Question: Please answer amd show all work please 2. An analyst wants to use the Black-Scholes model to value call options on the stock of Heath

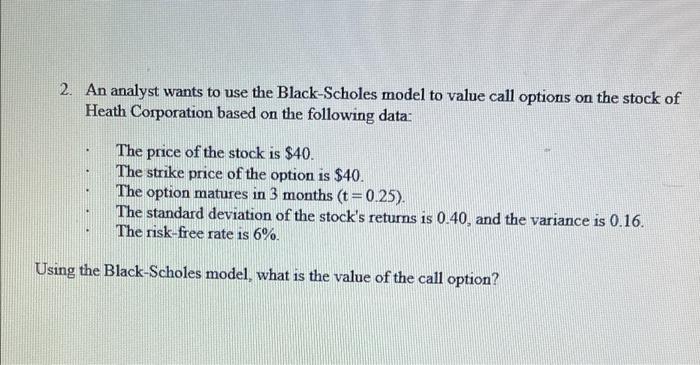

2. An analyst wants to use the Black-Scholes model to value call options on the stock of Heath Corporation based on the following data: The price of the stock is $40. The strike price of the option is $40. The option matures in 3 months (t = 0.25). The standard deviation of the stock's returns is 0.40, and the variance is 0.16. The risk-free rate is 6%. Using the Black-Scholes model, what is the value of the call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts