Question: can u help me solve this step by this. no excel solution here you go hinc two years ago for replaced by an upgraded mode

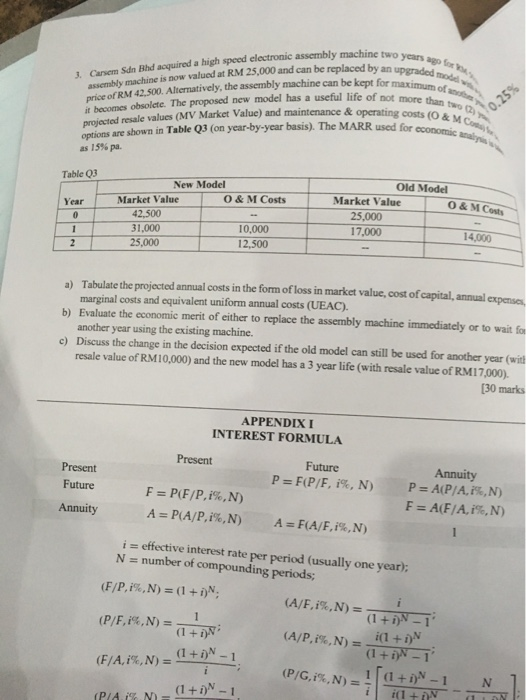

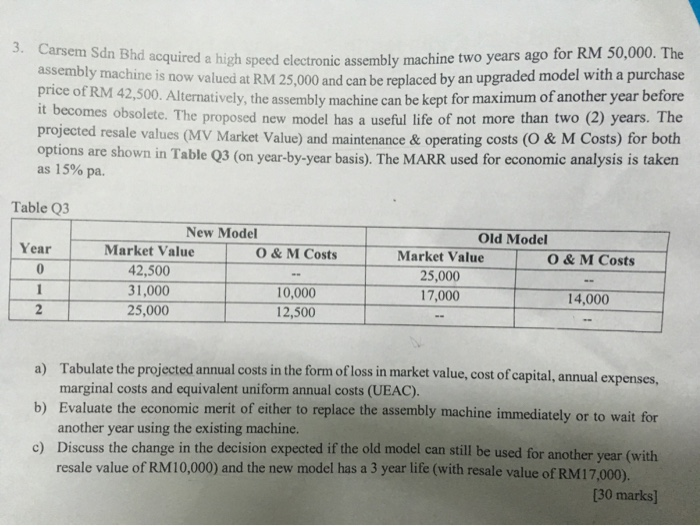

hinc two years ago for replaced by an upgraded mode for maximum of e of not more than two Carsem Sdn Bhd acquired a high speed electronic assembly machine bly machine is now valued at RM 25,000 and can be replaced by an model arie of RM 42.500. Alternatively, the assembly machine can be kept for me it becomes obsolete. The proposed new model has a useful life of ed resale values (MV Market Value) and maintenance & operating costs (o options are shown in Table Q3 (on year-by-year basis). The MARR used for con as 15% pa. (O & O Co nas Table 03 Year New Model Market Value O&M Costs 42 500 31.000 10.000 25,000 12,500 Old Model Market Value Market Value O&M Costa 25,000 17.000 140 a) Tabulate the projected annual costs in the form of loss in market value, cost of capital, annual expenses marginal costs and equivalent uniform annual costs (UEAC). b) Evaluate the economic merit of either to replace the assembly machine immediately or to wait for another year using the existing machine. c) Discuss the change in the decision expected if the old model can still be used for another year (with resale value of RM10,000) and the new model has a 3 year life (with resale value of RM17.000). [30 marks APPENDIXI INTEREST FORMULA Present Present Future P = F(P/F, i%, N) Future Annuity P = A(P/A,1%,N) F= A(F/A,1%,N) F = P(F/P,1%,N) A = P(A/P,1%,N) Annuity A = F(A/F,1%,N) i = effective interest rate per period (usually one year); N = number of compounding periods; (F/P,1%,N) = (1+1) (A/F,1%,N) = (1 + iN - 1 (P/F,1%N) = 1 (1 + i) (F/A,i%N) = (1 + 1) - 1 PAR N = (1 + r)N-1 (A/P.1%,N) - (1 + i)N (1+i)N-1 (P/G,1%,N) - 1 (1 + i)N-1 (1 + EN N 1 hinc two years ago for replaced by an upgraded mode for maximum of e of not more than two Carsem Sdn Bhd acquired a high speed electronic assembly machine bly machine is now valued at RM 25,000 and can be replaced by an model arie of RM 42.500. Alternatively, the assembly machine can be kept for me it becomes obsolete. The proposed new model has a useful life of ed resale values (MV Market Value) and maintenance & operating costs (o options are shown in Table Q3 (on year-by-year basis). The MARR used for con as 15% pa. (O & O Co nas Table 03 Year New Model Market Value O&M Costs 42 500 31.000 10.000 25,000 12,500 Old Model Market Value Market Value O&M Costa 25,000 17.000 140 a) Tabulate the projected annual costs in the form of loss in market value, cost of capital, annual expenses marginal costs and equivalent uniform annual costs (UEAC). b) Evaluate the economic merit of either to replace the assembly machine immediately or to wait for another year using the existing machine. c) Discuss the change in the decision expected if the old model can still be used for another year (with resale value of RM10,000) and the new model has a 3 year life (with resale value of RM17.000). [30 marks APPENDIXI INTEREST FORMULA Present Present Future P = F(P/F, i%, N) Future Annuity P = A(P/A,1%,N) F= A(F/A,1%,N) F = P(F/P,1%,N) A = P(A/P,1%,N) Annuity A = F(A/F,1%,N) i = effective interest rate per period (usually one year); N = number of compounding periods; (F/P,1%,N) = (1+1) (A/F,1%,N) = (1 + iN - 1 (P/F,1%N) = 1 (1 + i) (F/A,i%N) = (1 + 1) - 1 PAR N = (1 + r)N-1 (A/P.1%,N) - (1 + i)N (1+i)N-1 (P/G,1%,N) - 1 (1 + i)N-1 (1 + EN N 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts