Question: can u pls help me with this? I have the example temple attached. Im looking to seeing your help and answer. I cut them into

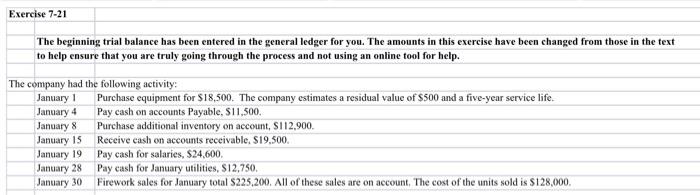

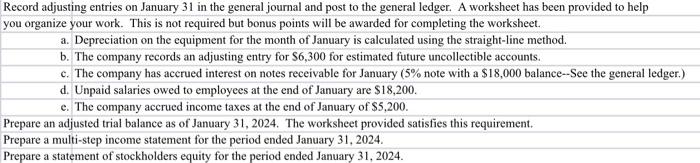

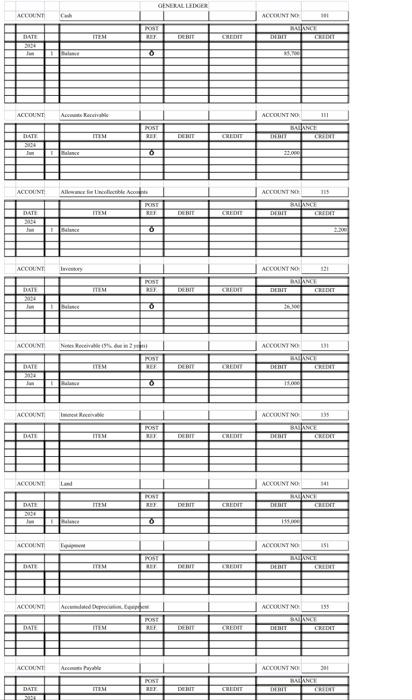

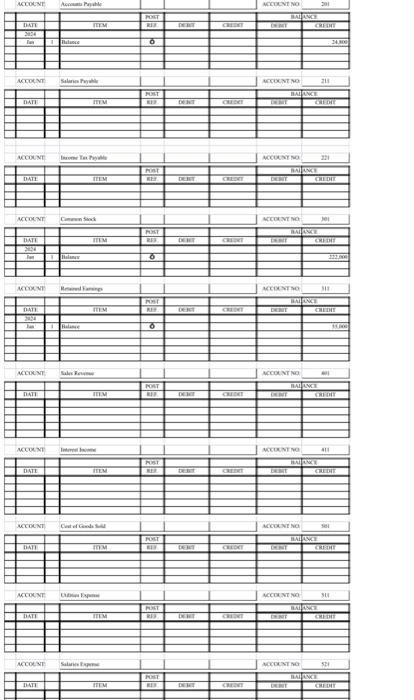

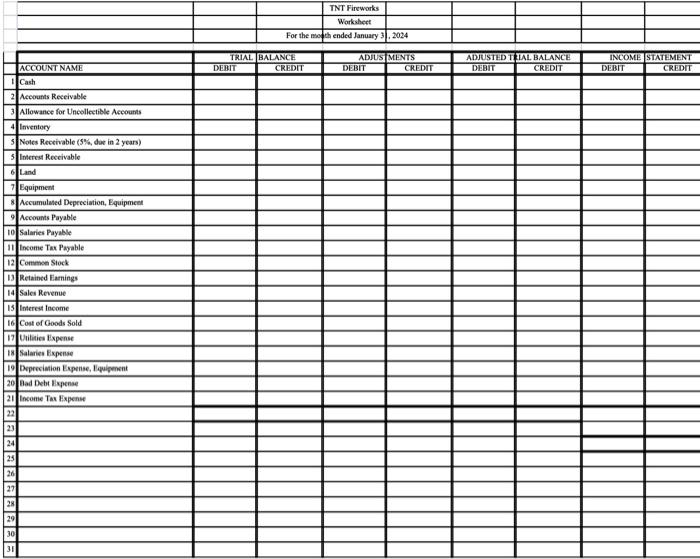

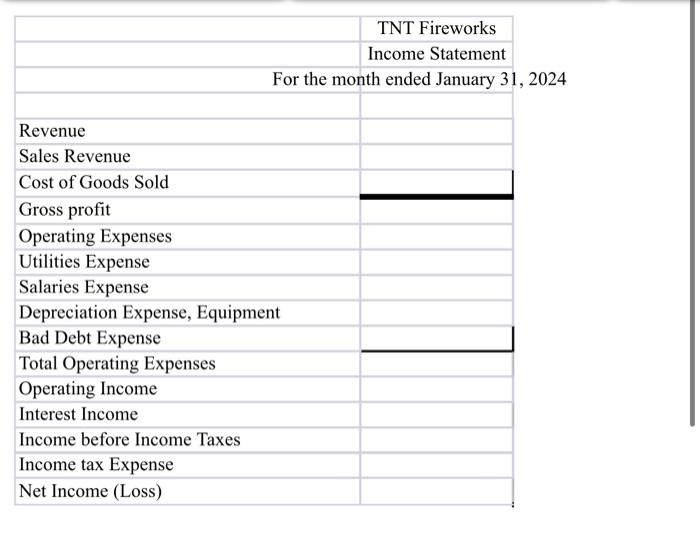

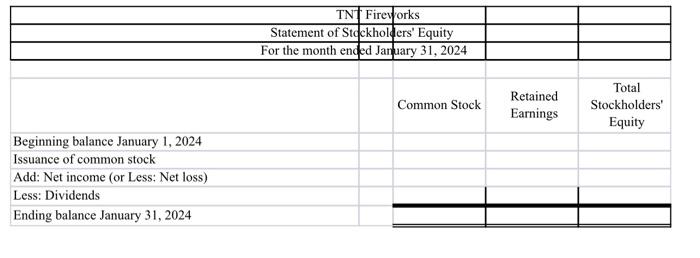

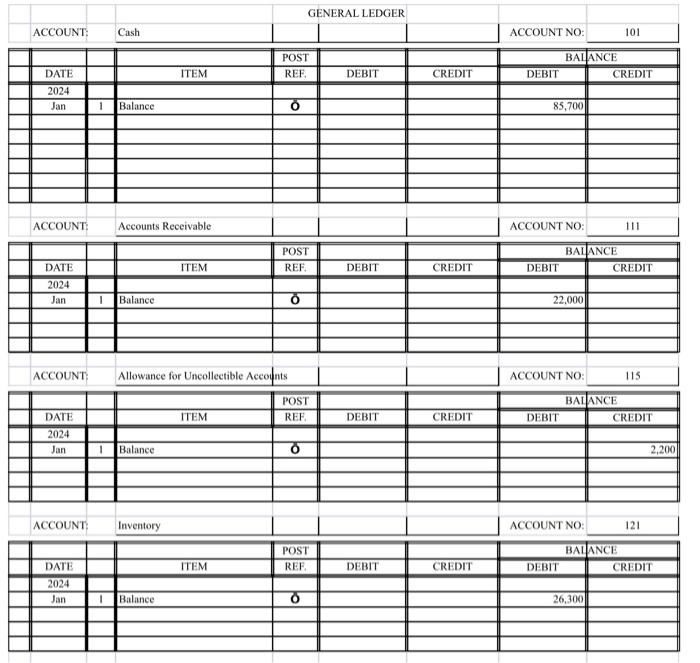

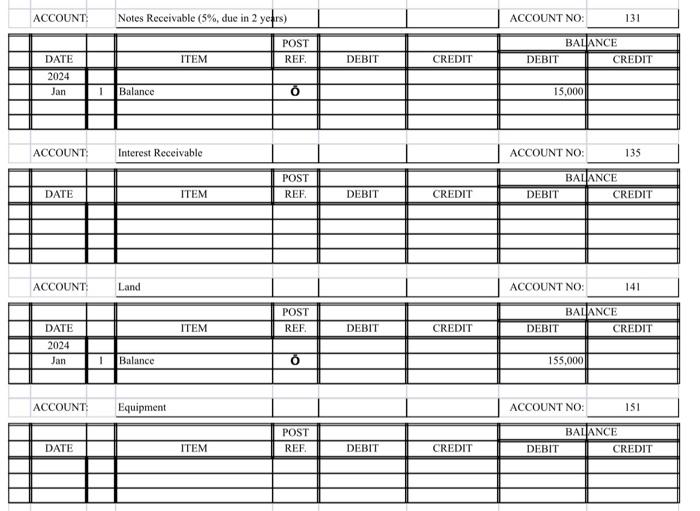

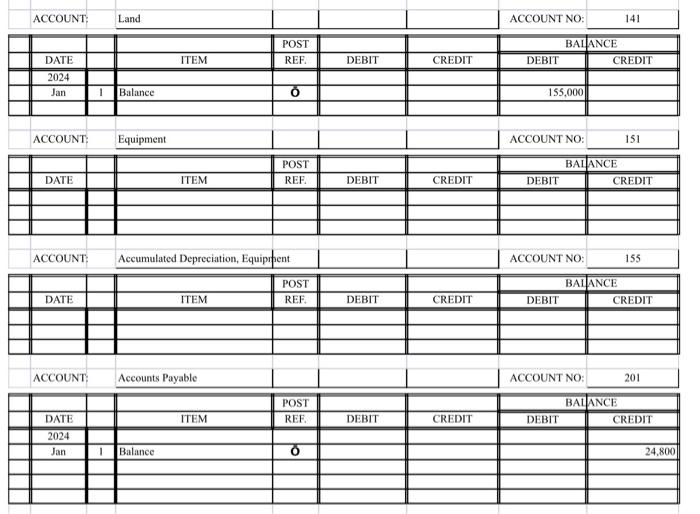

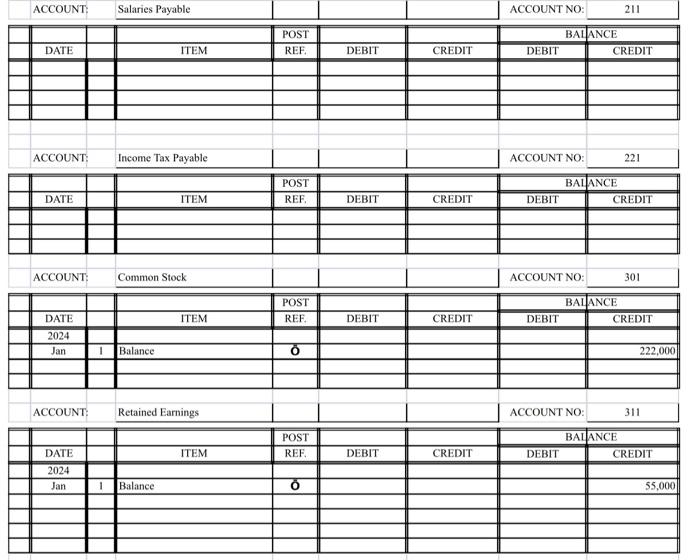

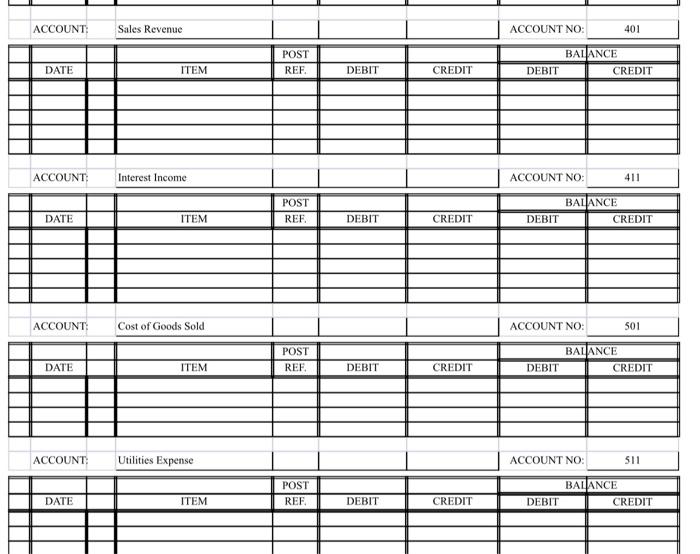

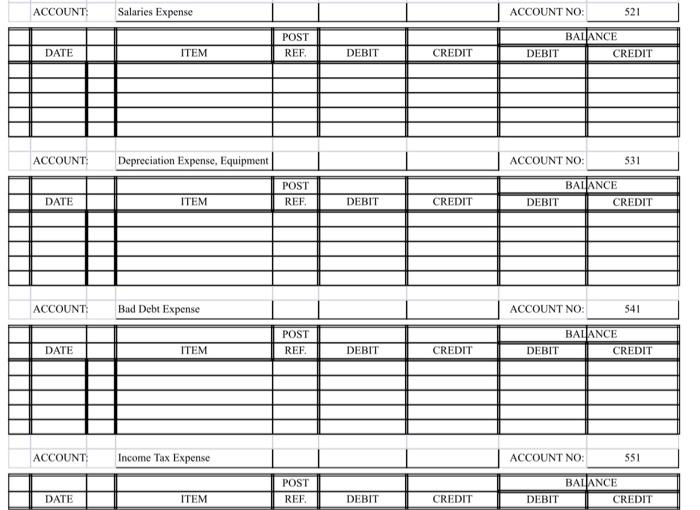

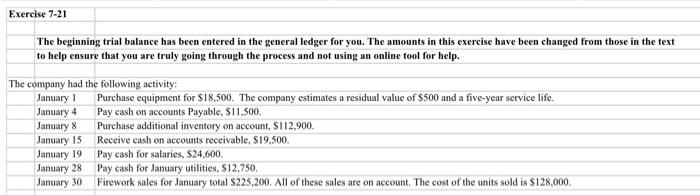

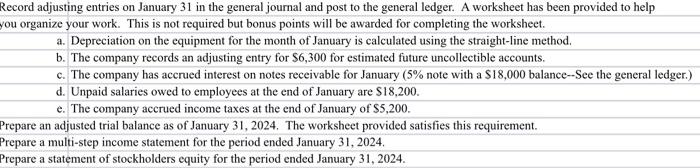

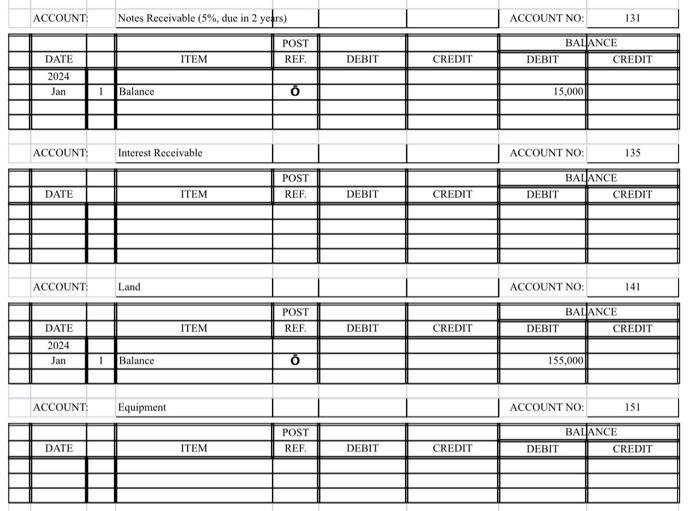

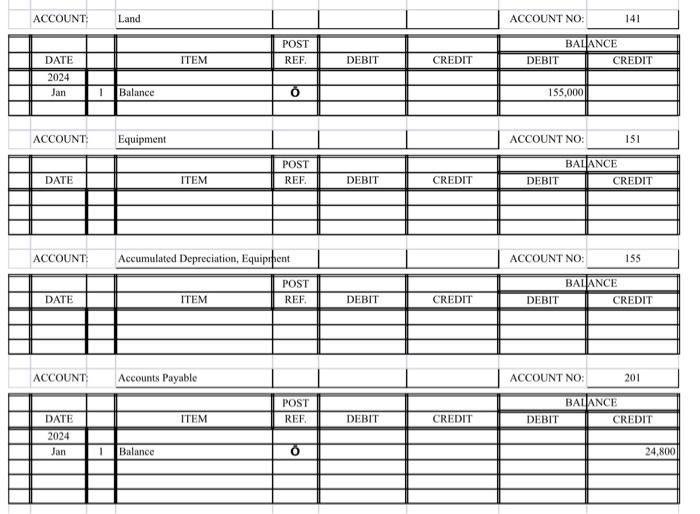

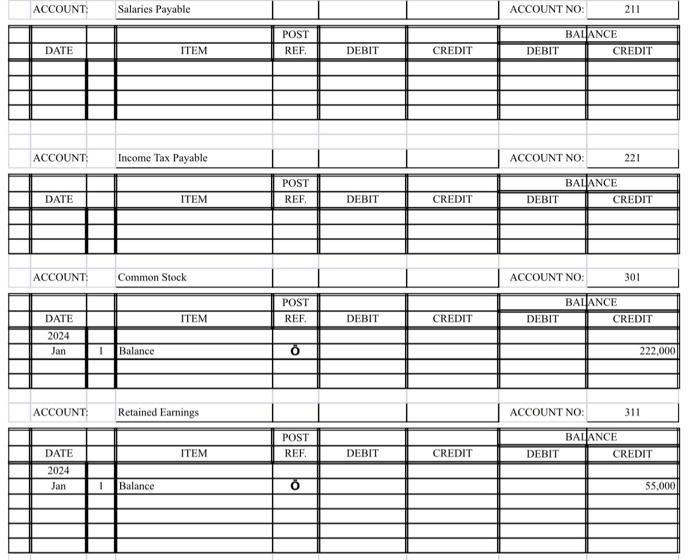

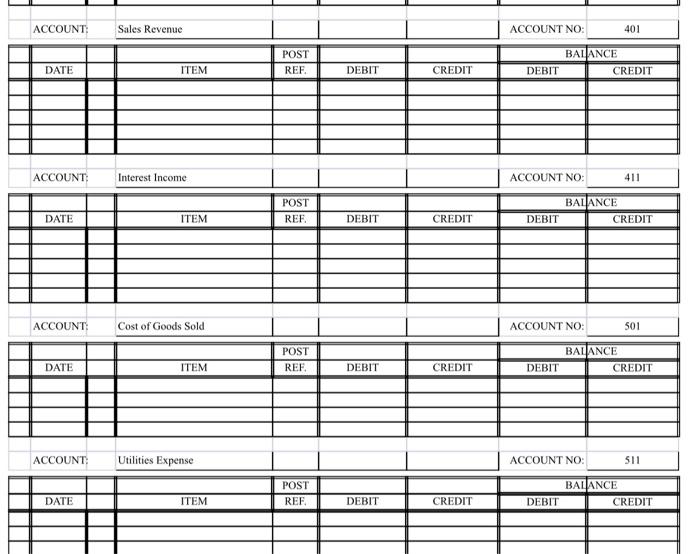

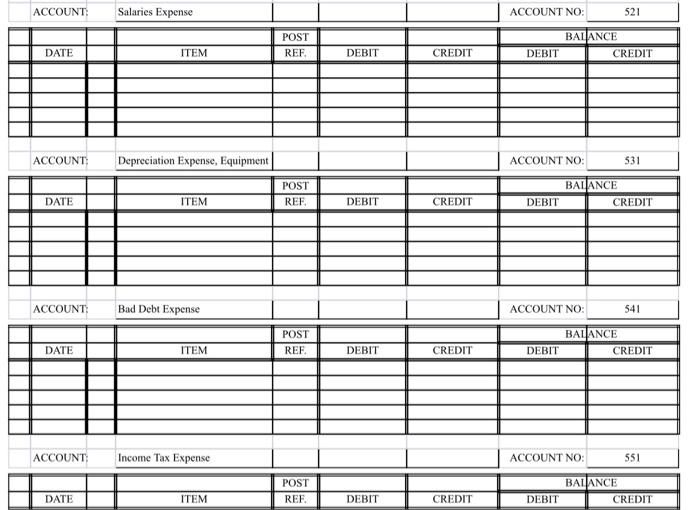

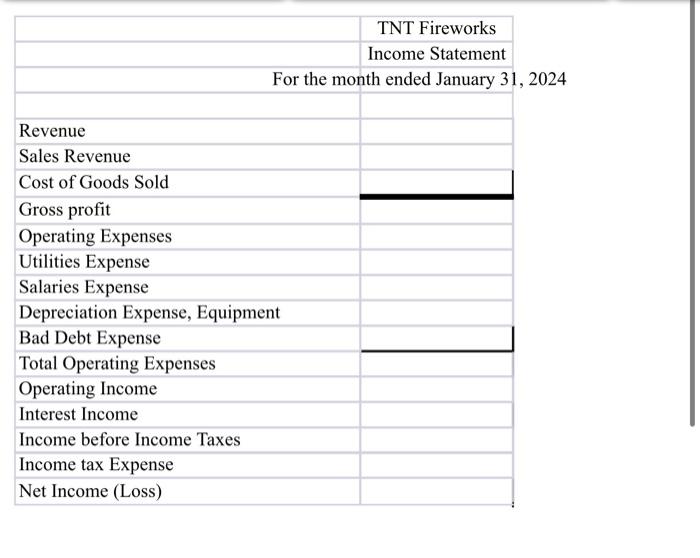

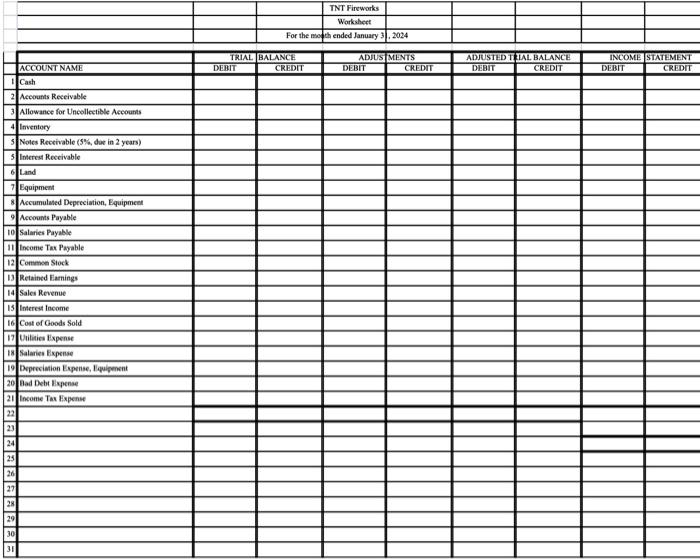

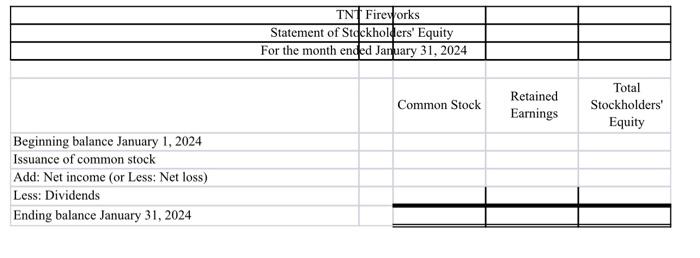

Exercise 7-21 The beginning trial balance has been entered in the general ledger for you. The amounts in this exercise have been changed from those in the text to help ensure that you are truly going through the process and not using an online tool for help. The company had the following activity: \begin{tabular}{|l|l|} \hline January 1 & Purchase equipment for $18,500. The company estimates a residual value of $500 and a five-year service life. \\ \hline January 4 & Pay cash on accounts Payable, $11,500. \\ \hline January 8 & Purchase additional inventory on account, $112,900. \\ \hline January 15 & Receive cash on accounts receivable, $19,500. \\ \hline January 19 & Pay cash for salaries, $24,600. \\ \hline January 28 & Pay cash for January utilities, $12,750. \\ \hline January 30 & Firework sales for January total $225,200. All of these sales are on account. The cost of the units sold is $128,000. \end{tabular} Record adjusting entries on January 31 in the general journal and post to the general ledger. A worksheet has been provided to help you organize your work. This is not required but bonus points will be awarded for completing the worksheet. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $6,300 for estimated future uncollectible accounts. c. The company has accrued interest on notes receivable for January ( 5% note with a $18,000 balance-See the general ledger.) d. Unpaid salaries owed to employees at the end of January are $18,200. e. The company accrued income taxes at the end of January of $5,200. Prepare an adjusted trial balance as of January 31,2024 . The worksheet provided satisfies this requirement. Prepare a multi-step income statement for the period ended January 31, 2024. Prepare a statement of stockholders equity for the period ended January 31,2024. \begin{tabular}{|l|l|} \hline & \multicolumn{1}{|c|}{ TNT Fireworks } \\ \hline & Income Statement \\ \hline \multicolumn{1}{|l|}{ For the month ended January 31,} \\ \hline Revenue & \\ \hline Sales Revenue & \\ \hline Cost of Goods Sold & \\ \hline Gross profit & \\ \hline Operating Expenses & \\ \hline Utilities Expense & \\ \hline Salaries Expense & \\ \hline Depreciation Expense, Equipment & \\ \hline Bad Debt Expense & \\ \hline Total Operating Expenses & \\ \hline Operating Income & \\ \hline Interest Income & \\ \hline Income before Income Taxes & \\ \hline Income tax Expense & \\ \hline Net Income (Loss) & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|} \hline TNT Fireworks & & \\ \hline Statement of Stockholders' Equity & & \\ \hline For the month ended January 31, 2024 & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} ACCOUNT: Retained Earnings & & & ACCOUNT NO: & 311 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline ACCOUNT: & Sales Revenue & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} ACCOUNT: & Interest Income & & & ACCOUNT NO: \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} ACCOUNT: Cost of Goods Sold & & & & ACCOUNT NO: \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} ACCOUNT: Bad Debt Expense & & & ACCOUNT NO: & 541 \\ \hline \hline \end{tabular} Exercise 7-21 The beginning trial balance has been entered in the general ledger for you. The amounts in this exercise have been changed from those in the text to help ensure that you are truly going through the process and not using an online tool for help. The company had the following activity: \begin{tabular}{|l|l|} \hline January 1 & Purchase equipment for $18,500. The company estimates a residual value of $500 and a five-year service life. \\ \hline January 4 & Pay cash on accounts Payable, $11,500. \\ \hline January 8 & Purchase additional inventory on account, $112,900. \\ \hline January 15 & Receive cash on accounts receivable, $19,500. \\ \hline January 19 & Pay cash for salaries, $24,600. \\ \hline January 28 & Pay cash for January utilities, $12,750. \\ \hline January 30 & Firework sales for January total $225,200. All of these sales are on account. The cost of the units sold is $128,000. \end{tabular} Record adjusting entries on January 31 in the general journal and post to the general ledger. A worksheet has been provided to help ou organize your work. This is not required but bonus points will be awarded for completing the worksheet. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $6,300 for estimated future uncollectible accounts. c. The company has accrued interest on notes receivable for January ( 5% note with a $18,000 balance-See the general ledger.) d. Unpaid salaries owed to employees at the end of January are \$18,200. e. The company accrued income taxes at the end of January of $5,200. Prepare an adjusted trial balance as of January 31,2024 . The worksheet provided satisfies this requirement. repare a multi-step income statement for the period ended January 31, 2024. Prepare a statement of stockholders equity for the period ended January 31,2024. \begin{tabular}{|l|l|l|l|l|} ACCOUNT: Retained Earnings & & & ACCOUNT NO: & 311 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} \hline ACCOUNT: & Sales Revenue & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} ACCOUNT: & Interest Income & & & ACCOUNT NO: \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} ACCOUNT: Cost of Goods Sold & & & & ACCOUNT NO: \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} ACCOUNT: Bad Debt Expense & & & ACCOUNT NO: & 541 \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|} \hline & \multicolumn{1}{|c|}{ TNT Fireworks } \\ \hline & Income Statement \\ \hline \multicolumn{1}{|l|}{ For the month ended January 31,} \\ \hline Revenue & \\ \hline Sales Revenue & \\ \hline Cost of Goods Sold & \\ \hline Gross profit & \\ \hline Operating Expenses & \\ \hline Utilities Expense & \\ \hline Salaries Expense & \\ \hline Depreciation Expense, Equipment & \\ \hline Bad Debt Expense & \\ \hline Total Operating Expenses & \\ \hline Operating Income & \\ \hline Interest Income & \\ \hline Income before Income Taxes & \\ \hline Income tax Expense & \\ \hline Net Income (Loss) & \\ \hline \end{tabular} \begin{tabular}{|r|l|l|} \hline TNT Fireworks & & \\ \hline Statement of Stockholders' Equity & & \\ \hline For the month ended January 31, 2024 & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts