Question: Can someone please help with this? I need the solutions and the formulas and I will give a thumb up. Thank you in advance. For

Can someone please help with this? I need the solutions and the formulas and I will give a thumb up. Thank you in advance.

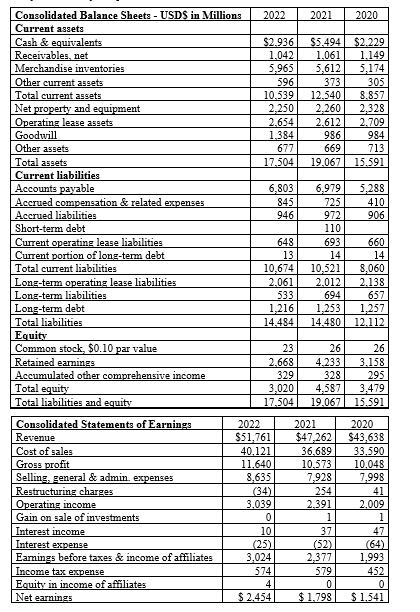

For this module, you will design your input and output ranges according to the Principles of Spreadsheet Design. Calculate and analyze Best Buy's capital structure ratios.

\begin{tabular}{|l|r|r|r|} \hline Consolidated Balance Sheets - USDS in Millions & \multicolumn{1}{|c|}{2022} & 2021 & 2020 \\ \hline Current assets & & & \\ \hline Cash \& equivalents & $2,936 & $5,494 & $2,229 \\ \hline Receivables, net & 1,042 & 1,061 & 1,149 \\ \hline Merchandise inventories & 5,965 & 5,612 & 5,174 \\ \hline Other current asgets & 596 & 373 & 305 \\ \hline Total current asgets & 10,539 & 12,540 & 8,857 \\ \hline Net property and equipment & 2,250 & 2,260 & 2,328 \\ \hline Operating lease asgets & 2,654 & 2,612 & 2,709 \\ \hline Goodwill & 1,384 & 986 & 984 \\ \hline Other assets & 677 & 669 & 713 \\ \hline Total assets & 17,504 & 19,067 & 15,591 \\ \hline Current liabilities & & & \\ \hline Accounts payable & 6,803 & 6,979 & 5,288 \\ \hline Accrued compengation \& related expenses & 845 & 725 & 410 \\ \hline Accrued liabilities & 946 & 972 & 906 \\ \hline Short-term debt & & 110 & \\ \hline Current operating lease liabilities & 648 & 693 & 660 \\ \hline Current portion of long-term debt & 13 & 14 & 14 \\ \hline Total current liabilities & 10,674 & 10,521 & 8,060 \\ \hline Long-term operating lease liabilities & 2,061 & 2,012 & 2,138 \\ \hline Long-term liabilities & 533 & 694 & 657 \\ \hline Long-term debt & 1,216 & 1,253 & 1,257 \\ \hline Total liabilities & 14,484 & 14,480 & 12,112 \\ \hline Equity & 2,668 & & \\ \hline Common stock, \$0.10 par value & 4,239 & 328 & 3,158 \\ \hline Retained earnings & 4,587 & 3,479 \\ \hline Accumulated other comprehensive income & 19,067 & 15,591 \\ \hline Total equity & 23 & 26 & 26 \\ \hline Total liabilities and equity & 17,504 & 153 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline Consolidated Statements of Earnings & \multicolumn{1}{|c|}{2022} & \multicolumn{1}{c|}{2021} & \multicolumn{1}{c|}{2020} \\ \hline Revenue & $51,761 & $47,262 & $43,638 \\ \hline Cost of sales & 40,121 & 36,689 & 33,590 \\ \hline Gross profit & 11,640 & 10,573 & 10,048 \\ \hline Selling, general \& admin. expenses & 8,635 & 7,928 & 7,998 \\ \hline Reatructuring charges & (34) & 254 & 41 \\ \hline Operating income & 3,039 & 2,391 & 2,009 \\ \hline Gain on sale of invegtments & 0 & 1 & 1 \\ \hline Interest income & 10 & 37 & 47 \\ \hline Interest expense & (25) & (52) & (64) \\ \hline Earnings before taxes \& income of affiliates & 3,024 & 2,377 & 1,993 \\ \hline Income tax expense & 574 & 579 & 452 \\ \hline Equity in income of affiliates & 4 & 0 & 0 \\ \hline Net earnings & $2,454 & $1,798 & $1,541 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline Consolidated Balance Sheets - USDS in Millions & \multicolumn{1}{|c|}{2022} & 2021 & 2020 \\ \hline Current assets & & & \\ \hline Cash \& equivalents & $2,936 & $5,494 & $2,229 \\ \hline Receivables, net & 1,042 & 1,061 & 1,149 \\ \hline Merchandise inventories & 5,965 & 5,612 & 5,174 \\ \hline Other current asgets & 596 & 373 & 305 \\ \hline Total current asgets & 10,539 & 12,540 & 8,857 \\ \hline Net property and equipment & 2,250 & 2,260 & 2,328 \\ \hline Operating lease asgets & 2,654 & 2,612 & 2,709 \\ \hline Goodwill & 1,384 & 986 & 984 \\ \hline Other assets & 677 & 669 & 713 \\ \hline Total assets & 17,504 & 19,067 & 15,591 \\ \hline Current liabilities & & & \\ \hline Accounts payable & 6,803 & 6,979 & 5,288 \\ \hline Accrued compengation \& related expenses & 845 & 725 & 410 \\ \hline Accrued liabilities & 946 & 972 & 906 \\ \hline Short-term debt & & 110 & \\ \hline Current operating lease liabilities & 648 & 693 & 660 \\ \hline Current portion of long-term debt & 13 & 14 & 14 \\ \hline Total current liabilities & 10,674 & 10,521 & 8,060 \\ \hline Long-term operating lease liabilities & 2,061 & 2,012 & 2,138 \\ \hline Long-term liabilities & 533 & 694 & 657 \\ \hline Long-term debt & 1,216 & 1,253 & 1,257 \\ \hline Total liabilities & 14,484 & 14,480 & 12,112 \\ \hline Equity & 2,668 & & \\ \hline Common stock, \$0.10 par value & 4,239 & 328 & 3,158 \\ \hline Retained earnings & 4,587 & 3,479 \\ \hline Accumulated other comprehensive income & 19,067 & 15,591 \\ \hline Total equity & 23 & 26 & 26 \\ \hline Total liabilities and equity & 17,504 & 153 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline Consolidated Statements of Earnings & \multicolumn{1}{|c|}{2022} & \multicolumn{1}{c|}{2021} & \multicolumn{1}{c|}{2020} \\ \hline Revenue & $51,761 & $47,262 & $43,638 \\ \hline Cost of sales & 40,121 & 36,689 & 33,590 \\ \hline Gross profit & 11,640 & 10,573 & 10,048 \\ \hline Selling, general \& admin. expenses & 8,635 & 7,928 & 7,998 \\ \hline Reatructuring charges & (34) & 254 & 41 \\ \hline Operating income & 3,039 & 2,391 & 2,009 \\ \hline Gain on sale of invegtments & 0 & 1 & 1 \\ \hline Interest income & 10 & 37 & 47 \\ \hline Interest expense & (25) & (52) & (64) \\ \hline Earnings before taxes \& income of affiliates & 3,024 & 2,377 & 1,993 \\ \hline Income tax expense & 574 & 579 & 452 \\ \hline Equity in income of affiliates & 4 & 0 & 0 \\ \hline Net earnings & $2,454 & $1,798 & $1,541 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts