Question: can you answer d e f 6021FIN Question 3 Maple Plc has never paid a dividend; however, it has just announced that it will pay

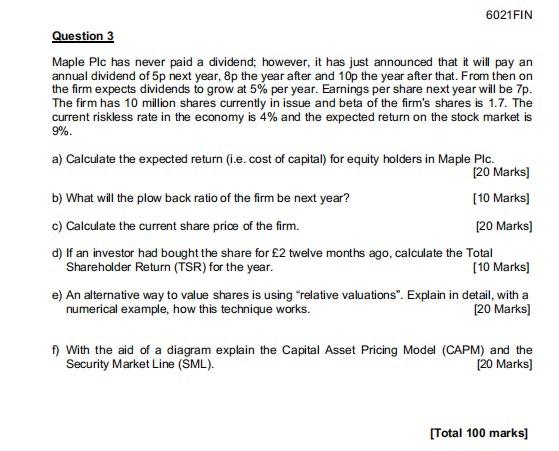

6021FIN Question 3 Maple Plc has never paid a dividend; however, it has just announced that it will pay an annual dividend of 5p next year, 8p the year after and 10p the year after that. From then on the firm expects dividends to grow at 5% per year. Earnings per share next year will be 7p. The firm has 10 million shares currently in issue and beta of the firm's shares is 1.7. The current riskless rate in the economy is 4% and the expected return on the stock market is 9% a) Calculate the expected return (i.e. cost of capital for equity holders in Maple Plc. [20 Marks) b) What will the plow back ratio of the firm be next year? [10 Marks) c) Calculate the current share price of the firm. [20 Marks) d) If an investor had bought the share for 2 twelve months ago, calculate the Total Shareholder Return (TSR) for the year. [10 Marks) e) An alternative way to value shares is using relative valuations". Explain in detail, with a numerical example, how this technique works. [20 Marks) ) With the aid of a diagram explain the Capital Asset Pricing Model (CAPM) and the Security Market Line (SML). [20 Marks) [Total 100 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts