Question: can u help me do 1-5 i dont understand hoe they got each one? Exercise 16-10 (Algo) Financial Ratios for Assessing Market Performanc The financial

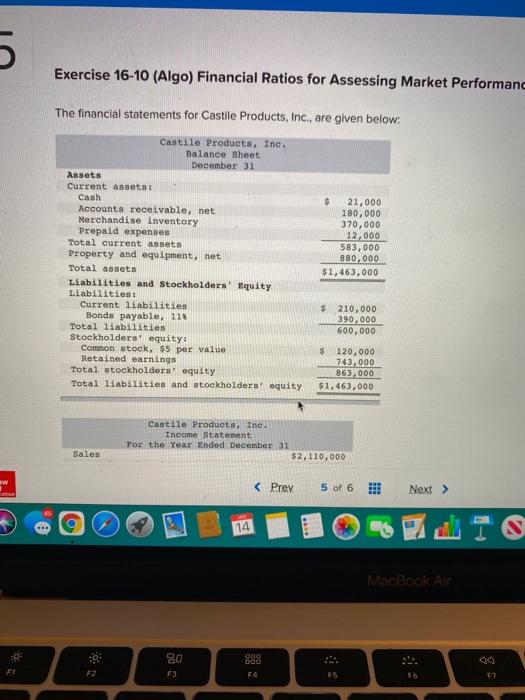

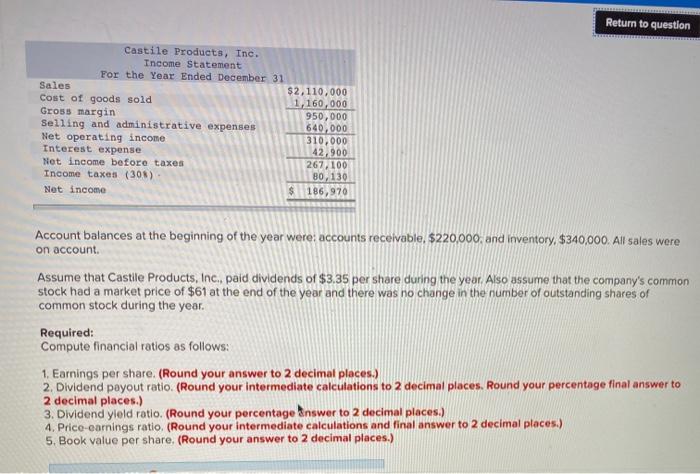

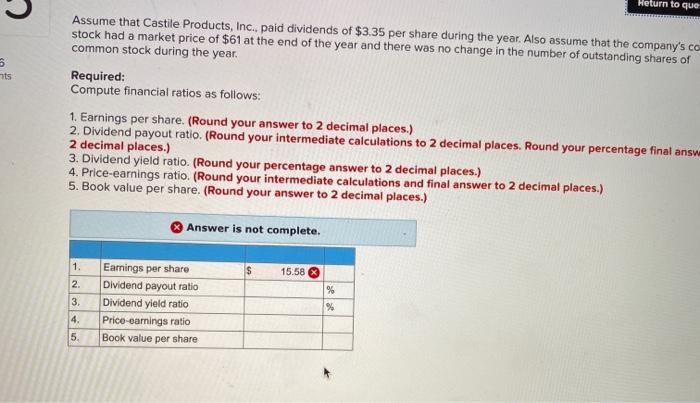

Exercise 16-10 (Algo) Financial Ratios for Assessing Market Performanc The financial statements for Castile Products, Inc., are given below: Cantile Products, Inc. Balance Sheet December 31 Assets Current assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Total current assets Property and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 116 Total liabilities Stockholders' equity: Common stock, $5 per value Retained earnings Total stockholdersequity Total liabilities and stockholderar equity $ 21,000 180,000 370,000 12.000 583,000 880,000 $1,463,000 $ 210,000 390,000 600,000 $ 120,000 743,000 863,000 $1,463,000 Castile Products, Inc. Income Statement For the Year Ended December 31 $2,110,000 Sales 14 MacBook Air 000 DOO 80 F3 FI F2 F F5 47 Return to question Castile Products, Inc. Income Statement For the Year Ended December 31 Sales $2,110,000 Cost of goods sold 1,160,000 Gross margin 950,000 Selling and administrative expenses 640,000 Net operating income 310,000 Interest expense 42,900 Net income before taxes 267.100 Income taxes (308) 80,130 Not income $ 186,970 Account balances at the beginning of the year were: accounts receivable, $220,000, and inventory $340,000. All sales were on account Assume that Castile Products, Inc, paid dividends of $3.35 per share during the year. Also assume that the company's common stock had a market price of $61 at the end of the year and there was no change in the number of outstanding shares of common stock during the year. Required: Compute financial ratios as follows: 1. Earnings per share. (Round your answer to 2 decimal places.) 2. Dividend payout ratio. (Round your intermediate calculations to 2 decimal places. Round your percentage final answer to 2 decimal places.) 3. Dividend yield ratio. (Round your percentage answer to 2 decimal places.) 4. Price-carnings ratio. (Round your intermediate calculations and final answer to 2 decimal places.) 5. Book value per share. (Round your answer to 2 decimal places.) Heturn to que S uts Assume that Castile Products, Inc., paid dividends of $3.35 per share during the year. Also assume that the company's co stock had a market price of $61 at the end of the year and there was no change in the number of outstanding shares of common stock during the year. Required: Compute financial ratios as follows: 1. Earnings per share. (Round your answer to 2 decimal places.) 2. Dividend payout ratio (Round your intermediate calculations to 2 decimal places. Round your percentage final answ 2 decimal places.) 3. Dividend yield ratio. (Round your percentage answer to 2 decimal places.) 4. Price earnings ratio. (Round your intermediate calculations and final answer to 2 decimal places.) 5. Book value per share. (Round your answer to 2 decimal places.) Answer is not complete. $ 1. 2. 15.58 3 Earnings per share Dividend payout ratio Dividend yield ratio Price-carings ratio Book value per share % % 4. 5. Exercise 16-10 (Algo) Financial Ratios for Assessing Market Performanc The financial statements for Castile Products, Inc., are given below: Cantile Products, Inc. Balance Sheet December 31 Assets Current assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Total current assets Property and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 116 Total liabilities Stockholders' equity: Common stock, $5 per value Retained earnings Total stockholdersequity Total liabilities and stockholderar equity $ 21,000 180,000 370,000 12.000 583,000 880,000 $1,463,000 $ 210,000 390,000 600,000 $ 120,000 743,000 863,000 $1,463,000 Castile Products, Inc. Income Statement For the Year Ended December 31 $2,110,000 Sales 14 MacBook Air 000 DOO 80 F3 FI F2 F F5 47 Return to question Castile Products, Inc. Income Statement For the Year Ended December 31 Sales $2,110,000 Cost of goods sold 1,160,000 Gross margin 950,000 Selling and administrative expenses 640,000 Net operating income 310,000 Interest expense 42,900 Net income before taxes 267.100 Income taxes (308) 80,130 Not income $ 186,970 Account balances at the beginning of the year were: accounts receivable, $220,000, and inventory $340,000. All sales were on account Assume that Castile Products, Inc, paid dividends of $3.35 per share during the year. Also assume that the company's common stock had a market price of $61 at the end of the year and there was no change in the number of outstanding shares of common stock during the year. Required: Compute financial ratios as follows: 1. Earnings per share. (Round your answer to 2 decimal places.) 2. Dividend payout ratio. (Round your intermediate calculations to 2 decimal places. Round your percentage final answer to 2 decimal places.) 3. Dividend yield ratio. (Round your percentage answer to 2 decimal places.) 4. Price-carnings ratio. (Round your intermediate calculations and final answer to 2 decimal places.) 5. Book value per share. (Round your answer to 2 decimal places.) Heturn to que S uts Assume that Castile Products, Inc., paid dividends of $3.35 per share during the year. Also assume that the company's co stock had a market price of $61 at the end of the year and there was no change in the number of outstanding shares of common stock during the year. Required: Compute financial ratios as follows: 1. Earnings per share. (Round your answer to 2 decimal places.) 2. Dividend payout ratio (Round your intermediate calculations to 2 decimal places. Round your percentage final answ 2 decimal places.) 3. Dividend yield ratio. (Round your percentage answer to 2 decimal places.) 4. Price earnings ratio. (Round your intermediate calculations and final answer to 2 decimal places.) 5. Book value per share. (Round your answer to 2 decimal places.) Answer is not complete. $ 1. 2. 15.58 3 Earnings per share Dividend payout ratio Dividend yield ratio Price-carings ratio Book value per share % % 4. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts