Question: can someone simplify this method? ency is the critical issue to life insurance needs and assist want. Married couples who are dependent on the in

can someone simplify this method?

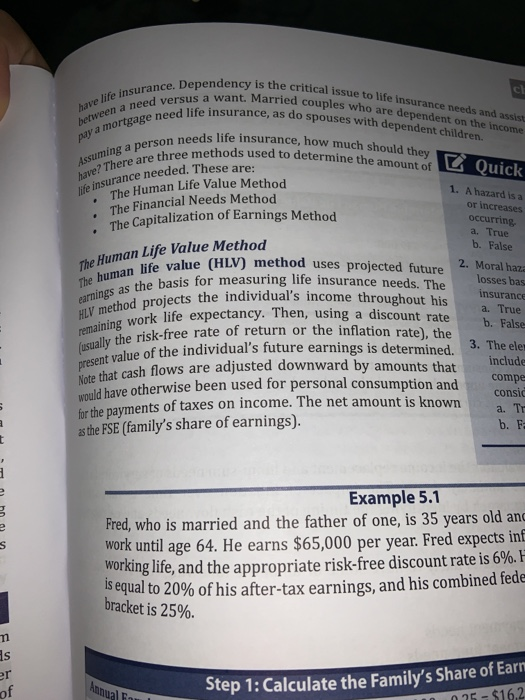

can someone simplify this method?ency is the critical issue to life insurance needs and assist want. Married couples who are dependent on the in life insurance, as do spouses with dependent children life insurance. Dependen een a need versus a wan have a need have life insur between a neen life insurance, as do spouses with dependent on the a mortgage need life Assuming a person need have? There are three needs life insurance, how much should they e three methods used to determine the ar rmine the amount of eeded. These are: Quick to insurance needed. These a The The Human Life Value Method The Financial Needs Method The Capitalization of Earnings Method 1. A hazard is a or increases occurring a. True b. False the Human Life Value Method losses bas The human life val earnings as the basi HLV method projects the remaining work life exr (usually the risk-free rat present value of the indi life value (HLV) method uses projected future 2. Moral haza the basis for measuring life insurance needs. The roiects the individual's income throughout his insurance work life expectancy. Then, using a discount rate a. True b. False e risk-free rate of return or the inflation rate), the lue of the individual's future earnings is determined. 3. The ele cash flows are adjusted downward by amounts that include compe Whave otherwise been used for personal consumption and consid the payments of taxes on income. The net amount is known a. To as the FSE (family's share of earnings). b. F: Note that cash flows are adiu on hy Example 5.1 Fred, who is married and the father of one, is 35 years old and work until age 64. He earns $65,000 per year. Fred expects inf working life, and the appropriate risk-free discount rate is 6%. F is equal to 20% of his after-tax earnings, and his combined fede bracket is 25%. Annual Step 1: Calculate the Family's Share of Earn 025 - $16,2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts