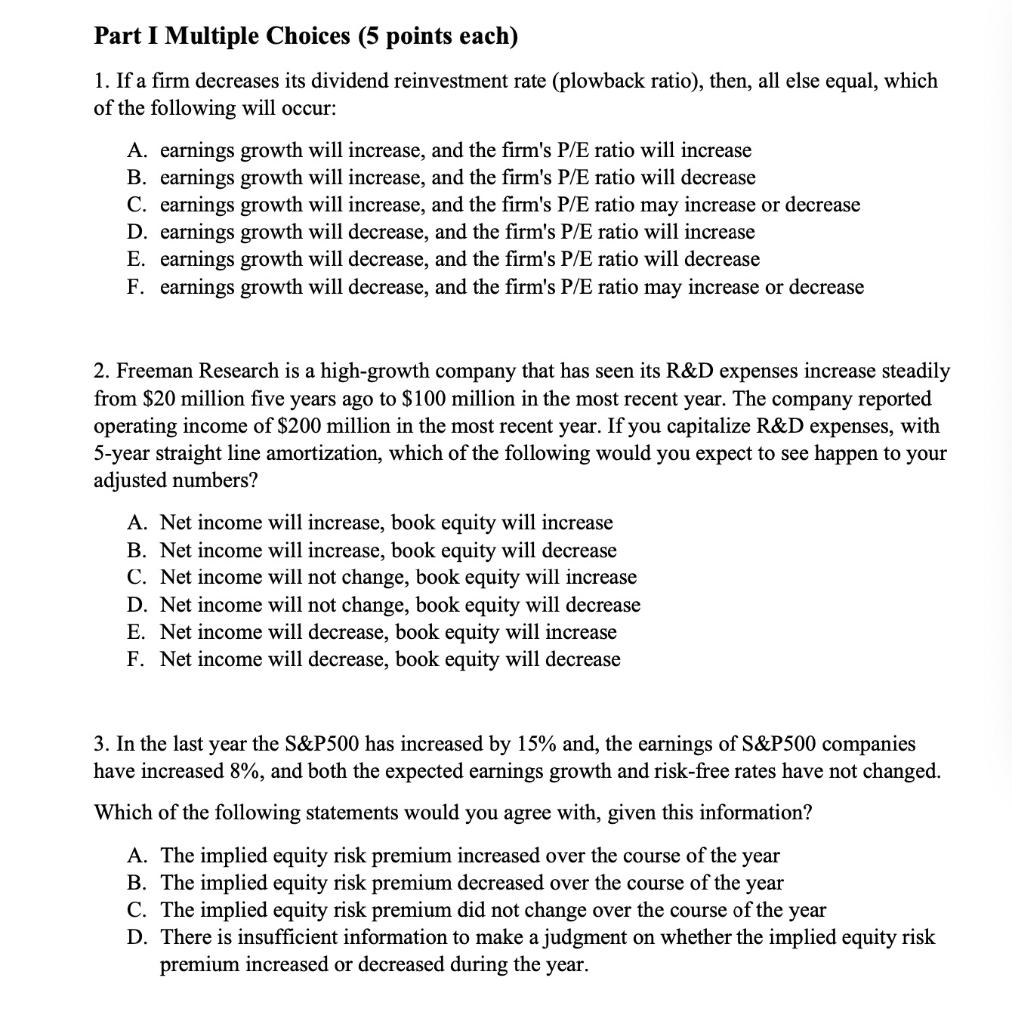

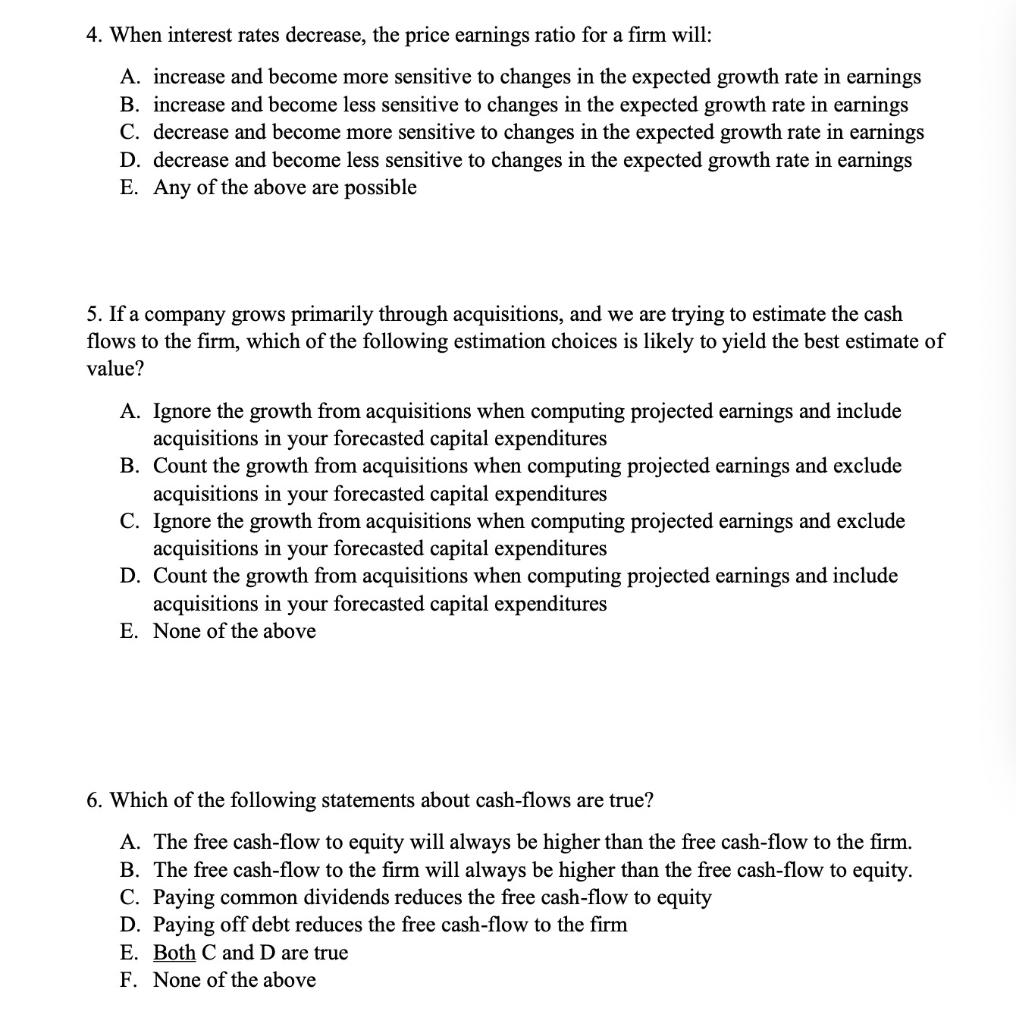

Part I Multiple Choices (5 points each) 1. If a firm decreases its dividend reinvestment rate (plowback ratio), then, all else equal, which of the following will occur: A. earnings growth will increase, and the firm's P/E ratio will increase B. earnings growth will increase, and the firm's P/E ratio will decrease C. earnings growth will increase, and the firm's P/E ratio may increase or decrease D. earnings growth will decrease, and the firm's P/E ratio will increase E. earnings growth will decrease, and the firm's P/E ratio will decrease F. earnings growth will decrease, and the firm's P/E ratio may increase or decrease 2. Freeman Research is a high-growth company that has seen its R&D expenses increase steadily from $20 million five years ago to $100 million in the most recent year. The company reported operating income of $200 million in the most recent year. If you capitalize R&D expenses, with 5-year straight line amortization, which of the following would you expect to see happen to your adjusted numbers? A. Net income will increase, book equity will increase B. Net income will increase, book equity will decrease C. Net income will not change, book equity will increase D. Net income will not change, book equity will decrease E. Net income will decrease, book equity will increase F. Net income will decrease, book equity will decrease 3. In the last year the S&P500 has increased by 15% and, the earnings of S&P500 companies have increased 8%, and both the expected earnings growth and risk-free rates have not changed. Which of the following statements would you agree with, given this information? A. The implied equity risk premium increased over the course of the year B. The implied equity risk premium decreased over the course of the year C. The implied equity risk premium did not change over the course of the year D. There is insufficient information to make a judgment on whether the implied equity risk premium increased or decreased during the year. 4. When interest rates decrease, the price earnings ratio for a firm will: A. increase and become more sensitive to changes in the expected growth rate in earnings B. increase and become less sensitive to changes in the expected growth rate in earnings C. decrease and become more sensitive to changes in the expected growth rate in earnings D. decrease and become less sensitive to changes in the expected growth rate in earnings E. Any of the above are possible 5. If a company grows primarily through acquisitions, and we are trying to estimate the cash flows to the firm, which of the following estimation choices is likely to yield the best estimate of value? A. Ignore the growth from acquisitions when computing projected earnings and include acquisitions in your forecasted capital expenditures B. Count the growth from acquisitions when computing projected earnings and exclude acquisitions in your forecasted capital expenditures C. Ignore the growth from acquisitions when computing projected earnings and exclude acquisitions in your forecasted capital expenditures D. Count the growth from acquisitions when computing projected earnings and include acquisitions in your forecasted capital expenditures E. None of the above 6. Which of the following statements about cash-flows are true? A. The free cash-flow to equity will always be higher than the free cash-flow to the firm. B. The free cash-flow to the firm will always be higher than the free cash-flow to equity. C. Paying common dividends reduces the free cash-flow to equity D. Paying off debt reduces the free cash-flow to the firm E. Both C and D are true F. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts