Question: can someone please help me, I been posting the same question few times now and nobody is getting back to me, how long does it

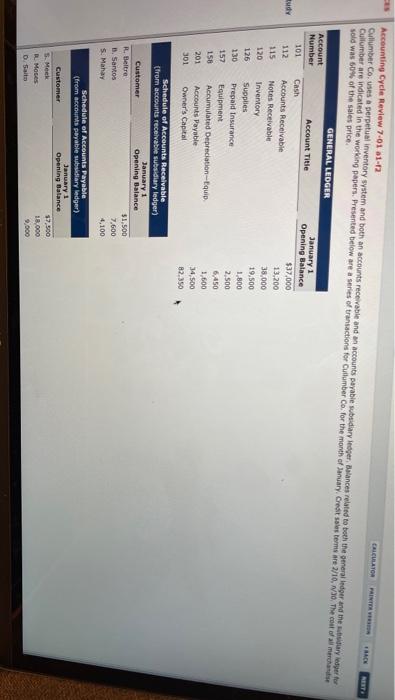

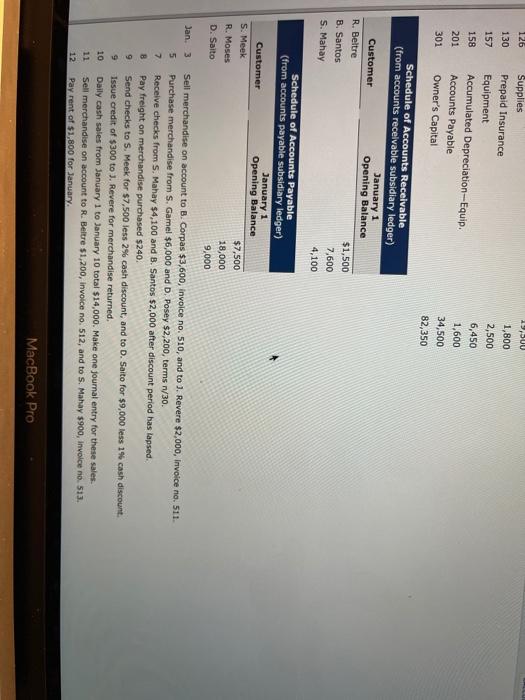

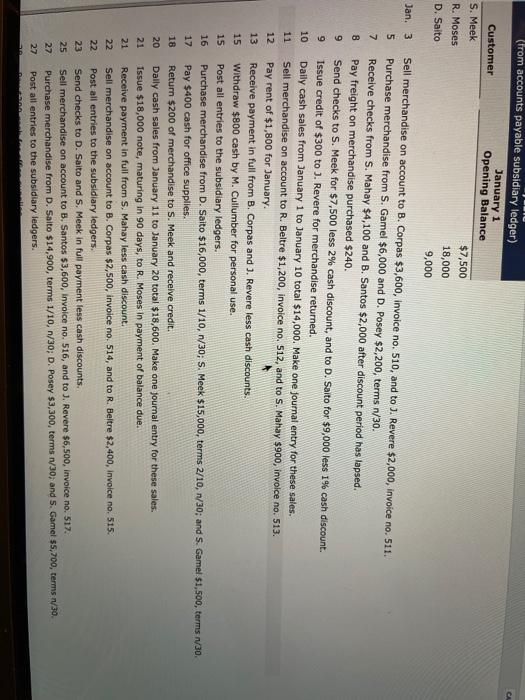

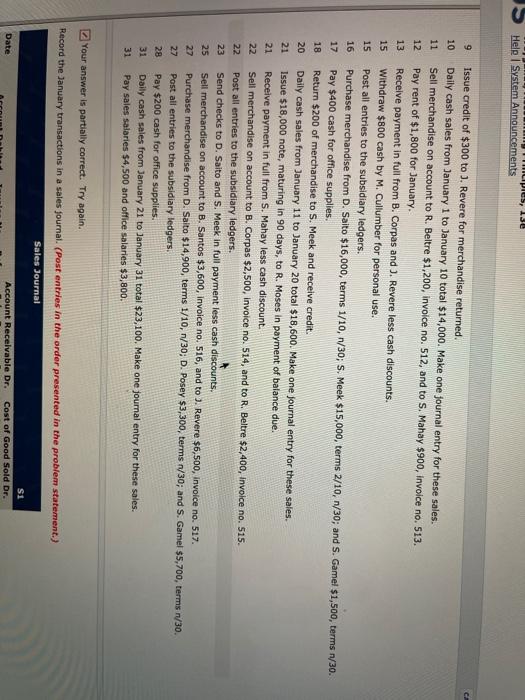

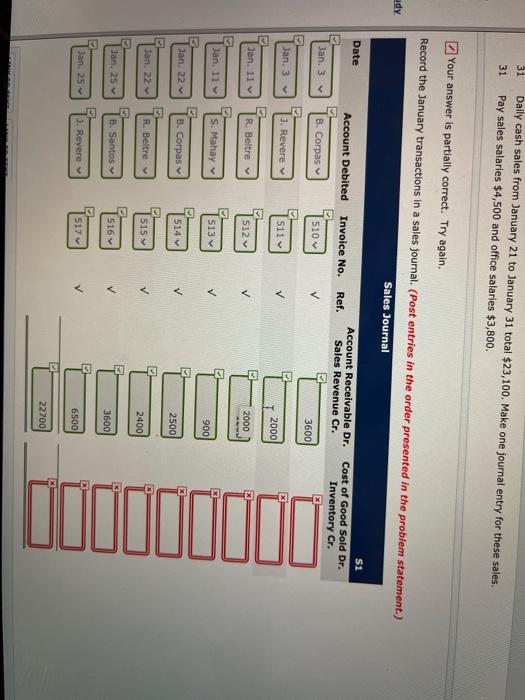

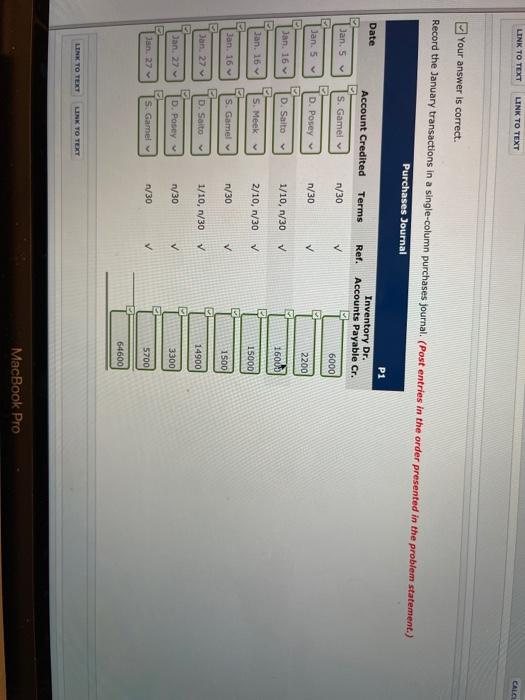

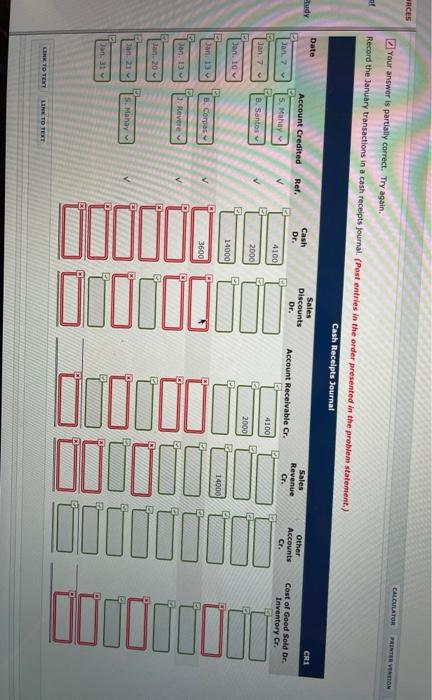

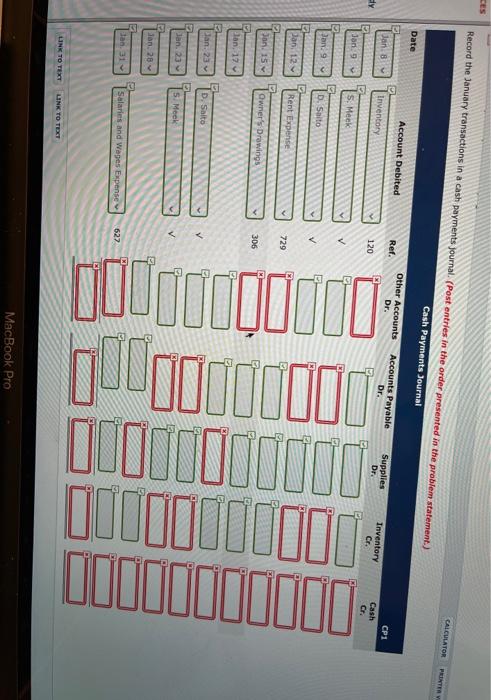

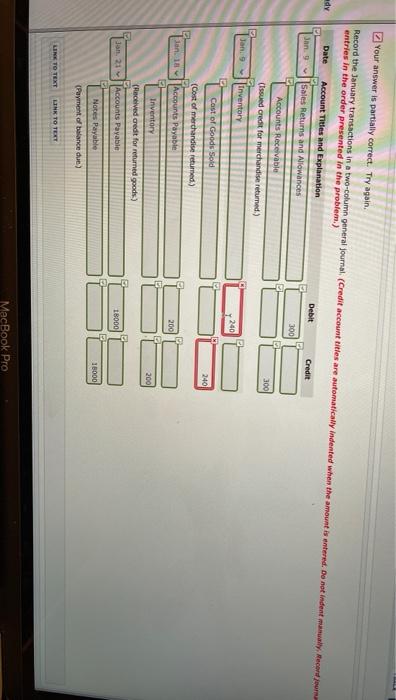

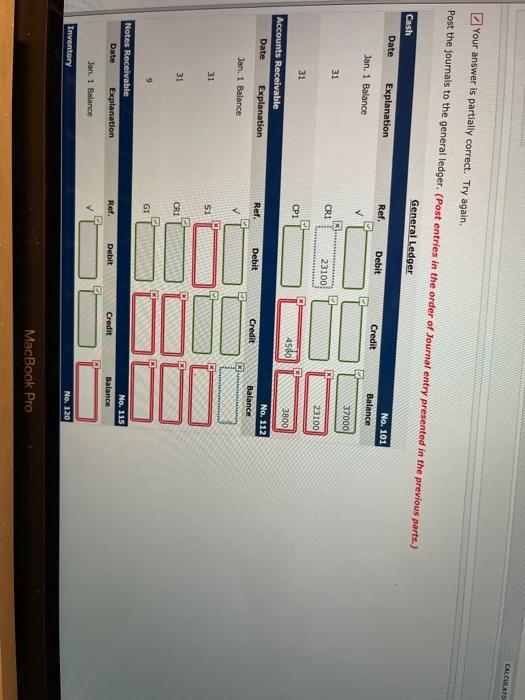

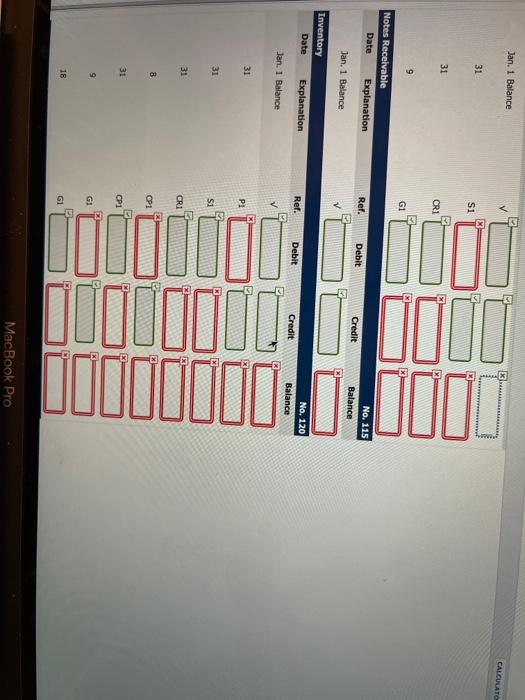

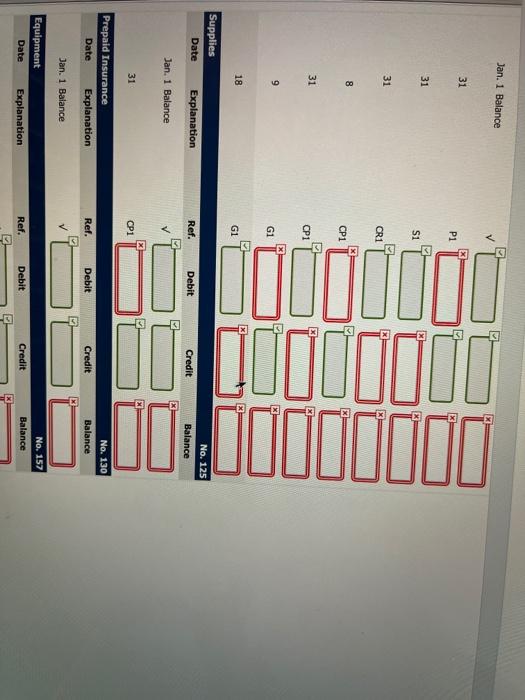

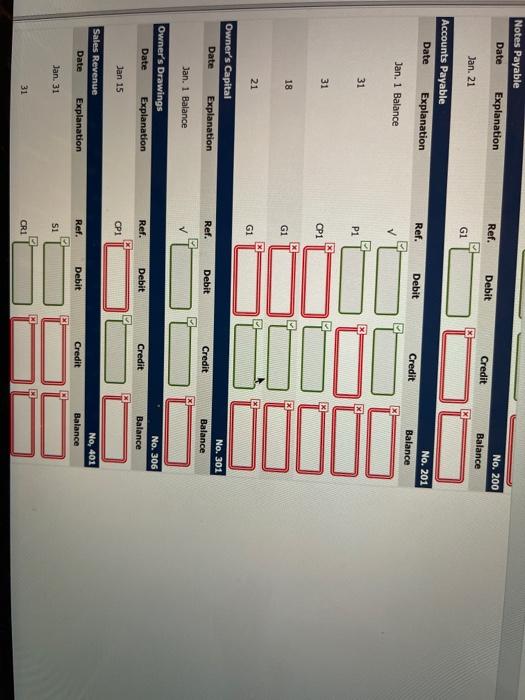

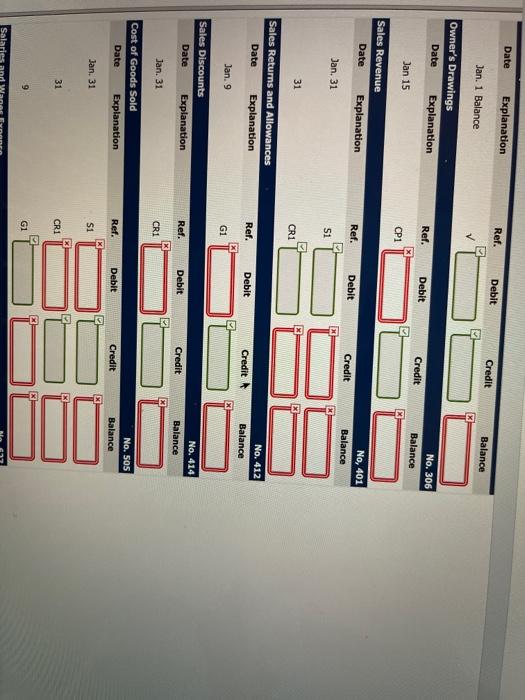

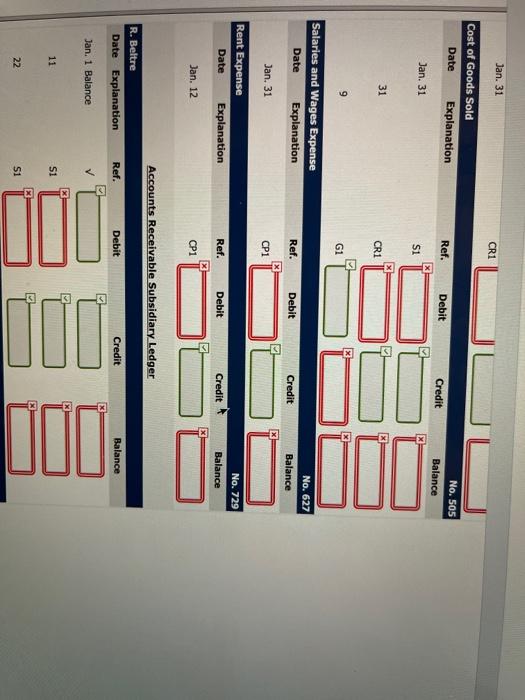

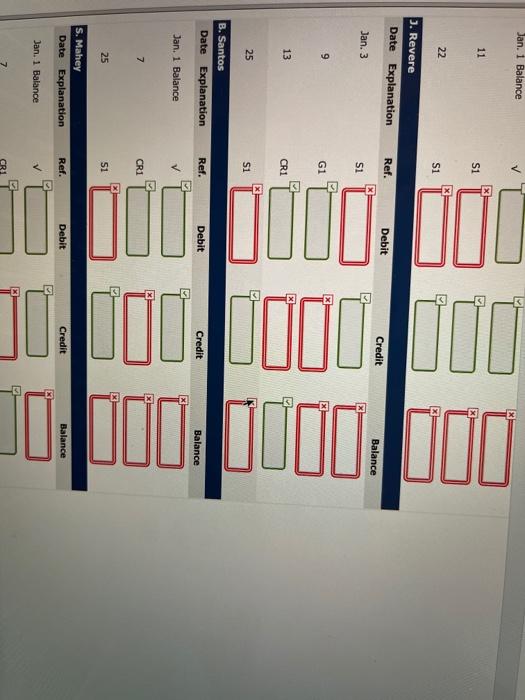

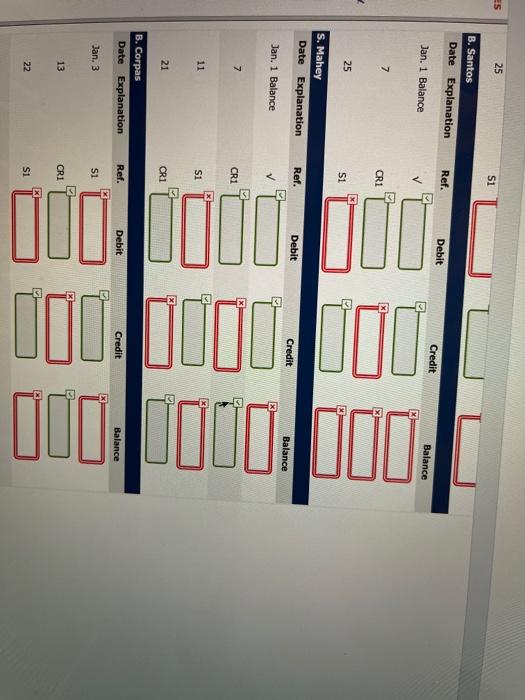

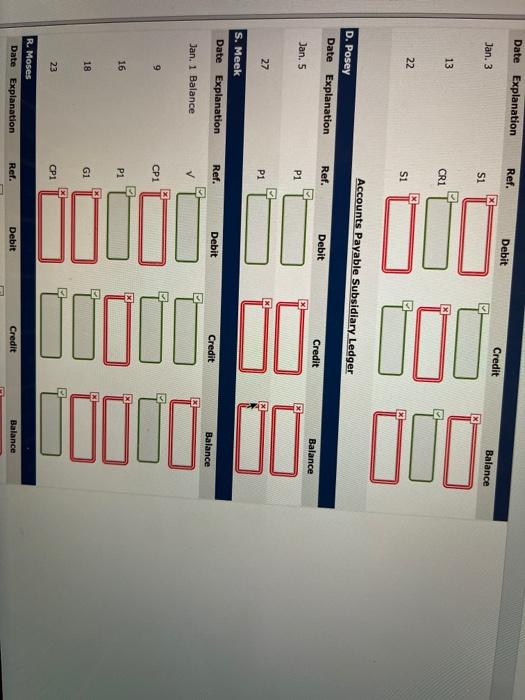

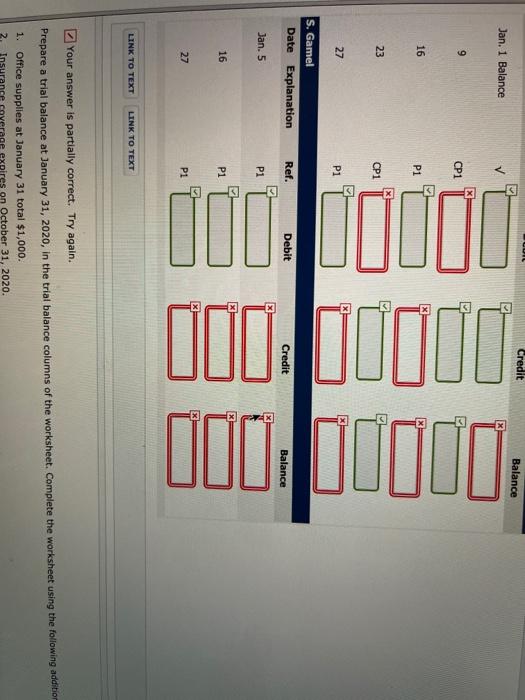

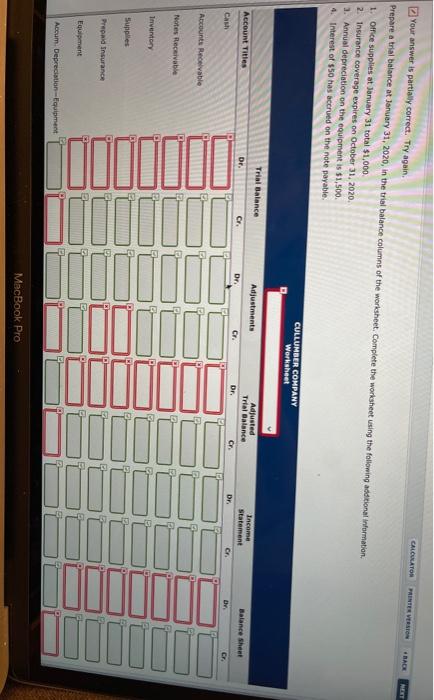

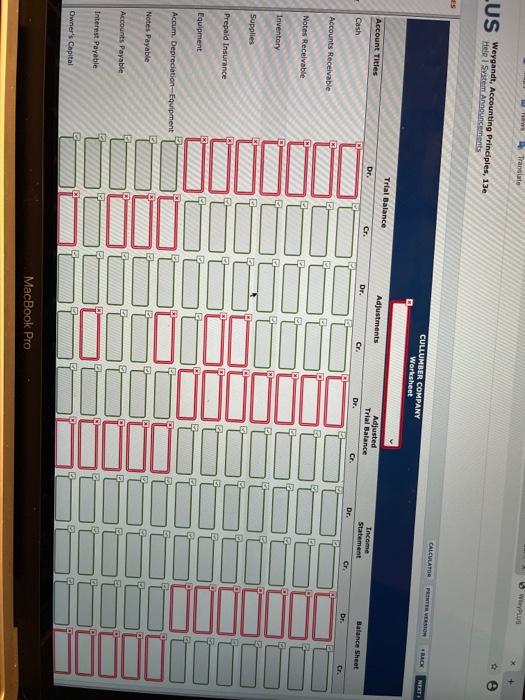

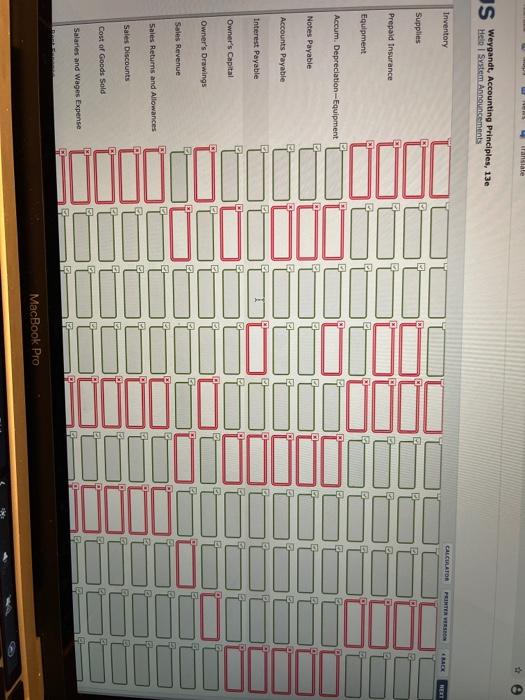

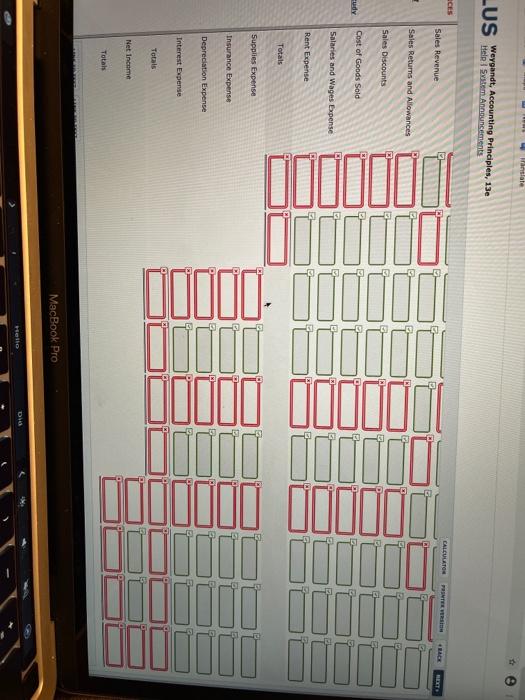

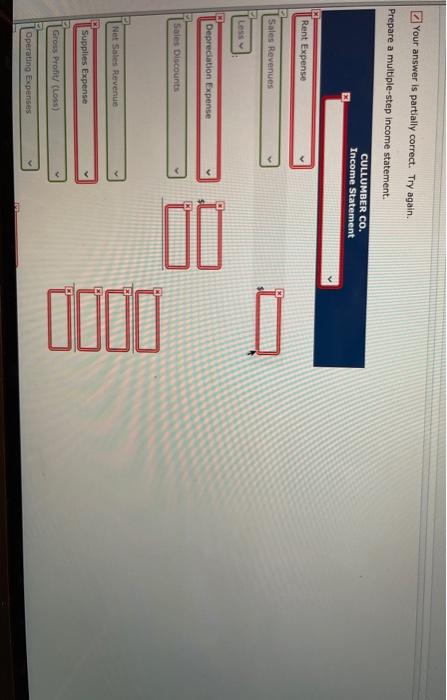

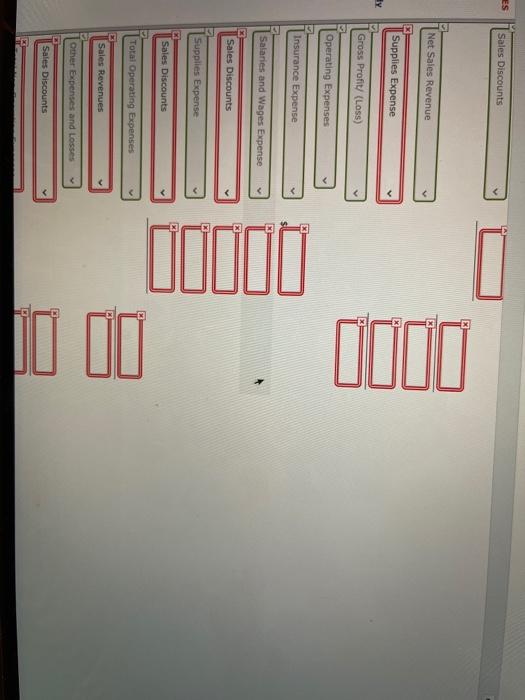

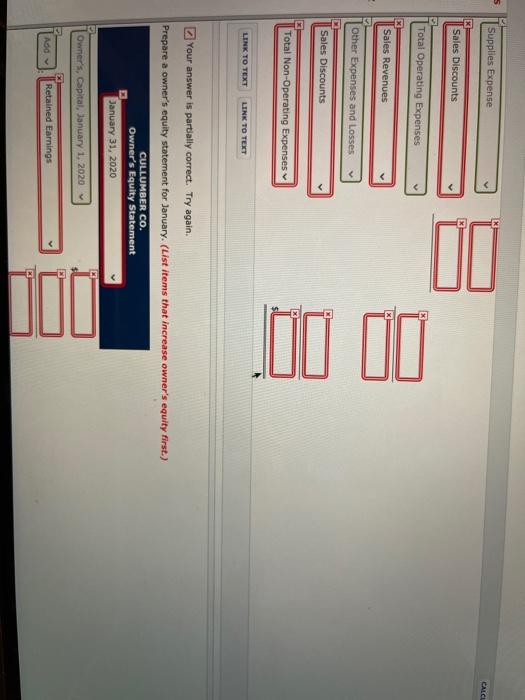

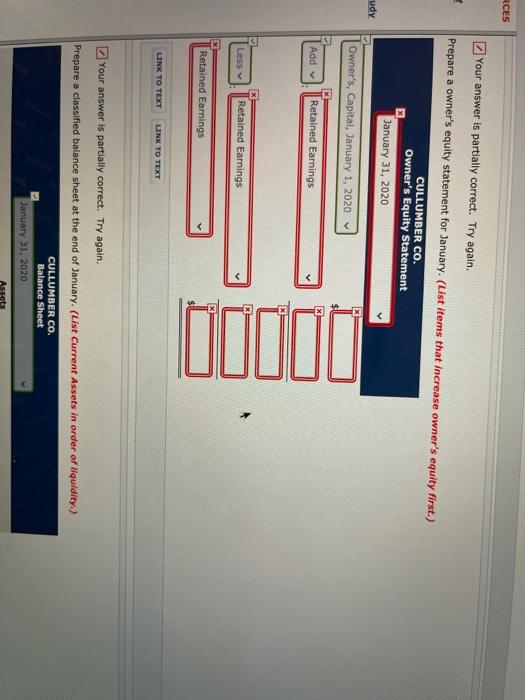

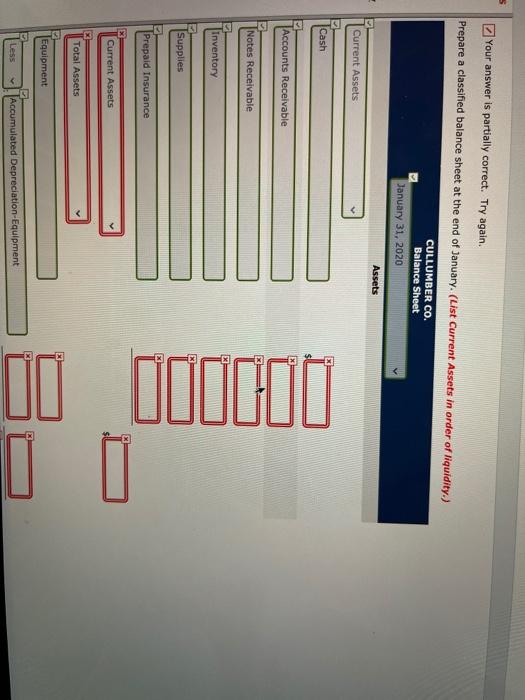

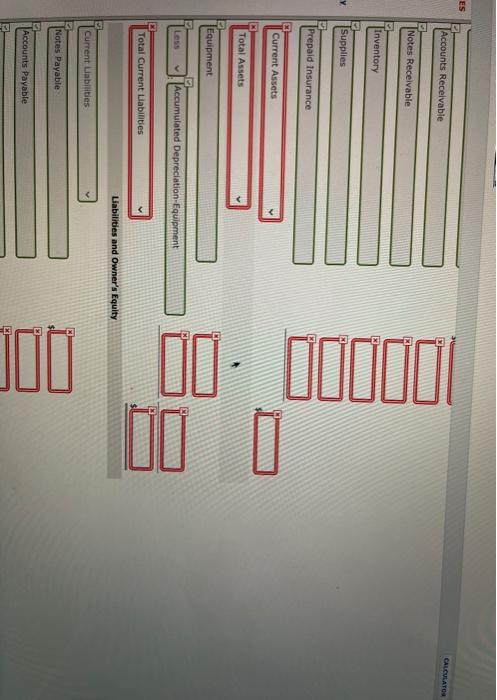

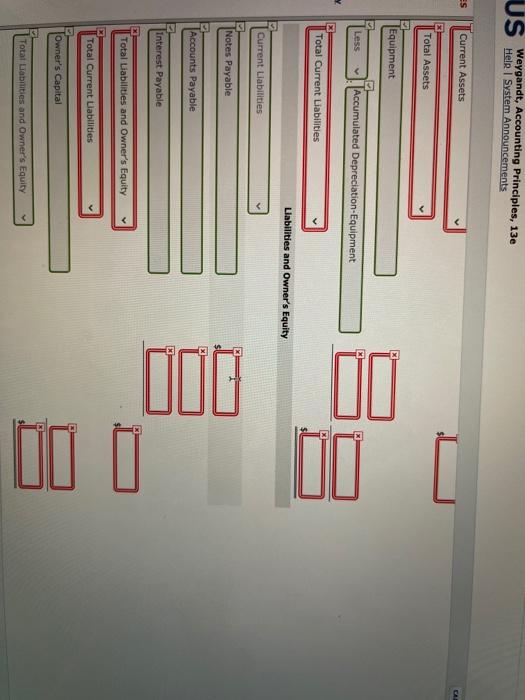

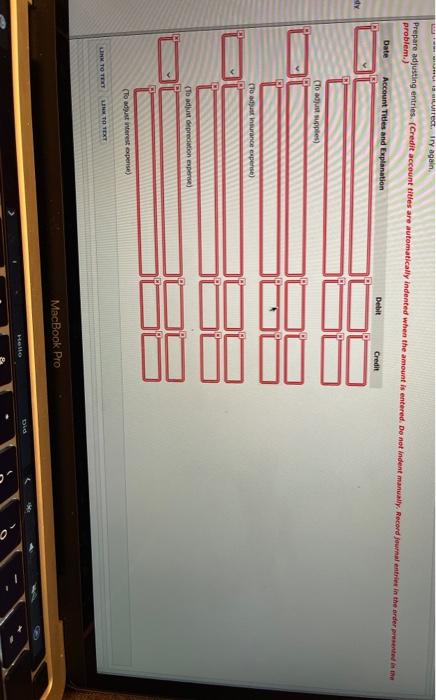

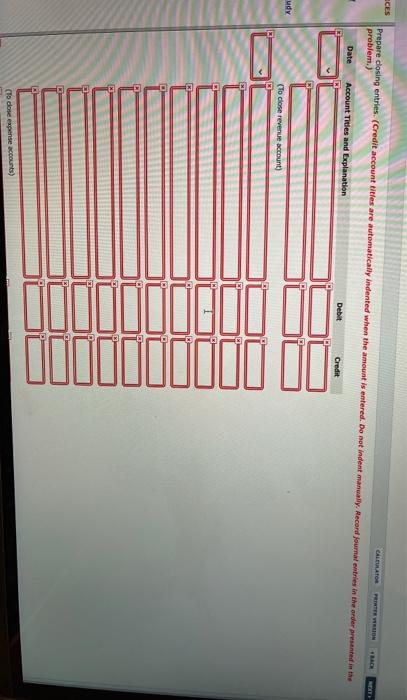

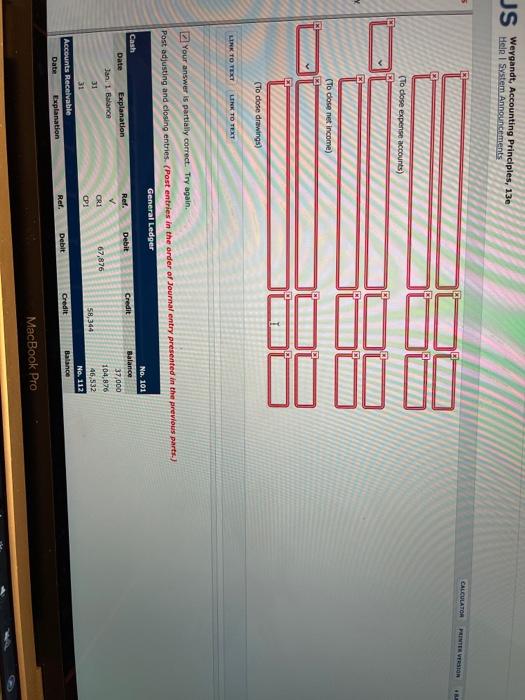

tudy Accounting Cycle Review 7-01 1-12 CALCULATOR Cullumber Coutes a perpetual inventory system and both an accounts receivable and an accounts payable subsidiary leaper Balances related to both the general ledger and the respeto MERT Culomber are indicated in the working papers. Presented below are a series of transactions for Cullumber Co. for the month of January. Credit sal terms are 2/10, 30. The commerchand sold was 60% of the sales price GENERAL LEDGER Account Number Account Title January 1 Opening Balance 101 Cash $37,000 112 Accounts Receivable 115 13,200 Notes Receivable 120 38,000 Inventory 19,500 126 Supplies 1 800 130 Prepaid Insurance 2.500 157 Equipment 6,450 156 Accumulated Depreciation Equip 1,600 201 Accounts Payable 34,500 301 Owner's Capital 82.350 Schedule of Accounts Receivable (from accounts receivable subsidiary ledger) January 1 Customer Opening Balance R. Beltre $1,500 B. Santos 7,600 5. Mahay 4,100 Schedule of Accounts Payable (from accounts payable subsidiary ledger) January 1 Customer Opening Balance 17.500 BL Moses 18.000 9,000 126 19 DUV 130 157 158 Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equip. Accounts Payable Owner's Capital 1,800 2,500 6,450 1,600 34,500 82,350 201 301 Schedule of Accounts Receivable (from accounts receivable subsidiary ledger) January 1 Customer Opening Balance R. Beltre $1,500 B. Santos 7,600 S. Mahay 4,100 Schedule of Accounts Payable (from accounts payable subsidiary ledger) January 1 Customer Opening Balance S. Meek $7,500 R. Moses 18,000 D. Saito 9,000 Jan. 3 5 7 B 9 Sell merchandise on account to B. Corpas $3,600, Invoice no. 510, and to J. Revere $2,000, Invoice no. 511 Purchase merchandise from S. Gamel $6,000 and D. Posey $2,200, terms 1/30. Receive checks from S. Mahay $4,100 and B. Santos $2,000 after discount period has lapsed Pay freight on merchandise purchased $240. Send checks to S. Meek for $7.500 less 2% cash discount, and to D. Saito for $9,000 less 1% cash discount. Issue credit of $300 to J. Revere for merchandise returned. Daily cash sales from January 1 to January 10 total $14,000. Make one journal entry for these sales Sell merchandise on account to R. Beltre $1,200, Invoice no. 512, and to S. Mahay $900, Invoice no. 513. Pay rent of $1,800 for January 9 10 11 12 MacBook Pro (trom accounts payable subsidiary ledger) January 1 Customer Opening Balance S. Meek $7,500 R. Moses 18,000 D. Saito 9,000 Jan. 3 Sell merchandise on account to B. Corpas $3,600, invoice no. 510, and to J. Revere $2,000, invoice no. 511. 5 Purchase merchandise from S. Gamel $6,000 and D. Posey $2,200, terms /30. 7 Receive checks from S. Mahay $4,100 and B. Santos $2,000 after discount period has lapsed. B Pay freight on merchandise purchased $240. 9 Send checks to S. Meek for $7,500 less 2% cash discount, and to D. Saito for $9,000 less 1% cash discount. 9 Issue credit of $300 to J. Revere for merchandise returned. 10 Daily cash sales from January 1 to January 10 total $14,000. Make one journal entry for these sales. 11 Sell merchandise on account to R. Beltre $1,200, invoice no. 512, and to S. Mahay $900, involce no. 513. 12 Pay rent of $1,800 for January 13 Receive payment in full from B. Corpas and ). Revere less cash discounts. 15 Withdraw $800 cash by M. Cullumber for personal use. Post all entries to the subsidiary ledgers. 16 Purchase merchandise from D. Saito $16,000, terms 1/10, 1/30; S. Meek $15,000, terms 2/10, 1/30; and S. Gemel $1,500, terms 1/30 17 Pay $400 cash for office supplies. 18 Return $200 of merchandise to S. Meek and receive credit. 20 Daily cash sales from January 11 to January 20 total $18,600. Make one journal entry for these sales. 21 Issue $18,000 note, maturing in 90 days, to R. Moses in payment of balance due. 21 Receive payment in full from S. Mahay less cash discount. 22 Sell merchandise on account to B. Corpas $2,500, invoice no. 514, and to R. Beltre $2,400, Invoice no. 515. 22 Post all entries to the subsidiary ledgers. 23 Send checks to D. Saito and S. Meek in full payment less cash discounts. 25 Sell merchandise on account to B. Santos $3,600, Invoice no. 516, and to J. Revere $6,500, invoice no. 517. 27 Purchase merchandise from D. Saito $14,900, terms 1/10, 1/30; D. Posey $3,300, terms 1/30, and S. Gamel $5,700, terms 1/30 27 Post all entries to the subsidiary ledgers. S Help System Announcements W LIPIES, 130 9 Issue credit of $300 to J. Revere for merchandise returned. 10 Daily cash sales from January 1 to January 10 total $14,000. Make one journal entry for these sales. 11 Sell merchandise on account to R. Beltre $1,200, invoice no. 512, and to S. Mahay $900, invoice no. 513. 12 Pay rent of $1,800 for January 13 Receive payment in full from B. Corpas and ). Revere less cash discounts. 15 Withdraw $800 cash by M. Cullumber for personal use. 15 Post all entries to the subsidiary ledgers. 16 Purchase merchandise from D. Saito $16,000, terms 1/10, 1/30; S. Meek $15,000, terms 2/10, 1/30; and S. Gamel $1,500, terms n/30. 17 Pay $400 cash for office supplies. 18 Return $200 of merchandise to S. Meek and receive credit 20 Daily cash sales from January 11 to January 20 total $18,600. Make one journal entry for these sales. 21 Issue $18,000 note, maturing in 90 days, to R. Moses in payment of balance due. 21 Receive payment in full from S. Mahay less cash discount. 22 Sell merchandise on account to B. Corpas $2,500, Invoice no. 514, and to R. Beltre $2,400, Invoice no. 515. 22 Post all entries to the subsidiary ledgers, 23 Send checks to D. Saito and S. Meek in full payment less cash discounts. 25 Sell merchandise on account to B. Santos $3,600, Invoice no. 516, and to ). Revere $6,500, Invoice no. 517. 27 Purchase merchandise from D. Saito $14,900, terms 1/10, 1/30; D. Posey $3,300, terms n/30; and S. Gamel $5,700, terms n/30. 27 Post all entries to the subsidiary ledgers. 28 Pay $200 cash for office supplies. 31 Daily cash sales from January 21 to January 31 total $23,100. Make one journal entry for these sales. 31 Pay sales salaries $4,500 and office salaries $3,800. Your answer is partially correct. Try again. Record the January transactions in a sales journal. (Post entries in the order presented in the problem statement.) Sales Journal Date Account Receivable Dr. Si Cost of Good Sold Dr. 31 Daily cash sales from January 21 to January 31 total $23,100. Make one journal entry for these sales. Pay sales salaries $4,500 and office salaries $3,800. 31 Your answer is partially correct. Try again. Record the January transactions in a sales journal. (Post entries in the order presented in the problem statement.) dy Sales Journal Date Account Debited Invoice No. Ref. Account Receivable Dr. Sales Revenue Cr. S1 Cost of Good Sold Dr. Inventory Cr. Jan. 3 B. Corpas 510 3600 Jan. 3 3. Revere 511 2000 Jan. 11 R. Beltre 512 2000 Jan. 11 S. Mahay 513 v 900 Jan. 22 B. Corpas 514 2500 Jan. 22 R Beltre 515 2400 Jan. 25 B. Santos 516 * 3600 Jan. 25 5. Revere 517 6500 22700 LINK TO TEXT LINK TO TEXT CALC Your answer is correct. Record the January transactions in a single-column purchases journal. (Post entries in the order presented in the problem statement.) Purchases Journal P1 Date Account Credited Terms Ref. Inventory Dr. Accounts Payable Cr. Jan. 5 S. Gamel n/30 6000 Jan. 5 D. Posey n/30 2200 Jan. 16 M D. Saito 1/10, 1/30 16005 Jan. 16 5. Meek 2/10, 1/30 15000 Jan. 16 S. Gamel n/30 1500 Jan 27 D. Saito 1/10, 1/30 14900 Jan 27 D. Posey n/30 3300 Jan 27 S. Gamel n/30 5700 64600 LINK TO TEXT UNK TO TEXT MacBook Pro ENCES Your answer is partially correct. Try again. CALCULATOR Record the January transactions in a cash receipts journal (Pest entries in the order presented in the problem statement.) Cash Receipts Journal Date tudy Account Credited CRI Ref. Cash Dr. Sales Discounts Dr. Sales Revenue Cr. Account Receivable Cr. Other Accounts Cr. Jo. 7 5. May Cost of Good Sold Dr. Inventory Cr. 4100 4100 Jan 7 B. Santos 2000 2000 Jan lov 14000 14000 3. Corps 3600 Jan. 1) 3. Revere Jan 20 Jan 21 S. Mahay Doddi 3an. 31 LINK TO TEXT LIRE TO TEXT Record the January transactions in a cash payments journal. (Post entries in the order presented in the problem statement.) Cash Payments Journal CALCULATOR Date Account Debited Ref. Other Accounts Dr. Jan 8 Accounts Payable Dr. Inventory Supplies Dr. CPI Ely 120 Inventory Cr. Cash Jon 9 S. Meck 10 Jan. 9 D. Saito All llll Jan 12 Rent Expense 729 Jan. 15 Owner's Drawings 306 on. 17 UUUUUUUUUUU Jan. 23 u D. Saito S. Meck Jan 28 Son 31 Salaries and Wages Expense 627 E LINK TO TEXT LINK TO TEXT MacBook Pro Your answer is partially correct. Try again. Record the January transactions in a two-column general journal (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit ady Sales Returns and Allowances 300 Accounts Receivable (issued credit for merchandise returned) 300 Jan 9 Inventory 240 Cast of Goods Sold 240 (Cost of merchandise returned) Jan Accounts Payable 200 Inventory (Received credit for returned goods.) 200 Jan 21 Accounts Payable 18000 Notes Payable 16000 (Payment of balance dut) LINE TO TEXT LINK TO TEXT MacBook Pro CALCULATO Your answer is partially correct. Try again. Post the journals to the general ledger. (Post entries in the order of Journal entry presented in the previous parts.) General Ledger Cash No. 101 Date Explanation Debit Credit Balance Jan. 1 Balance 37000 Ref. 31 CRI 23100 23100 31 CP1 4580 3800 Accounts Receivable Date Explanation Ref. Debit No. 112 Balance Credit Jan. 1 Balance 31 Si 31 CRI G1 Notes Receivable Date Explanation Ref. Debit Credit No. 115 Balance Jan. 1 Balance Inventory No. 120 MacBook Pro Jan. 1 Balance CALCULATO 31 si II 31 2 CR1 9 G1 Notes Receivable Date Explanation Debit Ref. 22 Credit No. 115 Balance Jan. 1 Balance Inventory Date Explanation Ref. Debit Credit No. 120 Balance Jan. 1 Balance 31 31 S1 31 CRI 1 8 OP1 31 CP1 10000 9 GI 18 G1 MacBook Pro Jan. 1 Balance 31 P1 DOO 31 Si 31 CR1 DODODDI 8 CP1 31 CP1 9 G1 18 G1 Supplies Date Explanation Ref. Debit No. 125 Balance Credit Jan. 1 Balance 31 x CP1 Prepaid Insurance Date Explanation No. 130 Balance Ref. Debit Credit Jan. 1 Balance Equipment Explanation No. 157 Balance Date Ref. Debit Credit 18 G1 Supplies Date Explanation Ref. Debit Credit No. 125 Balance Jan. 1 Balance 31 CP1 Prepaid Insurance Explanation Date No. 130 Ref. Debit Credit Balance Jan. 1 Balance Equipment Date Explanation Ref. Debit No. 157 Balance Credit Ref. Debit Jan. 1 Balance Accumulated Depreciation-Equipment Date Explanation Jan. 1 Balance Notes Payable Date Explanation No. 158 Balance Credit x Ref. No. 200 Balance Debit Credit Jan. 21 G1 1 Accounts Payable Date Explanation No. 201 Balance Ref. Debit Credit Jan. 1 Balance 31 P1 IN Notes Payable Explanation Date Ref. Debit Credit No. 200 Balance G1 Jan. 21 Accounts Payable Date Explanation Ref. Debit Credit No. 201 Balance Jan. 1 Balance 31 P1 31 X OP1 18 G1 21 G1 Owner's Capital Date Explanation Ref. Debit No. 301 Balance Credit Jan. 1 Balance Owner's Drawings Date Explanation i Ref. Debit No. 306 Balance Credit M Jan 15 CPI Sales Revenue Date Explanation No, 401 Balance Ref. Debit Credit Jan. 31 SI 31 CRI Date Explanation Ref. Debit Credit Jan. 1 Balance Balance Owner's Drawings Date Explanation Ref. Debit Credit No. 306 Balance Jan 15 CP1 Sales Revenue Date Explanation Ref. Debit Credit No, 401 Balance Jan. 31 S1 31 CR1 Sales Returns and Allowances Date Explanation Ref. Debit No. 412 Balance Credit x Jan. 9 G1 Sales Discounts Date Explanation Ref. Debit No. 414 Balance Credit * Jan. 31 CR1 Cost of Goods Sold Date Explanation Ref. No. 505 Balance Debit Credit X Jan. 31 Si 31 CR1 GI Salarie Jan. 31 CR1 Cost of Goods Sold Date Explanation Ref. Debit Credit No. 505 Balance Jan. 31 x S1 31 CR1 9 G1 Salaries and Wages Expense Date Explanation Ref. No. 627 Balance Debit Credit CP1 Jan. 31 Rent Expense Date Explanation Ref. No. 729 Balance Debit Credit Jan. 12 CP1 Accounts Receivable Subsidiary Ledger R. Beltre Date Explanation Ref. Debit Credit Balance Jan. 1 Balance 11 S1 ull DOI idid 22 S1 Jan. 1 Balance 11 S1 22 S1 Revere Date Explanation Ref. Jan. 3 in 9 G1 idd: Ludd, Ida CRI S1 B. Santos Date Explanation Ref Jan. 1 Balance 7 CRI 25 51 S. Mahey Date Explanation Ref. Debit Balance Jan. 1 Balance ES 25 Si B. Santos Date Explanation Ref Debit Jan. 1 Balance Balance 7 CR1 25 Si S. Mahey Date Explanation Ref. Jan. 1 Balance 7 000000 11 COD. Odot. 21 CR1 B. Corpas Date Explanation Ref. Jan. 3 S1 13 CRI 22 S1 Date Explanation Ref. Debit Credit Jan. 3 Balance Si CRI UOD 000 Si Accounts Payable Subsidiary Ledger D. Posey Date Explanation Ref. Debit Credit Balance Jan 5 P1 X DO 27 EX P1 x S. Meek Date Explanation Ref. Debit Credit Jan. 1 Balance 9 CP1 16 lagod 18 22 R. Moses Date Explanation Ref. Debit Credit G1 X CP1 . Moses Date Explanation Ref. Debit Jan. 1 Balance 21 G1 D. Saito Date Explanation Ref. Jan. 1 Balance DOO julio. IO. DO id jdddd: DO: DO 9 27 P1 S. Gamel Date Explanation Ref. Debit Jan. 5 P1 Credit Jan. 1 Balance 9 CP1 16 23 27 P1 ol ugo. Dodno old colod Gamel Date Explanation Ref. Jan. 5 Pi 16 P1 27 P1 LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Prepare a trial balance at January 31, 2020, in the trial balance columns of the worksheet. Complete the worksheet using the following addition 1. Office supplies at January 31 total $1,000. on October 31, 2020 CALCULATOR Your answer is partially correct. Try again. Prepare a trial balance at January 31, 2020, in the trial balance columns of the worksheet. Complete the worksheet using the following additional information 1. Office Supplies at January 31 total $1,000 2. Insurance coverage expires on October 31, 2020 3. Annual depreciation on the equipment is $1,500 4. Interest of $50 has accrued on the note payable CULLUMBER COMPANY Worksheet Trial Balance Adjustments Account Titles Dr. Cr. Adjusted Trial Balance Dr. Cr Dr. Income Statement Dr. Balance Sheet Cr. Cash CF Accounts Receivable Notes Receivable . Inventory Supplies Prepaid Insurance Equipment Accum. Depreciation-quipment MecBook Pro News Translate Wypus LUS Weyande, Accounting Principles, 13 CALCULATO CULLUMBER COMPANY Worksheet D Trial Balance Account Titles Adjustments Dr. Cr. Adjusted Trial Balance Dr. Cr, Cash Dr. Cra Income Statement Dr. CF Balance Sheet Dr. C Accounts Receivable Notes Receivable Inventory Supplies Prepaid Insurance Equipment Accum. Depreciation Equipment Notes Payable E Accounts Payable Interest Payable Owner's Capital MacBook Pro Fale US Weyqandt, Accounting Principles, 13e Inventory CALCIATOR FEINTER Supplies Prepaid Insurance Equipment Accum. Depreciation Equipment Notes Payable Accounts Payable Interest Payable C Owner's Capital Owner's Drawings Sales Revenue G Sales Returns and Allowances Sales Discounts - Cost of Goods Sold EL Salaries and Wages Expense E MacBook Pro Franslate e LUS Weandt, Accounting Principles, 13 OCES CALCULATO INTER Sales Revenue Sales Returns and Allowances Sales Discounts Eudy Cost of Goods Sold Salaries and Wages Expense Rent Expense Totals Supplies Expense Insurance Expense Depreciation Expense dilli Interest Expense Totals Net Income Totals MacBook Pro DIO Your answer is partially correct. Try again. Prepare a multiple-step income statement. CULLUMBER CO. Income Statement Rent Expense Sales Revenues Less Depreciation Expense Sales Discounts Net Sales Revenue Supplies Expense Gross Profit (LOS) Operating Expenses ES Sales Discounts Net Sales Revenue Supplies Expense By Gross Profit/ (Loss) Operating Expenses DOJO ddddd Insurance Expense Salaries and Wages Expense Sales Discounts Supplies Expense Sales Discounts Total Operating Expenses Sales Revenues Other Expenses and Losses Sales Discounts 5 Supplies Expense CALCI Sales Discounts Total Operating Expenses Sales Revenues Other Expenses and Losses DO DO Sales Discounts Total Non-Operating Expenses LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Prepare a owner's equity statement for January. (List items that increase owner's equity first.) CULLUMBER CO. Owner's Equity Statement January 31, 2020 Owner's, Capital, January 1, 2020 Add Retained Earnings RCES Your answer is partially correct. Try again. Prepare a owner's equity statement for January. (List items that increase owner's equity first.) CULLUMBER CO. Owner's Equity Statement January 31, 2020 udy. Owner's, Capital, January 1, 2020 Add Retained Earnings Less Retained Earnings Retained Earnings LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Prepare a classified balance sheet at the end of January. (List Current Assets in order of liquidity.) CULLUMBER CO. Balance Sheet January 31, 2020 Your answer is partially correct. Try again. Prepare a classified balance sheet at the end of January. (List Current Assets in order of liquidity.) CULLUMBER CO. Balance Sheet January 31, 2020 Assets Current Assets Cash Accounts Receivable Notes Receivable Inventory Supplies Prepaid Insurance Current Assets Total Assets Equipment Less Accumulated Depreciation Equipment ES Accounts Receivable CALCULATOS Notes Receivable Inventory y Supplies Prepaid Insurance Current Assets Total Assets Equipment Accumulated Depreciation Equipment Total Current Liabilities Liabilities and Owner's Equity Current Liabilities Notes Payable Accounts Payable US Weygandt, Accounting Principles, 13e Help System Announcements ES Current Assets Total Assets Equipment Less Accumulated Depreciation Equipment x bo Total Current Liabilities Liabilities and Owner's Equity Current Liabilities Notes Payable Accounts Payable Interest Payable Total Liabilities and Owner's Equity Total Current Liabilities Owner's Capital Total Liabilities and Owner's Equity TEC. Try again Prepare adjusting entries. (Credit account titles are automatically indented when the amount is entered. De not indent manually. Record journal entries in the order presented in problem.) Date Account Titles and Explanation Debit Credit (To supplies) (Tout insurance expense) IM (To adjunt depreciation experie) (To adjust interest expense) LNM TO TERT TOTEKE MacBook Pro Bolo Di ECES Prepare closing entries. (Credit account titles are automatically indented when the amount is entered. De not indent manually. Record journal entries in the order presented in the problem.) CALCULATO 1 Date Account Tities and Explanation Debit Credit udy To close revenue account) (Todose expense accounts) JS Wandt, Accounting Principles, 13e CALCULATOR (To dose expense accounts) (Todose net income) (To dose drawings) LIRK TO TEXT LINK TO TEXT El Your answer is partially correct. Try again. Post adjusting and closing entries. (Post entries in the order of Journal entry presented in the previous parts.) General Ledger Debit Credit Cash Date Explanation Jan 1 Balance 31 Ref. 67,876 No. 101 Balance 37,000 104,876 46,532 No. 112 Balance CR1 CP: 58,364 31 Accounts Receivable Date Explanation Ref. Debit Credit MacBook Pro tudy Accounting Cycle Review 7-01 1-12 CALCULATOR Cullumber Coutes a perpetual inventory system and both an accounts receivable and an accounts payable subsidiary leaper Balances related to both the general ledger and the respeto MERT Culomber are indicated in the working papers. Presented below are a series of transactions for Cullumber Co. for the month of January. Credit sal terms are 2/10, 30. The commerchand sold was 60% of the sales price GENERAL LEDGER Account Number Account Title January 1 Opening Balance 101 Cash $37,000 112 Accounts Receivable 115 13,200 Notes Receivable 120 38,000 Inventory 19,500 126 Supplies 1 800 130 Prepaid Insurance 2.500 157 Equipment 6,450 156 Accumulated Depreciation Equip 1,600 201 Accounts Payable 34,500 301 Owner's Capital 82.350 Schedule of Accounts Receivable (from accounts receivable subsidiary ledger) January 1 Customer Opening Balance R. Beltre $1,500 B. Santos 7,600 5. Mahay 4,100 Schedule of Accounts Payable (from accounts payable subsidiary ledger) January 1 Customer Opening Balance 17.500 BL Moses 18.000 9,000 126 19 DUV 130 157 158 Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equip. Accounts Payable Owner's Capital 1,800 2,500 6,450 1,600 34,500 82,350 201 301 Schedule of Accounts Receivable (from accounts receivable subsidiary ledger) January 1 Customer Opening Balance R. Beltre $1,500 B. Santos 7,600 S. Mahay 4,100 Schedule of Accounts Payable (from accounts payable subsidiary ledger) January 1 Customer Opening Balance S. Meek $7,500 R. Moses 18,000 D. Saito 9,000 Jan. 3 5 7 B 9 Sell merchandise on account to B. Corpas $3,600, Invoice no. 510, and to J. Revere $2,000, Invoice no. 511 Purchase merchandise from S. Gamel $6,000 and D. Posey $2,200, terms 1/30. Receive checks from S. Mahay $4,100 and B. Santos $2,000 after discount period has lapsed Pay freight on merchandise purchased $240. Send checks to S. Meek for $7.500 less 2% cash discount, and to D. Saito for $9,000 less 1% cash discount. Issue credit of $300 to J. Revere for merchandise returned. Daily cash sales from January 1 to January 10 total $14,000. Make one journal entry for these sales Sell merchandise on account to R. Beltre $1,200, Invoice no. 512, and to S. Mahay $900, Invoice no. 513. Pay rent of $1,800 for January 9 10 11 12 MacBook Pro (trom accounts payable subsidiary ledger) January 1 Customer Opening Balance S. Meek $7,500 R. Moses 18,000 D. Saito 9,000 Jan. 3 Sell merchandise on account to B. Corpas $3,600, invoice no. 510, and to J. Revere $2,000, invoice no. 511. 5 Purchase merchandise from S. Gamel $6,000 and D. Posey $2,200, terms /30. 7 Receive checks from S. Mahay $4,100 and B. Santos $2,000 after discount period has lapsed. B Pay freight on merchandise purchased $240. 9 Send checks to S. Meek for $7,500 less 2% cash discount, and to D. Saito for $9,000 less 1% cash discount. 9 Issue credit of $300 to J. Revere for merchandise returned. 10 Daily cash sales from January 1 to January 10 total $14,000. Make one journal entry for these sales. 11 Sell merchandise on account to R. Beltre $1,200, invoice no. 512, and to S. Mahay $900, involce no. 513. 12 Pay rent of $1,800 for January 13 Receive payment in full from B. Corpas and ). Revere less cash discounts. 15 Withdraw $800 cash by M. Cullumber for personal use. Post all entries to the subsidiary ledgers. 16 Purchase merchandise from D. Saito $16,000, terms 1/10, 1/30; S. Meek $15,000, terms 2/10, 1/30; and S. Gemel $1,500, terms 1/30 17 Pay $400 cash for office supplies. 18 Return $200 of merchandise to S. Meek and receive credit. 20 Daily cash sales from January 11 to January 20 total $18,600. Make one journal entry for these sales. 21 Issue $18,000 note, maturing in 90 days, to R. Moses in payment of balance due. 21 Receive payment in full from S. Mahay less cash discount. 22 Sell merchandise on account to B. Corpas $2,500, invoice no. 514, and to R. Beltre $2,400, Invoice no. 515. 22 Post all entries to the subsidiary ledgers. 23 Send checks to D. Saito and S. Meek in full payment less cash discounts. 25 Sell merchandise on account to B. Santos $3,600, Invoice no. 516, and to J. Revere $6,500, invoice no. 517. 27 Purchase merchandise from D. Saito $14,900, terms 1/10, 1/30; D. Posey $3,300, terms 1/30, and S. Gamel $5,700, terms 1/30 27 Post all entries to the subsidiary ledgers. S Help System Announcements W LIPIES, 130 9 Issue credit of $300 to J. Revere for merchandise returned. 10 Daily cash sales from January 1 to January 10 total $14,000. Make one journal entry for these sales. 11 Sell merchandise on account to R. Beltre $1,200, invoice no. 512, and to S. Mahay $900, invoice no. 513. 12 Pay rent of $1,800 for January 13 Receive payment in full from B. Corpas and ). Revere less cash discounts. 15 Withdraw $800 cash by M. Cullumber for personal use. 15 Post all entries to the subsidiary ledgers. 16 Purchase merchandise from D. Saito $16,000, terms 1/10, 1/30; S. Meek $15,000, terms 2/10, 1/30; and S. Gamel $1,500, terms n/30. 17 Pay $400 cash for office supplies. 18 Return $200 of merchandise to S. Meek and receive credit 20 Daily cash sales from January 11 to January 20 total $18,600. Make one journal entry for these sales. 21 Issue $18,000 note, maturing in 90 days, to R. Moses in payment of balance due. 21 Receive payment in full from S. Mahay less cash discount. 22 Sell merchandise on account to B. Corpas $2,500, Invoice no. 514, and to R. Beltre $2,400, Invoice no. 515. 22 Post all entries to the subsidiary ledgers, 23 Send checks to D. Saito and S. Meek in full payment less cash discounts. 25 Sell merchandise on account to B. Santos $3,600, Invoice no. 516, and to ). Revere $6,500, Invoice no. 517. 27 Purchase merchandise from D. Saito $14,900, terms 1/10, 1/30; D. Posey $3,300, terms n/30; and S. Gamel $5,700, terms n/30. 27 Post all entries to the subsidiary ledgers. 28 Pay $200 cash for office supplies. 31 Daily cash sales from January 21 to January 31 total $23,100. Make one journal entry for these sales. 31 Pay sales salaries $4,500 and office salaries $3,800. Your answer is partially correct. Try again. Record the January transactions in a sales journal. (Post entries in the order presented in the problem statement.) Sales Journal Date Account Receivable Dr. Si Cost of Good Sold Dr. 31 Daily cash sales from January 21 to January 31 total $23,100. Make one journal entry for these sales. Pay sales salaries $4,500 and office salaries $3,800. 31 Your answer is partially correct. Try again. Record the January transactions in a sales journal. (Post entries in the order presented in the problem statement.) dy Sales Journal Date Account Debited Invoice No. Ref. Account Receivable Dr. Sales Revenue Cr. S1 Cost of Good Sold Dr. Inventory Cr. Jan. 3 B. Corpas 510 3600 Jan. 3 3. Revere 511 2000 Jan. 11 R. Beltre 512 2000 Jan. 11 S. Mahay 513 v 900 Jan. 22 B. Corpas 514 2500 Jan. 22 R Beltre 515 2400 Jan. 25 B. Santos 516 * 3600 Jan. 25 5. Revere 517 6500 22700 LINK TO TEXT LINK TO TEXT CALC Your answer is correct. Record the January transactions in a single-column purchases journal. (Post entries in the order presented in the problem statement.) Purchases Journal P1 Date Account Credited Terms Ref. Inventory Dr. Accounts Payable Cr. Jan. 5 S. Gamel n/30 6000 Jan. 5 D. Posey n/30 2200 Jan. 16 M D. Saito 1/10, 1/30 16005 Jan. 16 5. Meek 2/10, 1/30 15000 Jan. 16 S. Gamel n/30 1500 Jan 27 D. Saito 1/10, 1/30 14900 Jan 27 D. Posey n/30 3300 Jan 27 S. Gamel n/30 5700 64600 LINK TO TEXT UNK TO TEXT MacBook Pro ENCES Your answer is partially correct. Try again. CALCULATOR Record the January transactions in a cash receipts journal (Pest entries in the order presented in the problem statement.) Cash Receipts Journal Date tudy Account Credited CRI Ref. Cash Dr. Sales Discounts Dr. Sales Revenue Cr. Account Receivable Cr. Other Accounts Cr. Jo. 7 5. May Cost of Good Sold Dr. Inventory Cr. 4100 4100 Jan 7 B. Santos 2000 2000 Jan lov 14000 14000 3. Corps 3600 Jan. 1) 3. Revere Jan 20 Jan 21 S. Mahay Doddi 3an. 31 LINK TO TEXT LIRE TO TEXT Record the January transactions in a cash payments journal. (Post entries in the order presented in the problem statement.) Cash Payments Journal CALCULATOR Date Account Debited Ref. Other Accounts Dr. Jan 8 Accounts Payable Dr. Inventory Supplies Dr. CPI Ely 120 Inventory Cr. Cash Jon 9 S. Meck 10 Jan. 9 D. Saito All llll Jan 12 Rent Expense 729 Jan. 15 Owner's Drawings 306 on. 17 UUUUUUUUUUU Jan. 23 u D. Saito S. Meck Jan 28 Son 31 Salaries and Wages Expense 627 E LINK TO TEXT LINK TO TEXT MacBook Pro Your answer is partially correct. Try again. Record the January transactions in a two-column general journal (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit ady Sales Returns and Allowances 300 Accounts Receivable (issued credit for merchandise returned) 300 Jan 9 Inventory 240 Cast of Goods Sold 240 (Cost of merchandise returned) Jan Accounts Payable 200 Inventory (Received credit for returned goods.) 200 Jan 21 Accounts Payable 18000 Notes Payable 16000 (Payment of balance dut) LINE TO TEXT LINK TO TEXT MacBook Pro CALCULATO Your answer is partially correct. Try again. Post the journals to the general ledger. (Post entries in the order of Journal entry presented in the previous parts.) General Ledger Cash No. 101 Date Explanation Debit Credit Balance Jan. 1 Balance 37000 Ref. 31 CRI 23100 23100 31 CP1 4580 3800 Accounts Receivable Date Explanation Ref. Debit No. 112 Balance Credit Jan. 1 Balance 31 Si 31 CRI G1 Notes Receivable Date Explanation Ref. Debit Credit No. 115 Balance Jan. 1 Balance Inventory No. 120 MacBook Pro Jan. 1 Balance CALCULATO 31 si II 31 2 CR1 9 G1 Notes Receivable Date Explanation Debit Ref. 22 Credit No. 115 Balance Jan. 1 Balance Inventory Date Explanation Ref. Debit Credit No. 120 Balance Jan. 1 Balance 31 31 S1 31 CRI 1 8 OP1 31 CP1 10000 9 GI 18 G1 MacBook Pro Jan. 1 Balance 31 P1 DOO 31 Si 31 CR1 DODODDI 8 CP1 31 CP1 9 G1 18 G1 Supplies Date Explanation Ref. Debit No. 125 Balance Credit Jan. 1 Balance 31 x CP1 Prepaid Insurance Date Explanation No. 130 Balance Ref. Debit Credit Jan. 1 Balance Equipment Explanation No. 157 Balance Date Ref. Debit Credit 18 G1 Supplies Date Explanation Ref. Debit Credit No. 125 Balance Jan. 1 Balance 31 CP1 Prepaid Insurance Explanation Date No. 130 Ref. Debit Credit Balance Jan. 1 Balance Equipment Date Explanation Ref. Debit No. 157 Balance Credit Ref. Debit Jan. 1 Balance Accumulated Depreciation-Equipment Date Explanation Jan. 1 Balance Notes Payable Date Explanation No. 158 Balance Credit x Ref. No. 200 Balance Debit Credit Jan. 21 G1 1 Accounts Payable Date Explanation No. 201 Balance Ref. Debit Credit Jan. 1 Balance 31 P1 IN Notes Payable Explanation Date Ref. Debit Credit No. 200 Balance G1 Jan. 21 Accounts Payable Date Explanation Ref. Debit Credit No. 201 Balance Jan. 1 Balance 31 P1 31 X OP1 18 G1 21 G1 Owner's Capital Date Explanation Ref. Debit No. 301 Balance Credit Jan. 1 Balance Owner's Drawings Date Explanation i Ref. Debit No. 306 Balance Credit M Jan 15 CPI Sales Revenue Date Explanation No, 401 Balance Ref. Debit Credit Jan. 31 SI 31 CRI Date Explanation Ref. Debit Credit Jan. 1 Balance Balance Owner's Drawings Date Explanation Ref. Debit Credit No. 306 Balance Jan 15 CP1 Sales Revenue Date Explanation Ref. Debit Credit No, 401 Balance Jan. 31 S1 31 CR1 Sales Returns and Allowances Date Explanation Ref. Debit No. 412 Balance Credit x Jan. 9 G1 Sales Discounts Date Explanation Ref. Debit No. 414 Balance Credit * Jan. 31 CR1 Cost of Goods Sold Date Explanation Ref. No. 505 Balance Debit Credit X Jan. 31 Si 31 CR1 GI Salarie Jan. 31 CR1 Cost of Goods Sold Date Explanation Ref. Debit Credit No. 505 Balance Jan. 31 x S1 31 CR1 9 G1 Salaries and Wages Expense Date Explanation Ref. No. 627 Balance Debit Credit CP1 Jan. 31 Rent Expense Date Explanation Ref. No. 729 Balance Debit Credit Jan. 12 CP1 Accounts Receivable Subsidiary Ledger R. Beltre Date Explanation Ref. Debit Credit Balance Jan. 1 Balance 11 S1 ull DOI idid 22 S1 Jan. 1 Balance 11 S1 22 S1 Revere Date Explanation Ref. Jan. 3 in 9 G1 idd: Ludd, Ida CRI S1 B. Santos Date Explanation Ref Jan. 1 Balance 7 CRI 25 51 S. Mahey Date Explanation Ref. Debit Balance Jan. 1 Balance ES 25 Si B. Santos Date Explanation Ref Debit Jan. 1 Balance Balance 7 CR1 25 Si S. Mahey Date Explanation Ref. Jan. 1 Balance 7 000000 11 COD. Odot. 21 CR1 B. Corpas Date Explanation Ref. Jan. 3 S1 13 CRI 22 S1 Date Explanation Ref. Debit Credit Jan. 3 Balance Si CRI UOD 000 Si Accounts Payable Subsidiary Ledger D. Posey Date Explanation Ref. Debit Credit Balance Jan 5 P1 X DO 27 EX P1 x S. Meek Date Explanation Ref. Debit Credit Jan. 1 Balance 9 CP1 16 lagod 18 22 R. Moses Date Explanation Ref. Debit Credit G1 X CP1 . Moses Date Explanation Ref. Debit Jan. 1 Balance 21 G1 D. Saito Date Explanation Ref. Jan. 1 Balance DOO julio. IO. DO id jdddd: DO: DO 9 27 P1 S. Gamel Date Explanation Ref. Debit Jan. 5 P1 Credit Jan. 1 Balance 9 CP1 16 23 27 P1 ol ugo. Dodno old colod Gamel Date Explanation Ref. Jan. 5 Pi 16 P1 27 P1 LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Prepare a trial balance at January 31, 2020, in the trial balance columns of the worksheet. Complete the worksheet using the following addition 1. Office supplies at January 31 total $1,000. on October 31, 2020 CALCULATOR Your answer is partially correct. Try again. Prepare a trial balance at January 31, 2020, in the trial balance columns of the worksheet. Complete the worksheet using the following additional information 1. Office Supplies at January 31 total $1,000 2. Insurance coverage expires on October 31, 2020 3. Annual depreciation on the equipment is $1,500 4. Interest of $50 has accrued on the note payable CULLUMBER COMPANY Worksheet Trial Balance Adjustments Account Titles Dr. Cr. Adjusted Trial Balance Dr. Cr Dr. Income Statement Dr. Balance Sheet Cr. Cash CF Accounts Receivable Notes Receivable . Inventory Supplies Prepaid Insurance Equipment Accum. Depreciation-quipment MecBook Pro News Translate Wypus LUS Weyande, Accounting Principles, 13 CALCULATO CULLUMBER COMPANY Worksheet D Trial Balance Account Titles Adjustments Dr. Cr. Adjusted Trial Balance Dr. Cr, Cash Dr. Cra Income Statement Dr. CF Balance Sheet Dr. C Accounts Receivable Notes Receivable Inventory Supplies Prepaid Insurance Equipment Accum. Depreciation Equipment Notes Payable E Accounts Payable Interest Payable Owner's Capital MacBook Pro Fale US Weyqandt, Accounting Principles, 13e Inventory CALCIATOR FEINTER Supplies Prepaid Insurance Equipment Accum. Depreciation Equipment Notes Payable Accounts Payable Interest Payable C Owner's Capital Owner's Drawings Sales Revenue G Sales Returns and Allowances Sales Discounts - Cost of Goods Sold EL Salaries and Wages Expense E MacBook Pro Franslate e LUS Weandt, Accounting Principles, 13 OCES CALCULATO INTER Sales Revenue Sales Returns and Allowances Sales Discounts Eudy Cost of Goods Sold Salaries and Wages Expense Rent Expense Totals Supplies Expense Insurance Expense Depreciation Expense dilli Interest Expense Totals Net Income Totals MacBook Pro DIO Your answer is partially correct. Try again. Prepare a multiple-step income statement. CULLUMBER CO. Income Statement Rent Expense Sales Revenues Less Depreciation Expense Sales Discounts Net Sales Revenue Supplies Expense Gross Profit (LOS) Operating Expenses ES Sales Discounts Net Sales Revenue Supplies Expense By Gross Profit/ (Loss) Operating Expenses DOJO ddddd Insurance Expense Salaries and Wages Expense Sales Discounts Supplies Expense Sales Discounts Total Operating Expenses Sales Revenues Other Expenses and Losses Sales Discounts 5 Supplies Expense CALCI Sales Discounts Total Operating Expenses Sales Revenues Other Expenses and Losses DO DO Sales Discounts Total Non-Operating Expenses LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Prepare a owner's equity statement for January. (List items that increase owner's equity first.) CULLUMBER CO. Owner's Equity Statement January 31, 2020 Owner's, Capital, January 1, 2020 Add Retained Earnings RCES Your answer is partially correct. Try again. Prepare a owner's equity statement for January. (List items that increase owner's equity first.) CULLUMBER CO. Owner's Equity Statement January 31, 2020 udy. Owner's, Capital, January 1, 2020 Add Retained Earnings Less Retained Earnings Retained Earnings LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Prepare a classified balance sheet at the end of January. (List Current Assets in order of liquidity.) CULLUMBER CO. Balance Sheet January 31, 2020 Your answer is partially correct. Try again. Prepare a classified balance sheet at the end of January. (List Current Assets in order of liquidity.) CULLUMBER CO. Balance Sheet January 31, 2020 Assets Current Assets Cash Accounts Receivable Notes Receivable Inventory Supplies Prepaid Insurance Current Assets Total Assets Equipment Less Accumulated Depreciation Equipment ES Accounts Receivable CALCULATOS Notes Receivable Inventory y Supplies Prepaid Insurance Current Assets Total Assets Equipment Accumulated Depreciation Equipment Total Current Liabilities Liabilities and Owner's Equity Current Liabilities Notes Payable Accounts Payable US Weygandt, Accounting Principles, 13e Help System Announcements ES Current Assets Total Assets Equipment Less Accumulated Depreciation Equipment x bo Total Current Liabilities Liabilities and Owner's Equity Current Liabilities Notes Payable Accounts Payable Interest Payable Total Liabilities and Owner's Equity Total Current Liabilities Owner's Capital Total Liabilities and Owner's Equity TEC. Try again Prepare adjusting entries. (Credit account titles are automatically indented when the amount is entered. De not indent manually. Record journal entries in the order presented in problem.) Date Account Titles and Explanation Debit Credit (To supplies) (Tout insurance expense) IM (To adjunt depreciation experie) (To adjust interest expense) LNM TO TERT TOTEKE MacBook Pro Bolo Di ECES Prepare closing entries. (Credit account titles are automatically indented when the amount is entered. De not indent manually. Record journal entries in the order presented in the problem.) CALCULATO 1 Date Account Tities and Explanation Debit Credit udy To close revenue account) (Todose expense accounts) JS Wandt, Accounting Principles, 13e CALCULATOR (To dose expense accounts) (Todose net income) (To dose drawings) LIRK TO TEXT LINK TO TEXT El Your answer is partially correct. Try again. Post adjusting and closing entries. (Post entries in the order of Journal entry presented in the previous parts.) General Ledger Debit Credit Cash Date Explanation Jan 1 Balance 31 Ref. 67,876 No. 101 Balance 37,000 104,876 46,532 No. 112 Balance CR1 CP: 58,364 31 Accounts Receivable Date Explanation Ref. Debit Credit MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts