Question: Can someone please help with the below? BNE = Bayesian Nash Eq. Optimal,r Reserve Price in 0 Discrete Vickrey Auction: A seller chooses to sell

Can someone please help with the below? BNE = Bayesian Nash Eq.

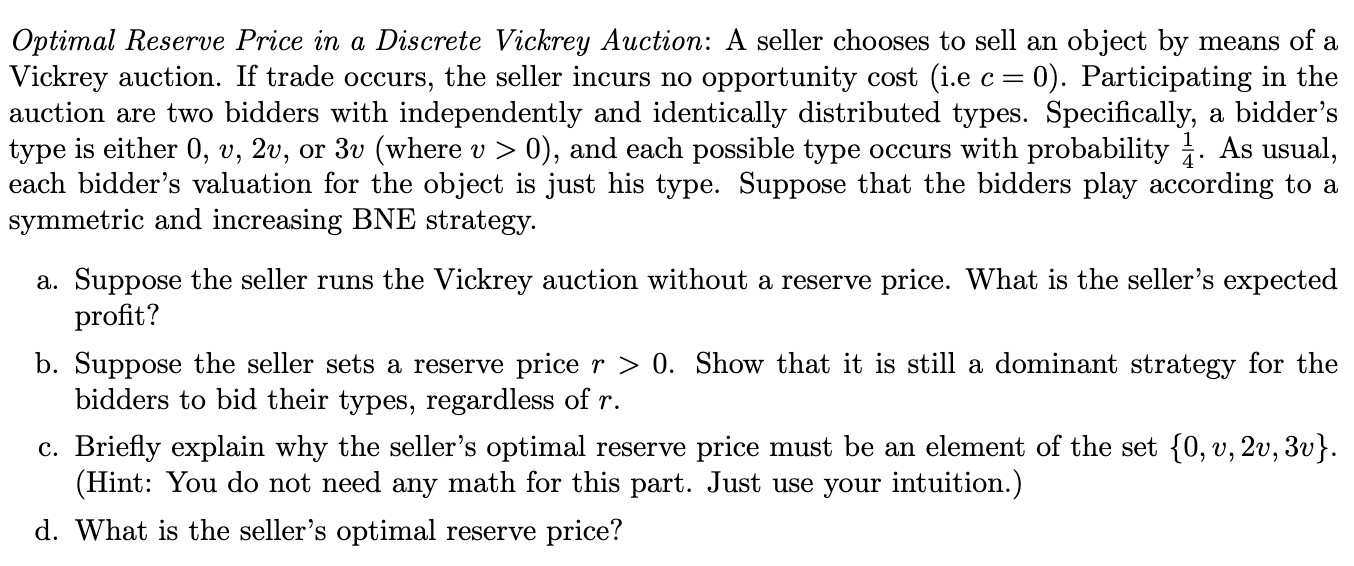

Optimal,r Reserve Price in 0 Discrete Vickrey Auction: A seller chooses to sell an object by means of a Vickrey auction. If trade occurs, the seller incurs no opportunity cost (i.e c = 0). Participating in the auction are two bidders with independently and identically distributed types. Specically, a bidder's type is either 0, o, 21), or 31) (where v > 0), and each possible type occurs with probability %. As usual, each bidder's valuation for the object is just his type. Suppose that the bidders play according to a Symmetric and increasing BNE strategy. a. Suppose the seller runs the Vickrey auction without a reserve price. What is the seller's expected prot? b. Suppose the seller sets a reserve price 2*" > 0. Show that it is still a dominant strategy for the bidders to bid their types, regardless of r. c. Briey explain why the seller's optimal reserve price must be an element of the set {0, 1;, 211,311}. (Hint: You do not need any math for this part. Just use your intuition.) d. What is the seller's optimal reserve price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts