Question: I only need the excel version. 1) You are advising a commercial real estate investor who is investigating the acquisition of an office building. The

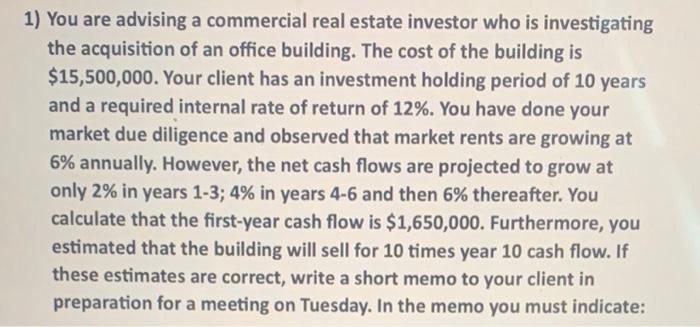

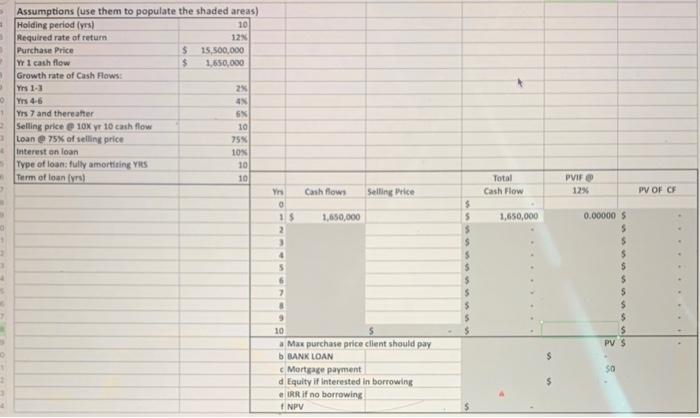

1) You are advising a commercial real estate investor who is investigating the acquisition of an office building. The cost of the building is $15,500,000. Your client has an investment holding period 10 years and a required internal rate of return of 12%. You have done your market due diligence and observed that market rents are growing at 6% annually. However, the net cash flows are projected to grow at only 2% in years 13;4% in years 4-6 and then 6% thereafter. You calculate that the first-year cash flow is $1,650,000. Furthermore, you estimated that the building will sell for 10 times year 10 cash flow. If these estimates are correct, write a short memo to your client in preparation for a meeting on Tuesday. In the memo you must indicate: 1) You are advising a commercial real estate investor who is investigating the acquisition of an office building. The cost of the building is $15,500,000. Your client has an investment holding period 10 years and a required internal rate of return of 12%. You have done your market due diligence and observed that market rents are growing at 6% annually. However, the net cash flows are projected to grow at only 2% in years 13;4% in years 4-6 and then 6% thereafter. You calculate that the first-year cash flow is $1,650,000. Furthermore, you estimated that the building will sell for 10 times year 10 cash flow. If these estimates are correct, write a short memo to your client in preparation for a meeting on Tuesday. In the memo you must indicate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts