Question: can someone please help answer these? thank you Using the free cash flow valuation model to price an IPO Personal Finance Problem Assume that you

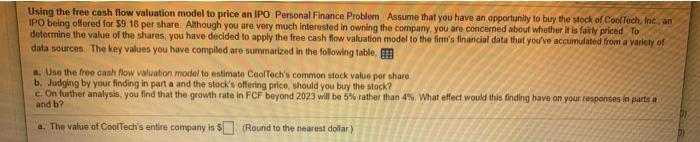

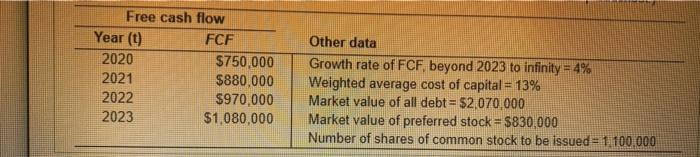

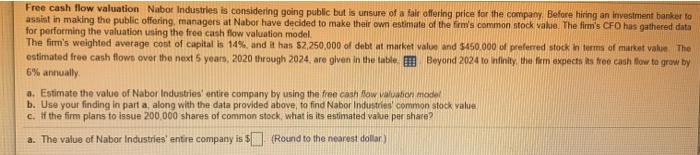

Using the free cash flow valuation model to price an IPO Personal Finance Problem Assume that you have an opportunity to buy the stock of CoolTech, Inc. an IPO being offered for $9 18 per share Although you are very much interested in owning the company, you are concerned about whether it is farly priced To determine the value of the shares, you have decided to apply the free cash flow valuation model to the firm's financial data that you've accumulated from a variety of data sources. The key values you have compiled are summarized in the following table, a. Use the free cash flow valuabon model to estimate CoolTech's common stock value por share b. Judging by your finding in parta and the stock's offering price, should you buy the stock? c. On further analysis, you find that the growth rate in FCF beyond 2023 will be 5% rather than 4% What effect would this finding have on your responses in parts a and b? a. The value of Cool Tech's entire company is $. Round to the nearest dollar) Free cash flow Year (t) FCF 2020 $750,000 2021 $880.000 2022 $970,000 2023 $1,080,000 Other data Growth rate of FCF beyond 2023 to infinity = 4% Weighted average cost of capital = 13% Market value of all debt = $2.070,000 Market value of preferred stock = $830,000 Number of shares of common stock to be issued = 1.100.000 Free cash flow valuation Nabor Industries is considering going public but is unsure of a fair offering price for the company Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm's common stock value. The firm's CFO has gathered data for performing the valuation using the free cash flow valuation model The firm's weighted average cost of capital is 14%, and it has 52,250,000 of debt at market value and $450.000 of preferred stock in terms of market value The estimated free cash flows over the next 5 years, 2020 through 2024 are given in the table. Beyond 2024 to infinity, the fim expects is free cash flow to grow by 6% annually a. Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model b. Use your finding in part a, along with the data provided above, to find Nabor Industries common stock value c. If the firm plans to issue 200,000 shares of common stock, what is its estimated value per share? 2. The value of Nabor Industries' entire company is 5 (Round to the nearest dollar) Year (1) 2020 2021 2022 2023 2024 Free cash flow (FCA) $240,000 $320,000 $380.000 $410,000 $480.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts