Question: can someone please me with this question View Policies Current Attempt in Progress A company purchases new machinery on January 31 for $180,000 which has

can someone please me with this question

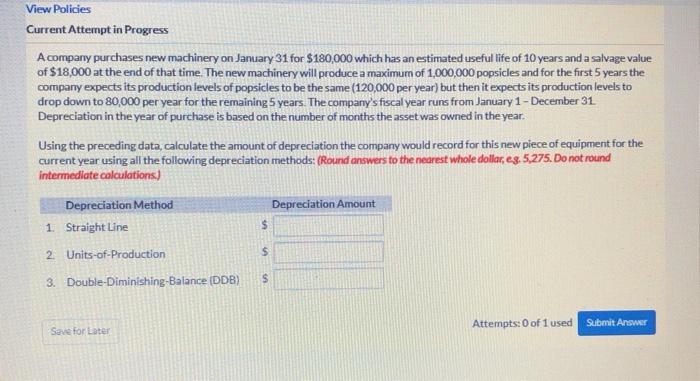

can someone please me with this questionView Policies Current Attempt in Progress A company purchases new machinery on January 31 for $180,000 which has an estimated useful life of 10 years and a salvage value of $18,000 at the end of that time. The new machinery will produce a maximum of 1,000,000 popsicles and for the first 5 years the company expects its production levels of popsicles to be the same (120,000 per year) but then it expects its production levels to drop down to 80,000 per year for the remaining 5 years. The company's fiscal year runs from January 1-December 31 Depreciation in the year of purchase is based on the number of months the asset was owned in the year. Using the preceding data, calculate the amount of depreciation the company would record for this new piece of equipment for the current year using all the following depreciation methods: (Round answers to the nearest whole dollar, eg. 5,275. Do not round intermediate calculations.) Depreciation Method Depreciation Amount 1 Straight Line 2 Units-of-Production $ $ $ 3. Double-Diminishing-Balance (DDB) Attempts: 0 of 1 used Submit Answer Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts