Question: can someone please help me make an adjusting entries for the month of june with this information??? SOS Is Return to Blackboard Kimmel, Financial Accounting,

can someone please help me make an adjusting entries for the month of june with this information??? SOS

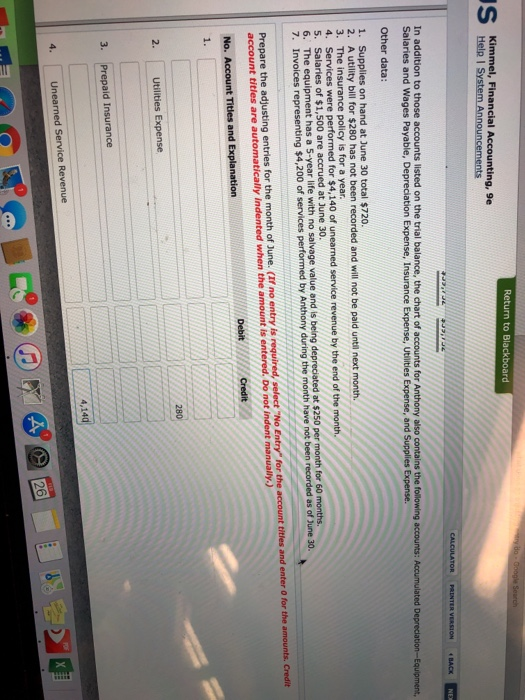

can someone please help me make an adjusting entries for the month of june with this information??? SOSIs Return to Blackboard Kimmel, Financial Accounting, 9e Help System Announcements 2.14 23:13 CALCULATOR INTER VERSION RACE In addition to those accounts listed on the trial balance, the chart of accounts for Anthony also contains the following accounts: Accumulated Depreciation Equipmen Salaries and Wages Payable, Depreciation Expense, Insurance Expense, Utilities Expense, and Supplies Expense. Other data: 1. Supplies on hand at June 30 total $720. 2. A utility bill for $280 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. Services were performed for $4,140 of unearned service revenue by the end of the month 5. Salaries of $1,500 are accrued at June 30. 6. The equipment has a 5-year life with no salvage value and is being depreciated at $250 per month for 60 months 7. Invoices representing $4,200 of services performed by Anthony during the month have not been recorded as of June 30. Prepare the adjusting entries for the month of June. (If no entry is required, select "No Entry for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit Utilities Expense 3. Prepaid Insurance 4,140 Unearned Service Revenue Is Return to Blackboard Kimmel, Financial Accounting, 9e Help System Announcements 2.14 23:13 CALCULATOR INTER VERSION RACE In addition to those accounts listed on the trial balance, the chart of accounts for Anthony also contains the following accounts: Accumulated Depreciation Equipmen Salaries and Wages Payable, Depreciation Expense, Insurance Expense, Utilities Expense, and Supplies Expense. Other data: 1. Supplies on hand at June 30 total $720. 2. A utility bill for $280 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. Services were performed for $4,140 of unearned service revenue by the end of the month 5. Salaries of $1,500 are accrued at June 30. 6. The equipment has a 5-year life with no salvage value and is being depreciated at $250 per month for 60 months 7. Invoices representing $4,200 of services performed by Anthony during the month have not been recorded as of June 30. Prepare the adjusting entries for the month of June. (If no entry is required, select "No Entry for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit Utilities Expense 3. Prepaid Insurance 4,140 Unearned Service Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts