Question: can we get this answer except part c (excel solver) and part d (lingo) plzz send this asap. A steel manufacturer runs a foundry and

can we get this answer except part c (excel solver) and part d (lingo)

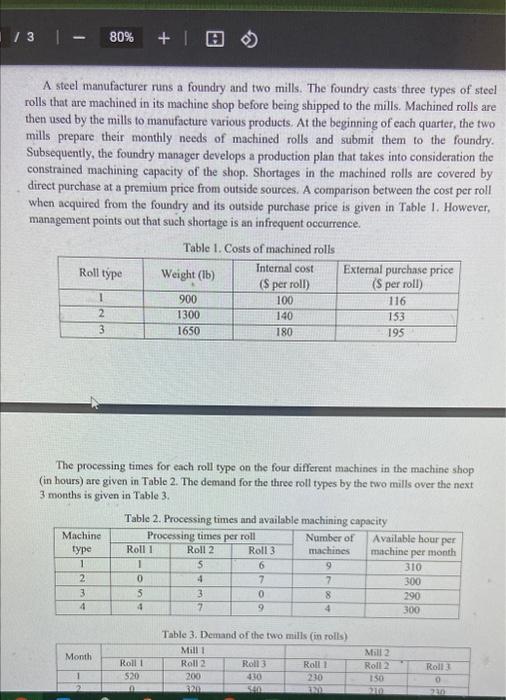

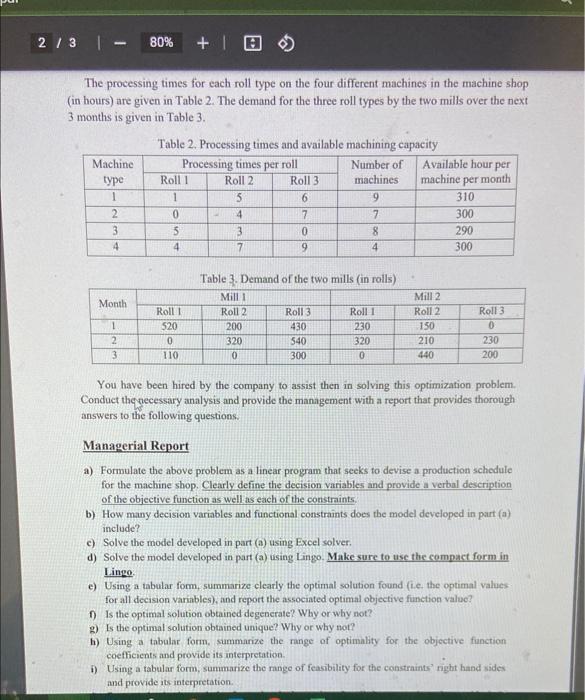

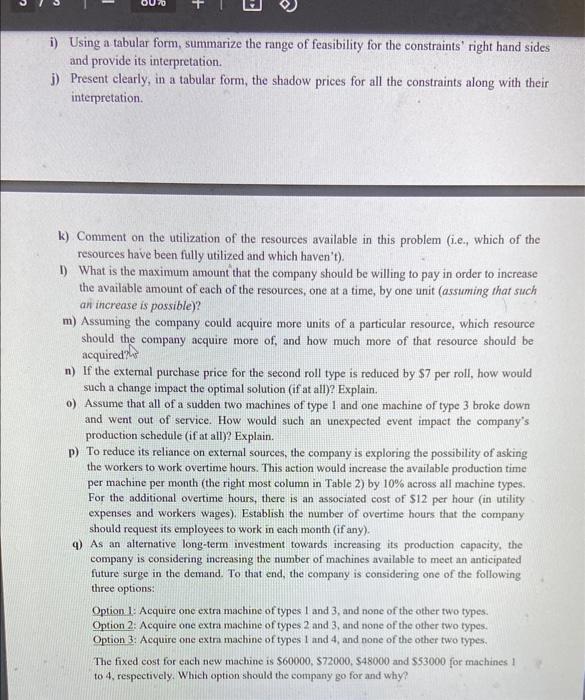

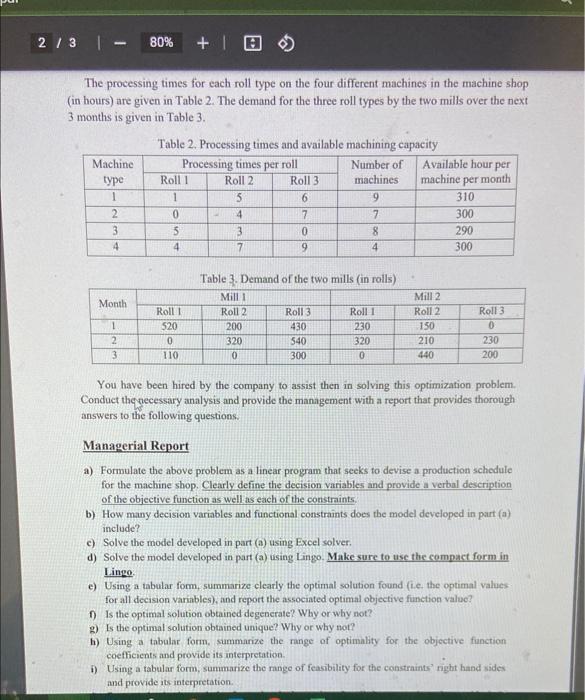

A steel manufacturer runs a foundry and two mills. The foundry casts three types of steel rolls that are machined in its machine shop before being shipped to the mills. Machined rolls are then used by the mills to manufacture various products. At the beginning of each quarter, the two mills prepare their monthly needs of machined rolls and submit them to the foundry. Subsequently, the foundry manager develops a production plan that takes into consideration the constrained machining capacity of the shop. Shortages in the machined rolls are covered by direct purchase at a premium price from outside sources. A comparison between the cost pet roll when acquired from the foundry and its outside purchase price is given in Table 1. However, management points out that such shortage is an infrequent occurrence. Table 1 Cots af marhined mlle The processing times for each roll type on the four different machines in the machine shop (in hours) are given in Table 2. The demand for the three roll types by the two mills over the next 3 months is given in Table 3 , Table 2. Processing times and available machinine canacitv Table 3. Demand of the two mills (in rolls) The processing times for each roll type on the four different machines in the machine shop (in hours) are given in Table 2. The demand for the three roll types by the two mills over the next 3 months is given in Table 3 . Table 2. Processing times and available machining capacity Table 3. Demand of the two mills (in rolls) You have been hired by the company to assist then in solving this optimization problem. Conduct the necessary analysis and provide the management with a report that provides thorough answers to the following questions. Managerial Report a) Formulate the above problem as a linear program that seeks to devise a production schedule for the machine shop. Clearly define the decision variables and provide a verbal description of the objective function as well as each of the constraints. b) How many decision variables and functional constraints does the model developed in part (a) include? c) Solve the model developed in part (a) using Excel solver. d) Solve the model developed in part (a) using Lingo. Make sure to use the compact form in Lingo. e) Using a tabular form, summarize clearly the optimal solution found (i.e, the optimal values for all decision variables), and report the associated optimal objective function value? f) Is the optimal solution obtained degenerate? Why or why not? g) Is the optimal solution obtained unique? Why or why not? h) Using a tabular form, summarize the range of optimality for the objective function coefficients and provide its interpretation. i) Using a tabular form, summarize the mange of feasibility for the constraints' night hand sides and provide its interpretation. i) Using a tabular form, summarize the range of feasibility for the constraints' right hand sides and provide its interpretation. j) Present clearly, in a tabular form, the shadow prices for all the constraints along with their interpretation. k) Comment on the utilization of the resources available in this problem (i.e., which of the resources have been fully utilized and which haven't). I) What is the maximum amount that the company should be willing to pay in order to increase the available amount of each of the resources, one at a time, by one unit (assuming that such an increase is possible)? m) Assuming the company could acquire more units of a particular resource, which resource should the company acquire more of, and how much more of that resource should be acquired? n) If the external purchase price for the second roll type is reduced by $7 per roll, how would such a change impact the optimal solution (if at all)? Explain. o) Assume that all of a sudden two machines of type 1 and one machine of type 3 broke down and went out of service. How would such an unexpected event impact the company's production schedule (if at all)? Explain. p) To reduce its reliance on external sources, the company is exploring the possibility of asking the workers to work overtime hours. This action would increase the available production time per machine per month (the right most column in Table 2) by 10% across all machine types. For the additional overtime hours, there is an associated cost of $12 per hour (in utility expenses and workers wages). Establish the number of overtime hours that the company should request its employees to work in each month (if any). 9) As an alternative long-term investment towards increasing its production capacity, the company is considering increasing the number of machines available to meet an anticipated future surge in the demand. To that end, the company is considering one of the following three options: Option 1: Acquire one extra machine of types 1 and 3 , and none of the other two types. Option 2: Acquire one extra machine of types 2 and 3, and none of the other two types. Option 3: Acquire one extm machine of types 1 and 4 , and none of the other two types. The fixed cost for each new machine is $60000,$72000,$48000 and $53000 for machines 1 to 4, respectively. Which option should the company go for and why plzz send this asap.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock