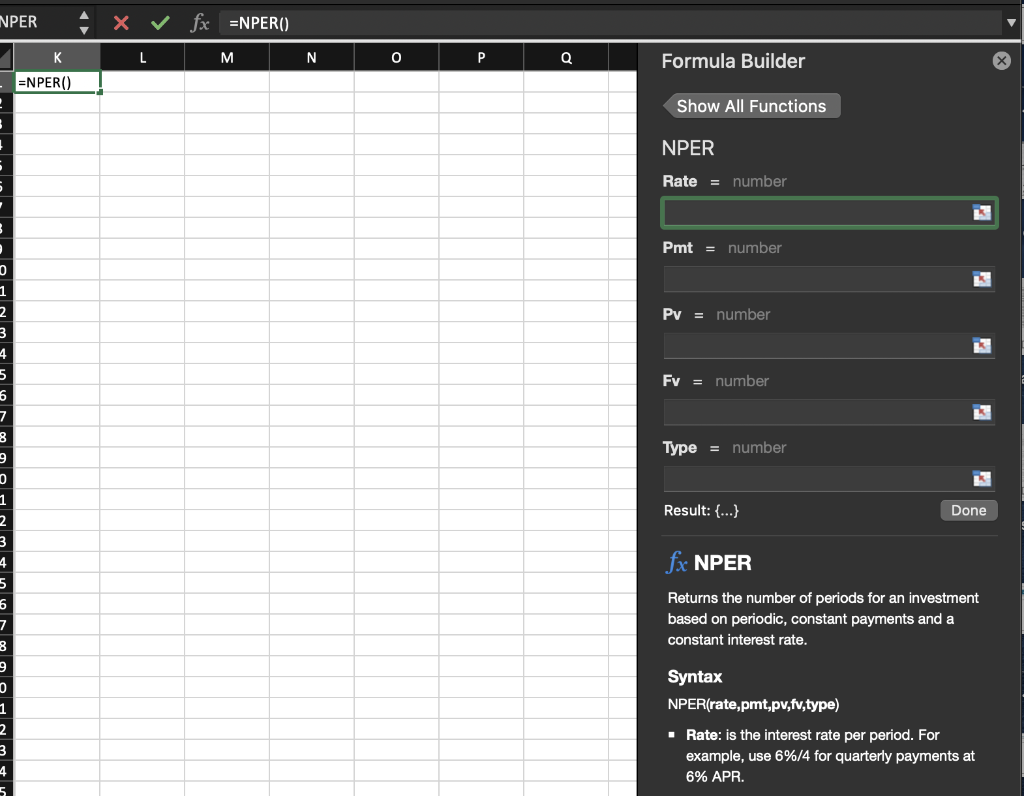

Question: Can someone please show me how to solve this using the NPER formula on excel or let me know if this is the right formula

Can someone please show me how to solve this using the NPER formula on excel or let me know if this is the right formula to use?

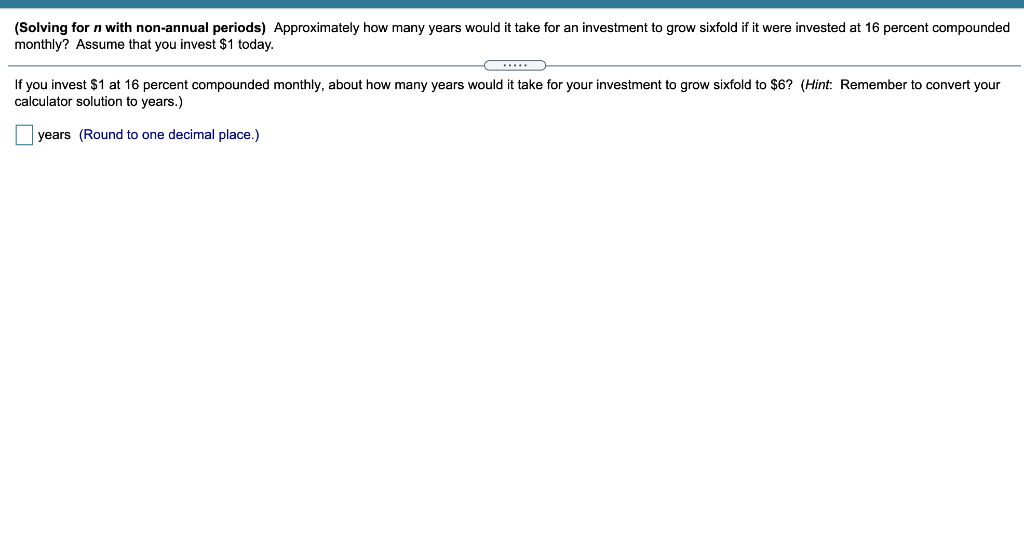

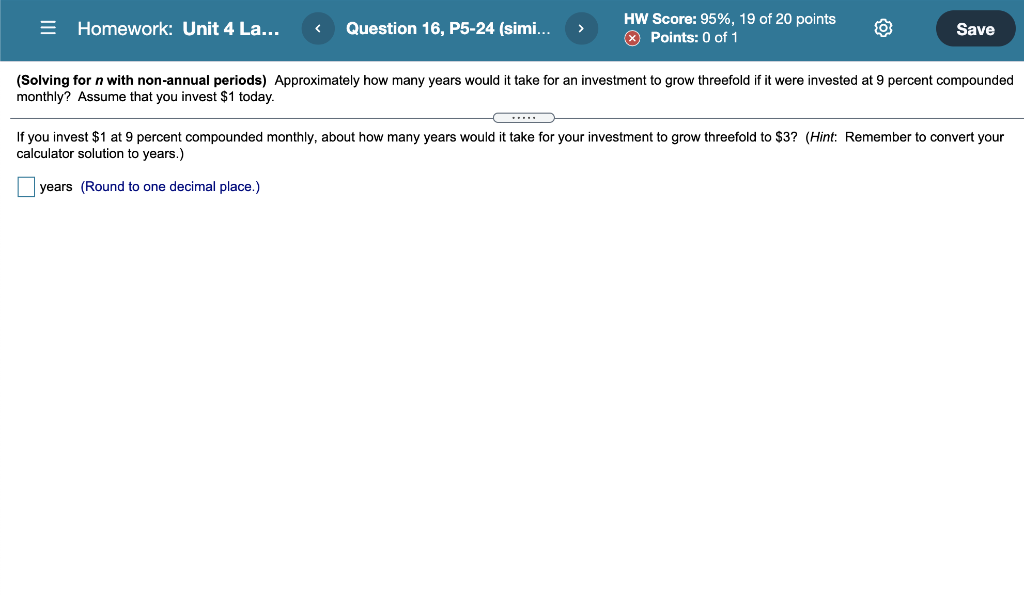

(Solving for n with non-annual periods) Approximately how many years would it take for an investment to grow sixfold if it were invested at 16 percent compounded monthly? Assume that you invest $1 today. . If you invest $1 at 16 percent compounded monthly, about how many years would it take for your investment to grow sixfold to $6? (Hint: Remember to convert your calculator solution to years.) years (Round to one decimal place.) = Homework: Unit 4 La... Question 16, P5-24 (simi... HW Score: 95%, 19 of 20 points X Points: 0 of 1 O Save (Solving for n with non-annual periods) Approximately how many years would it take for an investment to grow threefold if it were invested at 9 percent compounded monthly? Assume that you invest $1 today. .... If you invest $1 at 9 percent compounded monthly, about how many years would it take for your investment to grow threefold to $3? (Hint: Remember to convert your calculator solution to years.) years (Round to one decimal place.) NPER fx =NPER() L M N 0 P Q Formula Builder =NPER() Show All Functions NPER Rate = number Ek Pmt = number PV = number k 0 1 2 3 4 5 6 7 3 Fy = number Type = number Result: {...} Done 0 1 2 3 4 5 6 7 fx NPER Returns the number of periods for an investment based on periodic, constant payments and a constant interest rate. 9 1 2 3 4 5 Syntax NPER(rate,pmt,pv,fv,type) Rate: is the interest rate per period. For example, use 6%/4 for quarterly payments at 6% APR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts