Question: can someone show me how do these problems as well as how do them using a 84 ti calculator? 1) A firm has to pay

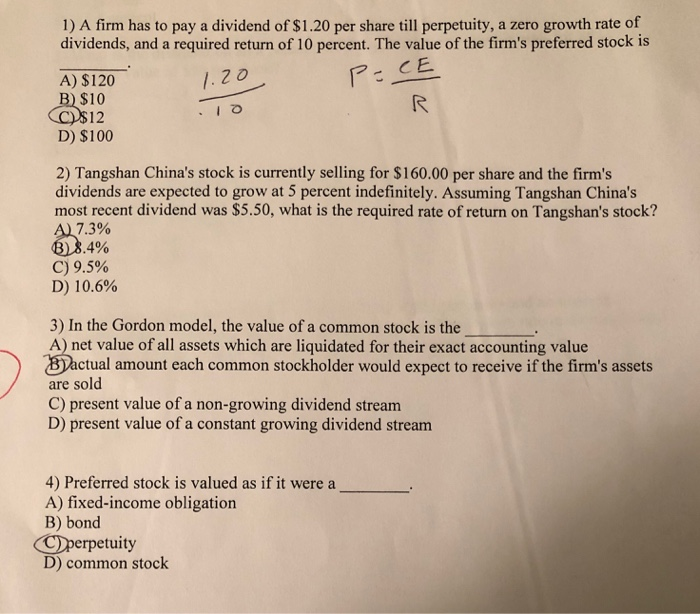

1) A firm has to pay a dividend of $1.20 per share till perpetuity, a zero growth rate of dividends, and a required return of 10 percent. The value of the firm's preferred stock is CE l.20 A) $120 $10 12 D) $100 2) Tangshan China's stock is currently selling for $160.00 per share and the firm's dividends are expected to grow at 5 percent indefinitely. Assuming Tangshan China's most recent dividend was $5.50, what is the required rate of return on Tangshan's stock? 7.3% 4% C) 9.5% D) 10.6% 3) In the Gordon model, the value of a common stock is the A) net value of all assets which are liquidated for their exact accounting value ctual amount each common stockholder would expect to receive if the firm's assets are sold C) present value of a non-growing dividend stream D) present value of a constant growing dividend stream 4) Preferred stock is valued as if it were a A) fixed-income obligation B) bond CDperpetuity D) common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts