Question: Can someone please help me and explain how they got marginal tax rate? Having trouble knowing where $44,000 came from. - Bill and Mercedes have

Can someone please help me and explain how they got marginal tax rate? Having trouble knowing where $44,000 came from.

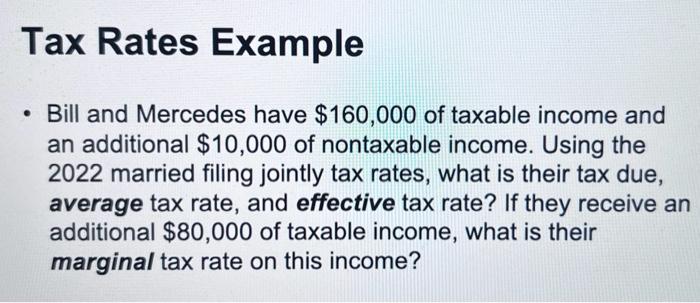

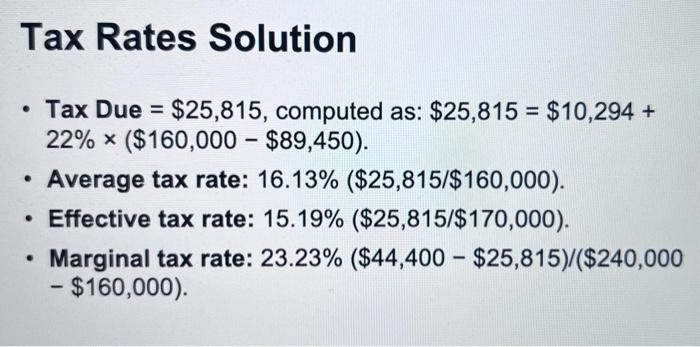

- Bill and Mercedes have $160,000 of taxable income and an additional $10,000 of nontaxable income. Using the 2022 married filing jointly tax rates, what is their tax due, average tax rate, and effective tax rate? If they receive an additional $80,000 of taxable income, what is their marginal tax rate on this income? - Tax Due =$25,815, computed as: $25,815=$10,294+ 22%($160,000$89,450). - Average tax rate: 16.13%($25,815/$160,000). - Effective tax rate: 15.19%($25,815/$170,000). - Marginal tax rate: 23.23%($44,400$25,815)/($240,000 - $160,000)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock