Question: Can someone please help me solve these? I have attached Questions and information needed. Acc 211 FA330 -Project 2 -50 points art Corporation's financial statements

Can someone please help me solve these? I have attached Questions and information needed.

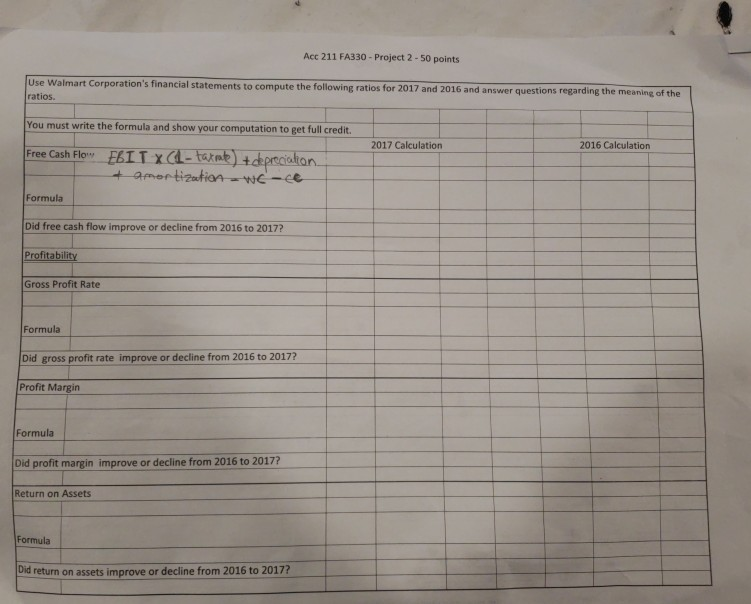

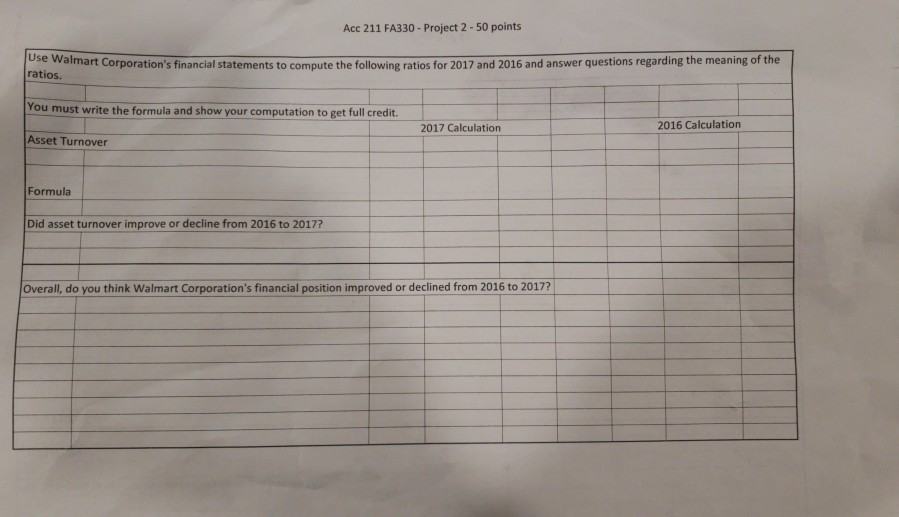

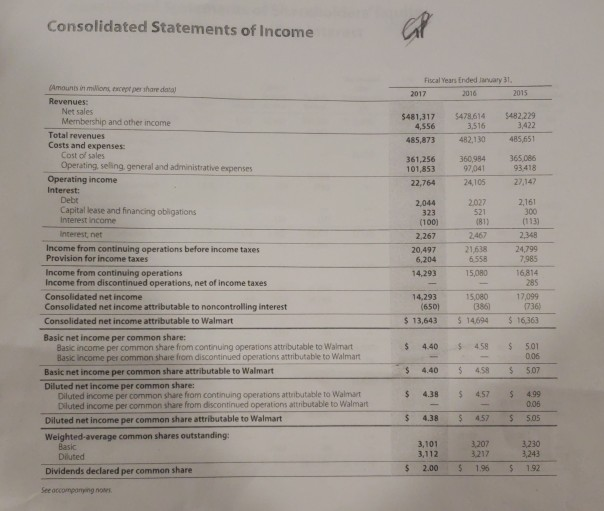

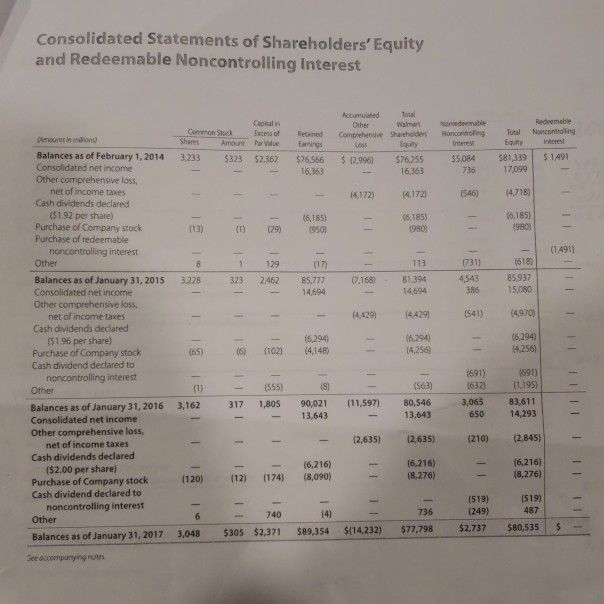

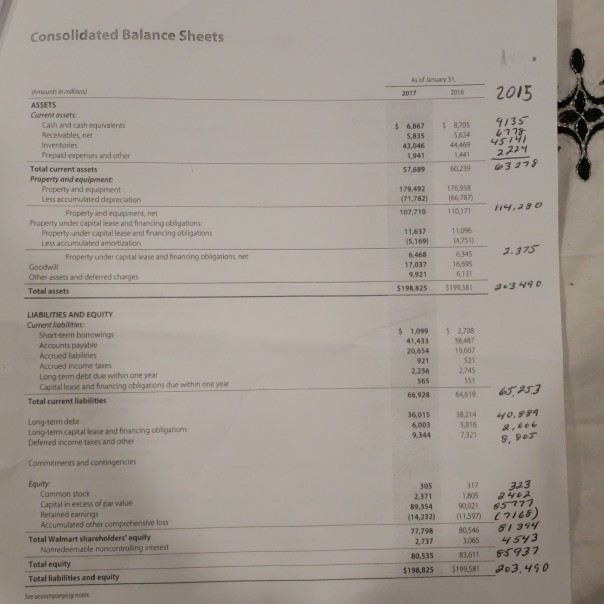

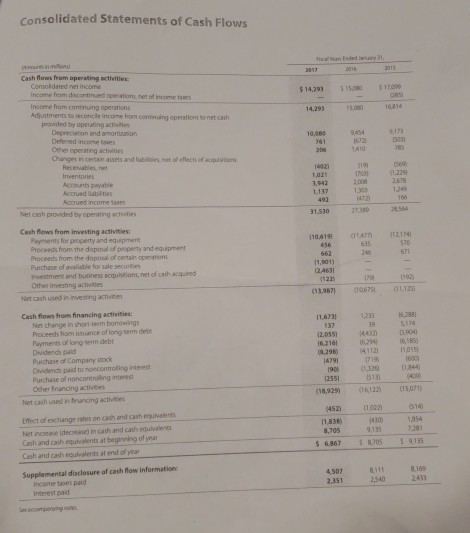

Acc 211 FA330 -Project 2 -50 points art Corporation's financial statements to compute the following ratios for 2017 and 2016 and answer questions regarding the meaning of the ratios. You must write the formula and show your computation to get full credit 2017 Calculation 2016 Calculation Free Cash Flo Formula Did free cash flow improve or decline from 2016 to 2017 Profitability Gross Profit Rate Formula Did gross profit rate improve or decline from 2016 to 2017? Profit Margin Formula Did profit margin improve or decline from 2016 to 20177 Return on Assets Formula Did return on assets improve or decline from 2016 to 20177 Acc 211 FA330- Project 2-50 points art corporation's financial statements to compute the following ratios for 2017 and 2016 and answer questions regarding the meaning of the ratios. ou must write the formula and show your computation to get full credit. 2017 Calculation 2016 Calculation Asset Turnover Formula Did asset turnover improve or decline from 2016 to 2017? Overall, do you think Walmart Corporation's financial position improved or declined from 2016 to 2017? Consolidated Statements of Income Fiscal Years Ended January 3 Amounb in milions, except per share data) Revenues 2017 2016 2015 Net sales $481,317 $478.614 $482,229 Membership and other income Total revenues Costs and expenses 4,556 3,516 3,422 485,873482,130 485,651 Cost of sales 361,256 360,984365,086 Operating, seling, general and administrative expenses Operating income Interest 101,853 22,764 97,041 24,105 93418 27,147 Debt 2,161 300 2,044 323 100) 2,267 Capital lease and financing obligations 521 181) 2.467 21,638 Interest income (133) interest, net Income from continuing operations before income taxes Provision for income taxes Income from continuing operations Income from discontinued operations, net of income taxes Consolidated net income Consolidated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart 2,348 24,799 7985 16814 285 17099 736 20,497 6,204 14,293 15,080 15,080 $ 14694 14,293 (650) $ 13,643 $ 16363 Basic net income per common share Basic income per common share from continuing operations attributable to Walmart Basic income per common share from discontinued operations attributable to Walmart $ 4.40 458 $501 006 $ 4.40 458 507 Basic net income per common share attributable to Walmart Diluted net income per common share Diluted income per common share from continuing operations attributable to Walmart Diluted income per common share from discontinued operations attributable to Walmart $4.38 457 $ 4.99 0.06 Diluted net income per common share attributable to Walmart $4.38457 5.05 Weighted-average common shares outstanding Basic Diluted 3,101 3,112 3,207 3217 3,230 3,243 Dividends declared per common share $ 2.00 5 196 192 See accomponying nows Consolidated Statements of Shareholders' Equity and Redeemable Noncontrolling Interest Accumulated Tota Captal in WalmartNonedeemable Redeemable Common Stock Excess of Retained Compehenive Sharehoiden Noncntroling Total Noncontioling Shares Amount Par Value Earings Equityinterest Equity Balances as of February 1, 2014 3,233 $323 $2362 $76.566 $ (2.996) $76255 $5,084 81339 $ 1,491 Consolidated net income Other comprehensive loss, 17,099 1546) (4718) 6,185) 16,363 736 net of income taxes (4172) (4172 Cash dividends declared ($1.92 per share) (6,185) (13) ) 91950 (61 85) - Purchase of Company stock Purchase of redeermable 980) noncontrolling interest (1.491) (731) 618) 85.937 15,080 Other 113 Balances as of January 31, 2015 3,228323 2.462 85,777 (7,168) 81.394 Consolidated net income Other comprehensive loss, 4,543 386 14,694 (4,429} 6,294) 14,694 net of income taxes (4,429) (S41) (4970) - Cash dividends declared (6,294) (65) (6) (102)(4,148) ($ 1 96 per share) 4,256) 4256) Purchase of Company stock Cash dividend declared to (691) (691) noncontrolling interest (632) (1,195 650 14,293 (210) (2,845) Other (1)(555) (563) Balances as of January 31, 2016 3,162 317 1,805 Consolidated net income Other comprehensive loss, 90,02 3,065 83,611 13,643 (2,635) (2,635 6,216) 13,643 net of income taxes Cash dividends declared (6,216) 6,216) (120) (12) (174) (8,090) ($2.00 per share) (8,276) -(8,276) Purchase of Company stock Cash dividend declared to (519) (249) (519) 487 noncontrolling interest 736 740 Balances as of January 31, 2017 3,048$305 $2,371 $89,354 $(14,232) $77,798 $2,737 $80,535 $ See accompanyling noters Consolidated Balance Sheets s of anuary 31, 017 2016 2015 ASSETS Current disets Cash and cash equivalients Recevables, net Inventories Prepaid expenses and other $ 6,867 8.7057 5,835 5,624 4.7 43,046444694519 1,941 1441 222Y 57,689 60,239 327F Total current assets Property and equipment Property and equipment Less accumulated depreciation 179,492 176958 71,782) (66.787 107,710 11017 Property and equipment, net Property under capital lease and financing oblgations 11,637 Property under capital lease and financing obligtions Less accumulated amortization (5,1691-045_ 2.3 1,096 47511 Property under capital lease and finanding obigations, ne 16,695 17,03713 9,921 Other assets and defered charges Total assets $198.825 $199581 2+440 LIABILITIES AND EQUITY Current iebilities Short-term borrowings Accounts payable Accrued lablities Accrued income taxes Long-term debt due within one year Capital lease and fnancing obligations due within one year $ 1,099 41,433 20,654 921 2,256 565 2705 38,487 19,607 521 2,745 551 6,928 646S33 36,015 38,214 40, 8,9 Total current liabilities Long-term debt Long-1erm capital lease and financing obligations 6,003 9,344 7321 . Deferred income taxes and other Commitments and contingencies Equity 17 323 305 2.371 Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive los 89,354 9002 85 777 (14.232) 01597 (/5) 2,37 3065 45y3 77,798 aos46 5139y Total Walmart shareholders' equity Nonredeemable noncontroling interest 80,535 83611 55937 Total equity $198,825 $199581 03, 450 Total liabilities and equity Ser accomparygnoes Consolidated Statements o f Cash Flows Cash flows from operating activitiex income fiom dscontinued opeation net of ncome ties income from continuing operations Adjustments to reconcle income fom continuing operatios so net cash $14,293 51500 $ 1709 14,293 5,00 6814 10,08945417 Defersed income taxes Other operating activities Changes in certain assets and lublioes net of efcts of qtio 703 229 Accrued labilities 31 530 70 Net cash provided by operating actwities Cash fows from investing activities Peyments for property and equipment Proceeds from the dsposal of property and equipment Proceeds from the doposal of certain openstiom Purchase of available for sale securties nwesment and buniness acquihtions, net of cash acqured 10,619(1 12174 Net cash used in investing activne (13.987) 10675) 1123) Cash flows from financing activities: 11,623,2356,28 Net change in shorl-term bonowings Proceeds fhom issuance of long term debr Payments of long-tern debt 12,055)44323.904 6.2161524615) 01,298)4112015 Puschase of Company stodk Dvidends paid to noncontroling intesest Purchase of noncontrolting int Ocher fnancing activties 900132 (1,844 (255) 513 18,929) 16122 (15,071 Net cash used in francing activities (452) 1,838) (102) 5140 Effect of exchange rates on cash and cash equvalenes Net increme idecrease) in cath and cash equhalen Cash and cash rqualents at begineing of yeur Cash and cash equivalents at end of yea $686758705 935 Supplemental disclosure of cash fNow informatio 1 869 2433 Income taxes paid Acc 211 FA330 -Project 2 -50 points art Corporation's financial statements to compute the following ratios for 2017 and 2016 and answer questions regarding the meaning of the ratios. You must write the formula and show your computation to get full credit 2017 Calculation 2016 Calculation Free Cash Flo Formula Did free cash flow improve or decline from 2016 to 2017 Profitability Gross Profit Rate Formula Did gross profit rate improve or decline from 2016 to 2017? Profit Margin Formula Did profit margin improve or decline from 2016 to 20177 Return on Assets Formula Did return on assets improve or decline from 2016 to 20177 Acc 211 FA330- Project 2-50 points art corporation's financial statements to compute the following ratios for 2017 and 2016 and answer questions regarding the meaning of the ratios. ou must write the formula and show your computation to get full credit. 2017 Calculation 2016 Calculation Asset Turnover Formula Did asset turnover improve or decline from 2016 to 2017? Overall, do you think Walmart Corporation's financial position improved or declined from 2016 to 2017? Consolidated Statements of Income Fiscal Years Ended January 3 Amounb in milions, except per share data) Revenues 2017 2016 2015 Net sales $481,317 $478.614 $482,229 Membership and other income Total revenues Costs and expenses 4,556 3,516 3,422 485,873482,130 485,651 Cost of sales 361,256 360,984365,086 Operating, seling, general and administrative expenses Operating income Interest 101,853 22,764 97,041 24,105 93418 27,147 Debt 2,161 300 2,044 323 100) 2,267 Capital lease and financing obligations 521 181) 2.467 21,638 Interest income (133) interest, net Income from continuing operations before income taxes Provision for income taxes Income from continuing operations Income from discontinued operations, net of income taxes Consolidated net income Consolidated net income attributable to noncontrolling interest Consolidated net income attributable to Walmart 2,348 24,799 7985 16814 285 17099 736 20,497 6,204 14,293 15,080 15,080 $ 14694 14,293 (650) $ 13,643 $ 16363 Basic net income per common share Basic income per common share from continuing operations attributable to Walmart Basic income per common share from discontinued operations attributable to Walmart $ 4.40 458 $501 006 $ 4.40 458 507 Basic net income per common share attributable to Walmart Diluted net income per common share Diluted income per common share from continuing operations attributable to Walmart Diluted income per common share from discontinued operations attributable to Walmart $4.38 457 $ 4.99 0.06 Diluted net income per common share attributable to Walmart $4.38457 5.05 Weighted-average common shares outstanding Basic Diluted 3,101 3,112 3,207 3217 3,230 3,243 Dividends declared per common share $ 2.00 5 196 192 See accomponying nows Consolidated Statements of Shareholders' Equity and Redeemable Noncontrolling Interest Accumulated Tota Captal in WalmartNonedeemable Redeemable Common Stock Excess of Retained Compehenive Sharehoiden Noncntroling Total Noncontioling Shares Amount Par Value Earings Equityinterest Equity Balances as of February 1, 2014 3,233 $323 $2362 $76.566 $ (2.996) $76255 $5,084 81339 $ 1,491 Consolidated net income Other comprehensive loss, 17,099 1546) (4718) 6,185) 16,363 736 net of income taxes (4172) (4172 Cash dividends declared ($1.92 per share) (6,185) (13) ) 91950 (61 85) - Purchase of Company stock Purchase of redeermable 980) noncontrolling interest (1.491) (731) 618) 85.937 15,080 Other 113 Balances as of January 31, 2015 3,228323 2.462 85,777 (7,168) 81.394 Consolidated net income Other comprehensive loss, 4,543 386 14,694 (4,429} 6,294) 14,694 net of income taxes (4,429) (S41) (4970) - Cash dividends declared (6,294) (65) (6) (102)(4,148) ($ 1 96 per share) 4,256) 4256) Purchase of Company stock Cash dividend declared to (691) (691) noncontrolling interest (632) (1,195 650 14,293 (210) (2,845) Other (1)(555) (563) Balances as of January 31, 2016 3,162 317 1,805 Consolidated net income Other comprehensive loss, 90,02 3,065 83,611 13,643 (2,635) (2,635 6,216) 13,643 net of income taxes Cash dividends declared (6,216) 6,216) (120) (12) (174) (8,090) ($2.00 per share) (8,276) -(8,276) Purchase of Company stock Cash dividend declared to (519) (249) (519) 487 noncontrolling interest 736 740 Balances as of January 31, 2017 3,048$305 $2,371 $89,354 $(14,232) $77,798 $2,737 $80,535 $ See accompanyling noters Consolidated Balance Sheets s of anuary 31, 017 2016 2015 ASSETS Current disets Cash and cash equivalients Recevables, net Inventories Prepaid expenses and other $ 6,867 8.7057 5,835 5,624 4.7 43,046444694519 1,941 1441 222Y 57,689 60,239 327F Total current assets Property and equipment Property and equipment Less accumulated depreciation 179,492 176958 71,782) (66.787 107,710 11017 Property and equipment, net Property under capital lease and financing oblgations 11,637 Property under capital lease and financing obligtions Less accumulated amortization (5,1691-045_ 2.3 1,096 47511 Property under capital lease and finanding obigations, ne 16,695 17,03713 9,921 Other assets and defered charges Total assets $198.825 $199581 2+440 LIABILITIES AND EQUITY Current iebilities Short-term borrowings Accounts payable Accrued lablities Accrued income taxes Long-term debt due within one year Capital lease and fnancing obligations due within one year $ 1,099 41,433 20,654 921 2,256 565 2705 38,487 19,607 521 2,745 551 6,928 646S33 36,015 38,214 40, 8,9 Total current liabilities Long-term debt Long-1erm capital lease and financing obligations 6,003 9,344 7321 . Deferred income taxes and other Commitments and contingencies Equity 17 323 305 2.371 Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive los 89,354 9002 85 777 (14.232) 01597 (/5) 2,37 3065 45y3 77,798 aos46 5139y Total Walmart shareholders' equity Nonredeemable noncontroling interest 80,535 83611 55937 Total equity $198,825 $199581 03, 450 Total liabilities and equity Ser accomparygnoes Consolidated Statements o f Cash Flows Cash flows from operating activitiex income fiom dscontinued opeation net of ncome ties income from continuing operations Adjustments to reconcle income fom continuing operatios so net cash $14,293 51500 $ 1709 14,293 5,00 6814 10,08945417 Defersed income taxes Other operating activities Changes in certain assets and lublioes net of efcts of qtio 703 229 Accrued labilities 31 530 70 Net cash provided by operating actwities Cash fows from investing activities Peyments for property and equipment Proceeds from the dsposal of property and equipment Proceeds from the doposal of certain openstiom Purchase of available for sale securties nwesment and buniness acquihtions, net of cash acqured 10,619(1 12174 Net cash used in investing activne (13.987) 10675) 1123) Cash flows from financing activities: 11,623,2356,28 Net change in shorl-term bonowings Proceeds fhom issuance of long term debr Payments of long-tern debt 12,055)44323.904 6.2161524615) 01,298)4112015 Puschase of Company stodk Dvidends paid to noncontroling intesest Purchase of noncontrolting int Ocher fnancing activties 900132 (1,844 (255) 513 18,929) 16122 (15,071 Net cash used in francing activities (452) 1,838) (102) 5140 Effect of exchange rates on cash and cash equvalenes Net increme idecrease) in cath and cash equhalen Cash and cash rqualents at begineing of yeur Cash and cash equivalents at end of yea $686758705 935 Supplemental disclosure of cash fNow informatio 1 869 2433 Income taxes paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts