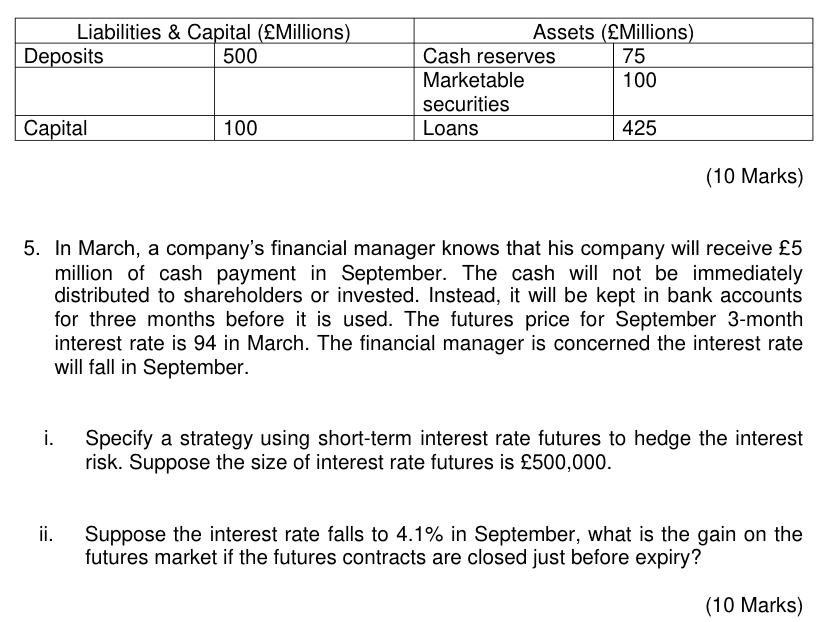

Question: can u please answer both with explanation. Liabilities & Capital (Millions) Deposits 500 Assets (Millions) Cash reserves 75 Marketable 100 securities Loans 425 Capital 100

can u please answer both with explanation.

Liabilities & Capital (Millions) Deposits 500 Assets (Millions) Cash reserves 75 Marketable 100 securities Loans 425 Capital 100 (10 Marks) 5. In March, a company's financial manager knows that his company will receive 5 million of cash payment in September. The cash will not be immediately distributed to shareholders or invested. Instead, it will be kept in bank accounts for three months before it is used. The futures price for September 3-month interest rate is 94 in March. The financial manager is concerned the interest rate will fall in September. i. Specify a strategy using short-term interest rate futures to hedge the interest risk. Suppose the size of interest rate futures is 500,000. Suppose the interest rate falls to 4.1% in September, what is the gain on the futures market if the futures contracts are closed just before expiry? (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts