Question: can someone solve using excel and show how please thanks can some one solve all through excel and show formula being used Financial Feasibility: Analysis

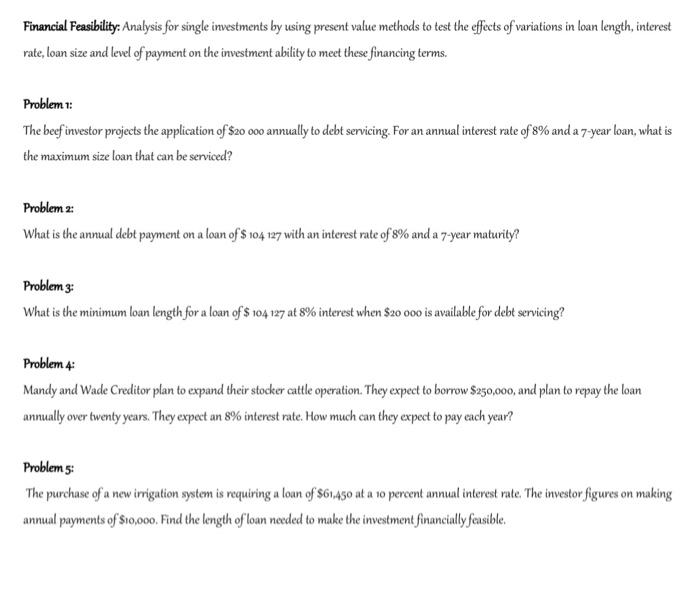

Financial Feasibility: Analysis for single investments by using present value methods to test the effects of variations in loan length, interest rate, loan size and level of payment on the investment ability to meet these financing terms. Problem: The beef investor projects the application of $20 000 annually to debt servicing. For an annual interest rate of 8% and a 7-year loan, what is the maximum size loan that can be serviced? Problem 2: What is the annual debt payment on a loan of $104 127 with an interest rate of 8% and a 7-year maturity? Problem 3: What is the minimum loan length for a loan of $ 104 127 at 8% interest when $20 000 is available for debt servicing? Problem 4 Mandy and Wade Creditor plan to expand their stocker cattle operation. They expect to borrow $250,000, and plan to repay the loan annually over twenty years. They expect an 8% interest rate. How much can they expect to pay each year? Problem 5: The purchase of a new irrigation system is requiring a loan of $61.450 at a 10 percent annual interest rate. The investor figures on making annual payments of $10,000. Find the length of loan needed to make the investment financially feasible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts