Question: can u help me with this? i have the example temple for it. Exercise 7-21 The beginning trial balance has been entered in the general

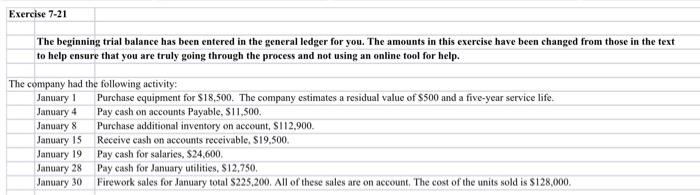

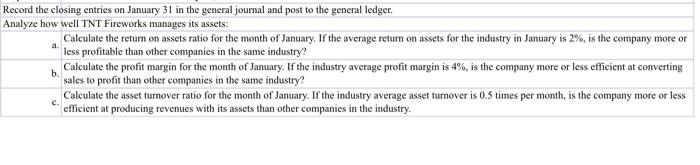

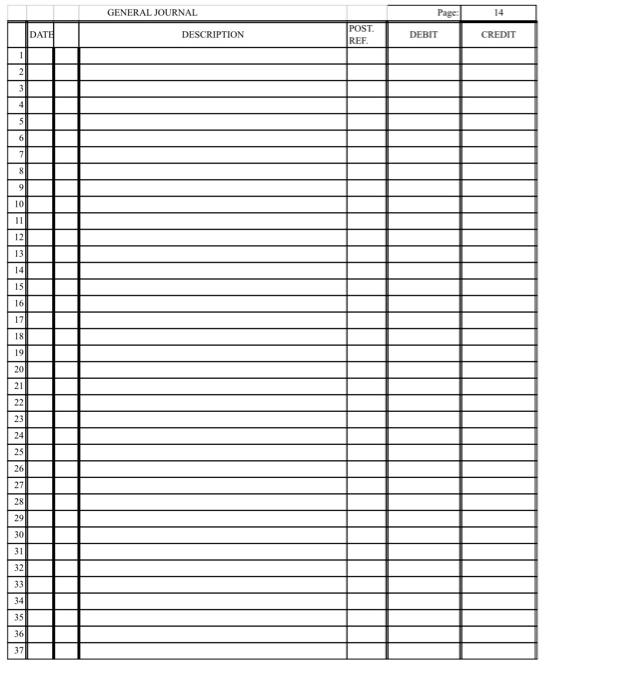

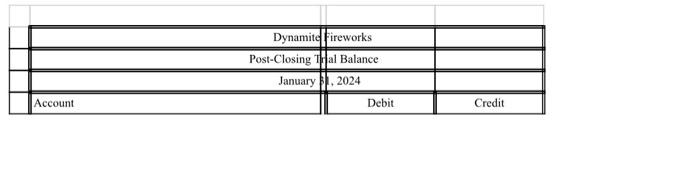

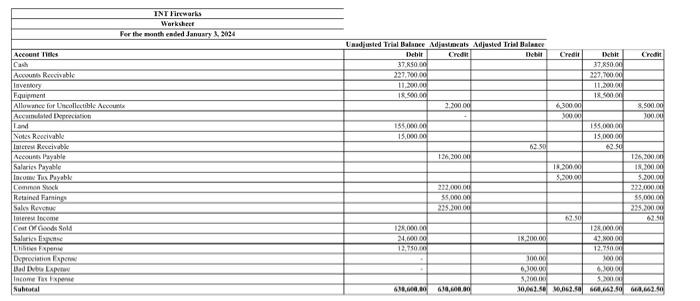

Exercise 7-21 The beginning trial balance has been entered in the general ledger for you. The amounts in this exercise have been changed from those in the text to help ensure that you are truly going through the process and not using an online tool for help. The company had the following activity: \begin{tabular}{|l|l|} \hline January 1 & Purchase equipment for $18,500. The company estimates a residual value of $500 and a five-year service life. \\ \hline January 4 & Pay cash on accounts Payable, $11,500. \\ \hline January 8 & Purchase additional inventory on account, $112,900. \\ \hline January 15 & Receive cash on accounts receivable, $19,500. \\ \hline January 19 & Pay cash for salaries, $24,600. \\ \hline January 28 & Pay cash for January utilities, $12,750. \\ \hline January 30 & Firework sales for January total $225,200. All of these sales are on account. The cost of the units sold is $128,000. \end{tabular} Record the closing entries on January 31 in the general journal and post to the general ledger. Analyze how well TNT Fireworks manages its assets: Calculate the return on assets ratio for the month of January. If the average return on assets for the industry in January is 2%, is the company more or less profitable than other companies in the same industry? b. Calculate the profit margin for the month of January. If the industry average profit margin is 4%, is the company more or less efficient at converting sales to profit than other companies in the same industry? c. Calculate the asset tumover ratio for the month of January. If the industry average asset tumover is 0.5 times per month, is the company more or less efficient at producing revenues with its assets than other companies in the industry. Exercise 7-21 The beginning trial balance has been entered in the general ledger for you. The amounts in this exercise have been changed from those in the text to help ensure that you are truly going through the process and not using an online tool for help. The company had the following activity: \begin{tabular}{|l|l|} \hline January 1 & Purchase equipment for $18,500. The company estimates a residual value of $500 and a five-year service life. \\ \hline January 4 & Pay cash on accounts Payable, $11,500. \\ \hline January 8 & Purchase additional inventory on account, $112,900. \\ \hline January 15 & Receive cash on accounts receivable, $19,500. \\ \hline January 19 & Pay cash for salaries, $24,600. \\ \hline January 28 & Pay cash for January utilities, $12,750. \\ \hline January 30 & Firework sales for January total $225,200. All of these sales are on account. The cost of the units sold is $128,000. \end{tabular} Record the closing entries on January 31 in the general journal and post to the general ledger. Analyze how well TNT Fireworks manages its assets: Calculate the return on assets ratio for the month of January. If the average return on assets for the industry in January is 2%, is the company more or less profitable than other companies in the same industry? b. Calculate the profit margin for the month of January. If the industry average profit margin is 4%, is the company more or less efficient at converting sales to profit than other companies in the same industry? c. Calculate the asset tumover ratio for the month of January. If the industry average asset tumover is 0.5 times per month, is the company more or less efficient at producing revenues with its assets than other companies in the industry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts