Question: can soneone solve this problem Problem 12-26 Adjusted Cash Flow From Assets LO3] You have looked at the current financial statements for Reigle Homes Co.

can soneone solve this problem

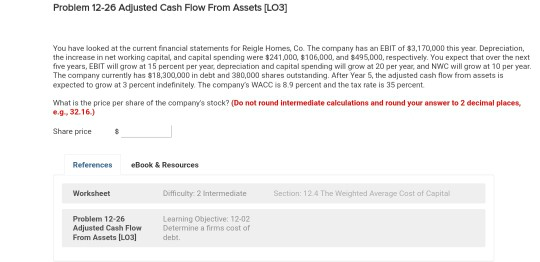

Problem 12-26 Adjusted Cash Flow From Assets LO3] You have looked at the current financial statements for Reigle Homes Co. The company has an EBIT of $3,170,000 this year. Depreciation, the increase in net working capital and capital spending were $241,000, $106,000 and $495,000, respectively. You expect that over the next frve years, EBIT will grow at 15 percent per year depreciation and capital spending will grow at 20 per year, and NWC will grow at 10 per year. The company currently has $18,300,000 in debt and 380,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3 percent indennitely. The company's WACC 8 9 percent and the tax rate is 35 percent What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places e.g. 32.16.) Share price $ References eBook & Resources Worksheet Difficulty: 2 Intermediate Section: 124 The Weighted Average Cost of Capital Problem 12-26 Adjusted Cash Flow From Assets (L03) Learning Objective: 12-02 Determine a firms cost of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts