Question: Can someone please review my fair value allocation schedule? Also, would acquiring this company be a good decision or not? The template is not supposed

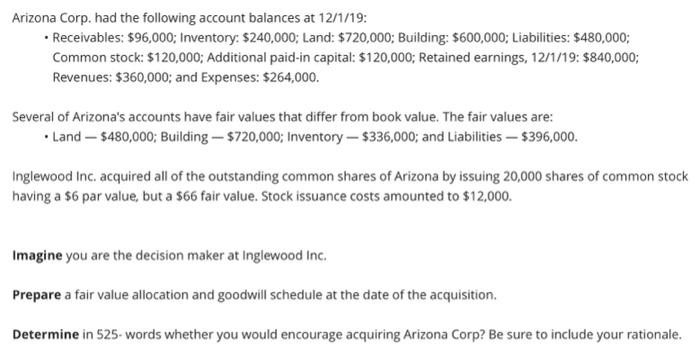

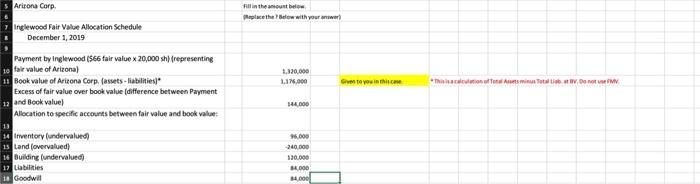

Arizona Corp. had the following account balances at 12/1/19: - Receivables: $96,000; Inventory: $240,000; Land: $720,000; Building: $600,000; Liabilities: $480,000; Common stock: $120,000; Additional paid-in capital: $120,000; Retained earnings, 12/1/19: $840,000; Revenues: $360,000; and Expenses: $264,000. Several of Arizona's accounts have fair values that differ from book value. The fair values are: - Land - $480,000; Building - \$720,000; Inventory - $336,000; and Liabilities - $396,000. Inglewood Inc. acquired all of the outstanding common shares of Arizona by issuing 20,000 shares of common stock having a $6 par value, but a $66 fair value. Stock issuance costs amounted to $12,000. Imagine you are the decision maker at Inglewood Inc. Prepare a fair value allocation and goodwill schedule at the date of the acquisition. Determine in 525- words whether you would encourage acquiring Arizona Corp? Be sure to include your rationale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts