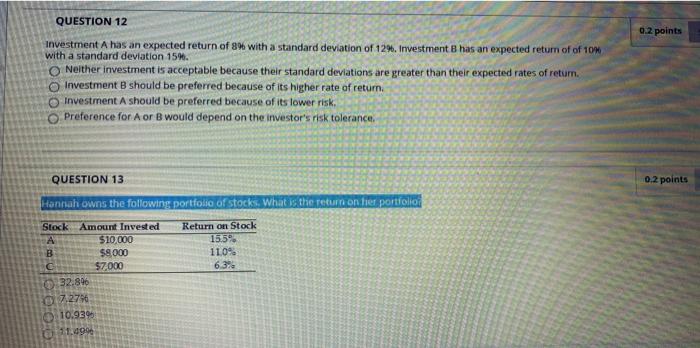

Question: Can somwone please help me with question 12& 13 QUESTION 12 0.2 points Investment A has an expected return of 89 with a standard deviation

QUESTION 12 0.2 points Investment A has an expected return of 89 with a standard deviation of 129. Investment B has an expected return of of 10 with a standard deviation 15. Neither investment is acceptable because their standard deviations are greater than their expected rates of retum. Investment B should be preferred because of its higher rate of return Investment A should be preferred because of its lower risk, Preference for A or B would depend on the investor's risk tolerance 0.2 points QUESTION 13 Hannah owns the following portfolio of stocks. What is the return on tier portfolio Return on Stock 15:59 110% 6.3% Stock Amount Invested A $10,000 B $8.000 $7,000 0:32.896 072786 10.93 11,099

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts