Question: Can someone please explain? I'm so confused! Compute the additional Medicare tax for the following taxpayers. If required, round your answers to the nearest dollar.

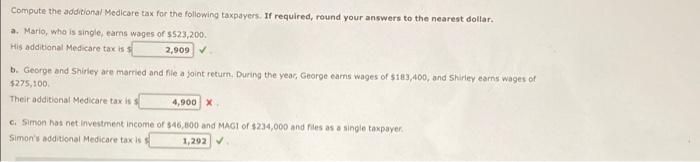

Compute the additional Medicare tax for the following taxpayers. If required, round your answers to the nearest dollar. a. Mario, who is single, carns wages of 5523,200 His additional Medicare tacis s 2,909 b. George and Shirley are married and file a joint return. During the year, George earns wages of $183,400, and Shirley earns wages of $275,100 Their additional Medicare taxis 4,900 X C. Simon hos net investment income of $46,000 and MAGI of $234,000 and les as a single taxpayer Simon's additional Medicare taxis 1,292

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts