Question: can someone show me how do these problems as well as how do them using a 84 ti calculator? 1) The approximate before-tax cost of

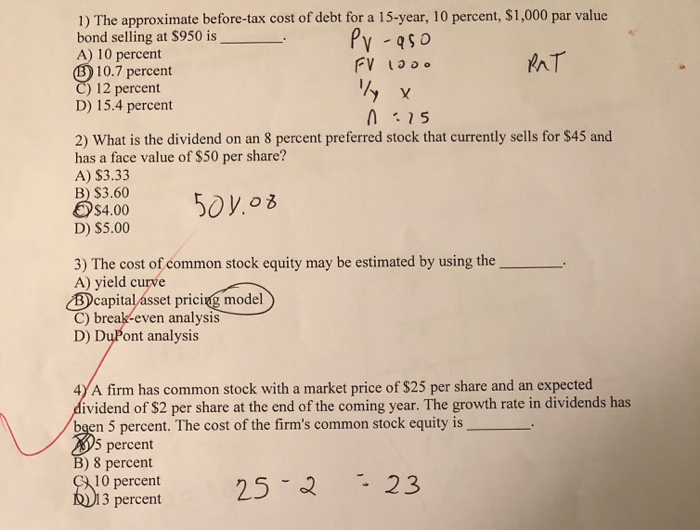

1) The approximate before-tax cost of debt for a 15-year, 10 percent, $1,000 par value bond selling at $950 is A) 10 percent 10.7 percent C) 12 percent D) 15.4 percent 2) What is the dividend on an 8 percent preferred stock that currently sells for $45 and has a face value of $50 per share? A) S3.33 B) $3.60 50 . 3 $4.00 D) $5.00 3) The cost of common stock equity may be estimated by using the A) yield curve Bcapital,sset pricig model C) break-even analysis D) DuPont analysis 4yA firm has common stock with a market price of $25 per share and an expected ividend of $2 per share at the end of the coming year. The growth rate in dividends has boen 5 percent. The cost of the firm's common stock equity is percent B) 8 percent 10 percent 3 percent 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts