Question: Can someone please show their work while answering this? 1) You are advising a commercial real estate investor who is investigating the acquisition of an

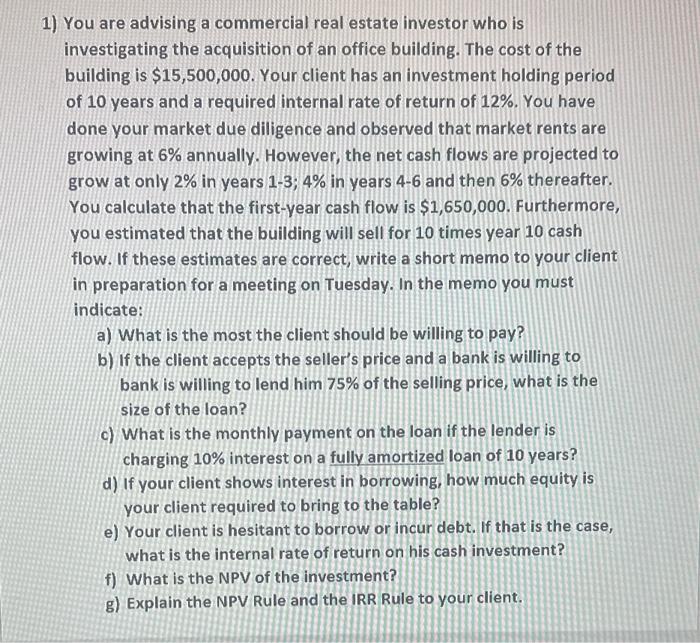

1) You are advising a commercial real estate investor who is investigating the acquisition of an office building. The cost of the building is $15,500,000. Your client has an investment holding period of 10 years and a required internal rate of return of 12%. You have done your market due diligence and observed that market rents are growing at 6% annually. However, the net cash flows are projected to grow at only 2% in years 13;4% in years 46 and then 6% thereafter. You calculate that the first-vear cash flow is $1,650,000. Furthermore, you estimated that the building will sell for 10 times year 10 cash flow. If these estimates are correct, write a short memo to your client in preparation for a meeting on Tuesday. In the memo you must indicate: a) What is the most the client should be willing to pay? b) If the client accepts the seller's price and a bank is willing to bank is willing to lend him 75% of the selling price, what is the size of the loan? c) What is the monthly payment on the loan if the lender is charging 10% interest on a fully amortized loan of 10 years? d) If your client shows interest in borrowing, how much equity is your client required to bring to the table? e) Your client is hesitant to borrow or incur debt. If that is the case, what is the internal rate of return on his cash investment? f) What is the NPV of the investment? g) Explain the NPV Rule and the IRR Rule to your client

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts