Question: can someone please explain thoroughly how they got 12.39% ? how do you calculate what the indifferent discount rate is? I rate! :) 4. A

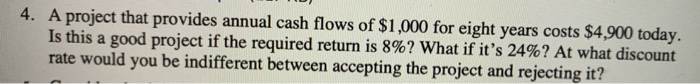

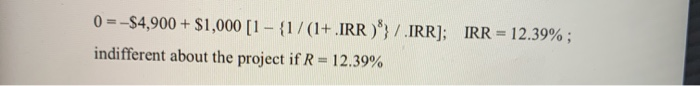

4. A project that provides annual cash flows of $1,000 for eight years costs $4,900 today. Is this a good project if the required return is 8%? What if it's 24%? At what discount rate would you be indifferent between accepting the project and rejecting it? 0 =-$4,900 + $1,000 [1 - {1/(1+.IRR)}/IRR); IRR = 12.39% ; indifferent about the project if R = 12.39%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts