Question: Can someone please show me the steps to finding the missing red numbers? I am confused on how to mathematically find them. Thanks! The following

Can someone please show me the steps to finding the missing red numbers? I am confused on how to mathematically find them. Thanks!

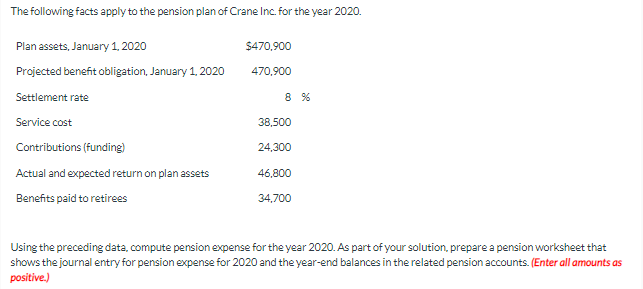

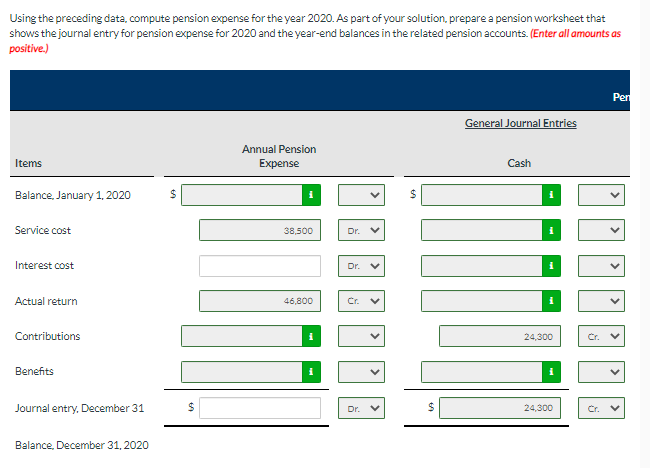

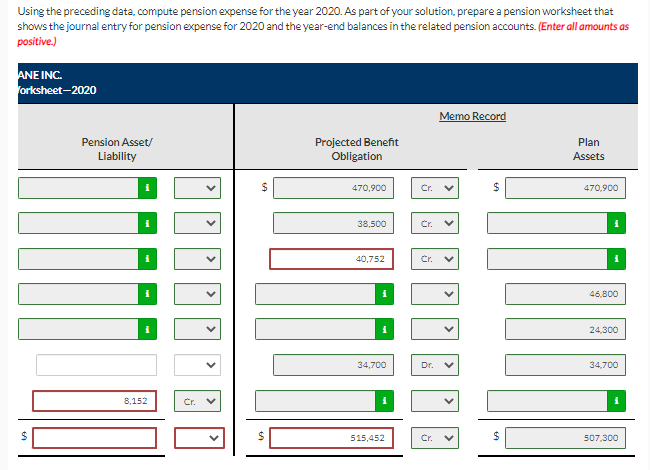

The following facts apply to the pension plan of Crane Inc. for the year 2020. $470.900 470.900 8 % Plan assets, January 1, 2020 Projected benefit obligation, January 1, 2020 Settlement rate Service cost Contributions (funding) Actual and expected return on plan assets Benefits paid to retirees 38,500 24,300 46,800 34,700 Using the preceding data, compute pension expense for the year 2020. As part of your solution, prepare a pension worksheet that shows the journal entry for pension expense for 2020 and the year-end balances in the related pension accounts. (Enter all amounts as positive.) Using the preceding data, compute pension expense for the year 2020. As part of your solution, prepare a pension worksheet that shows the journal entry for pension expense for 2020 and the year-end balances in the related pension accounts. (Enter all amounts as positive.) Per General Journal Entries Annual Pension Expense Items Cash Balance, January 1, 2020 $ $ Service cost 38,500 Dr. Interest cost Dr. Actual return 46,800 Cr. Contributions 24,300 Cr. Benefits Journal entry, December 31 $ Dr. 24,300 Cr. Balance, December 31, 2020 Using the preceding data, compute pension expense for the year 2020. As part of your solution, prepare a pension worksheet that shows the journal entry for pension expense for 2020 and the year-end balances in the related pension accounts. (Enter all amounts as positive.) ANE INC. Yorksheet-2020 Memo Record Pension Asset/ Liability Projected Benefit Obligation Plan Assets $ 470.900 Cr. $ 470.900 38,500 Cr. 40,752 Cr. 46,800 24.300 34,700 Dr. 34.700 8,152 Cr. $ $ 515,452 Cr. GA $ 507,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts