Question: Can you answer number 3 in a paragraph using the article provided Petrobrs of Brazil and the Cost of Capital1 The national oil company of

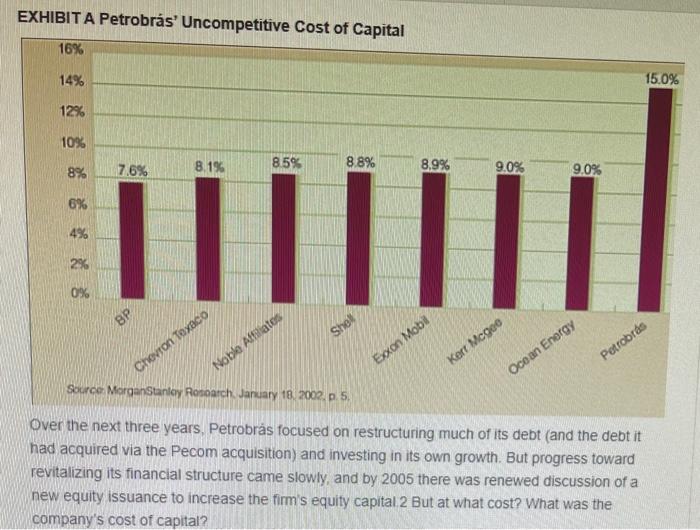

Petrobrs of Brazil and the Cost of Capital1 The national oil company of Brazil, Petrobrs, suffered from an ailment common in emerging marketsa high and uncompetitive cost of capital. Despite being widely considered the global leader in deepwater technology (the ability to drill and develop oil and gas fields more than a mile below the ocean's surface), unless it could devise a strategy to lower its cost of capital, it would be unable to exploit its true organizational competitive advantage. Many market analysts argued that the Brazilian company should follow the strategy employed by a number of Mexican companies and buy its way out of its dilemma. If Petrobrs were to acquire one of the many independent North American oil and gas companies, it might transform itself from being wholly "Brazilian" to partially "American" in the eyes of capital markets, and possibly lower its weighted average cost of capital (WACC) to between 6% and 8%. Petrleo Brasileiro S.A. (Petrobrs) was an integrated oil and gas company founded in 1954 by the Brazilian government as the national oil company of Brazil. The company was listed publicly in So Paulo in 1997 and on the New York Stock Exchange (NYSE PBR) in 2000. Despite the equity listings, the Brazilian government continued to be the controlling shareholder, with 33% of the total capital and 55% of the voting shares. As the national oil company of Brazil, the company's singular purpose was the reduction of Brazil's dependency on imported oil. A side effect of this focus, however, had been a lack of international diversification. Many of the company's critics argued that being both Brazilian and undiversified internationally resulted in an uncompetitive cost of capital Need for Diversification Petrobrs in 2002 was the largest company in Brazil, and the largest publicly traded oil company in Latin America. It was not, however, international in its operations. This inherent lack of international diversification was apparent to international investors, who assigned the company the same country risk factors and premiums they did to all other Brazilian companies. The result was a cost of capital in 2002, as seen in Exhibit A, that was 6% higher than the other firms shown Petrobrs embarked on a globalization strategy, with several major transactions heading up the process. In December 2001. Repsol-YPF of Argentina and Petrobrs concluded an exchange of operating assets valued at $500 million. In the exchange, Petrobrs received 99% interest in the Eg3 SA service station chain, while Repsol-YPF gained a 30% stake in a refinery, a 10% stake in an offshore oil field, and a fuel resale right to 230 service stations in Brazil. The agreement included an eight-year guarantee against currency risks. In October 2002, Petrobrs purchased Perez Companc (Pecom) of Argentina. Pecom had quickly come into play following the Argentine financial crisis in January 2002. Although Pecom had significant international reserves and production capability, the combined forces of a devalued Argentine peso, a largely dollar-denominated debt portfolio, and a multitude of Argentine government regulations that hindered its ability to hold and leverage hard currency resources, the company had moved quickly to find a buyer to refund its financial structure. Petrobrs took advantage of the opportunity. Pecom's ownership had been split between its original controlling family owners and their foundation, 58.6%, and public flotation of the remaining 41.4% Petrobrs had purchased the controlling interest, the full 58.6% interest outright from the family EXHIBIT A Petrobrs' Uncompetitive Cost of Capital 16% 14% 15.0% 12% 10% 85% 8.1% 8.8% 8% 7.6% 8.9% 9.0% 9.0% 6% 4% 2% 0% BP Shell Chevron Texaco Exoxon Mobi Kerr Mcgoo Petrobras Noble Affiliates Ocean Energy Source: Morgan Stanley Rosearch January 18, 2002, p. 5. Over the next three years, Petrobrs focused on restructuring much of its debt (and the debt it had acquired via the Pecom acquisition) and investing in its own growth. But progress toward revitalizing its financial structure came slowly, and by 2005 there was renewed discussion of a new equity issuance to increase the firm's equity capital 2 But at what cost? What was the company's cost of capital? Country Risk Exhibit A presented the cost of capital of a number of major oil and gas companies across the world, including Petrobrs in 2002. This comparison could occur only if all capital costs were calculated in a common currency, in this case, the U.S. dollar. The global oil and gas markets had long been considered "dollar-denominated," and any company operating in these markets, regardless of where it actually operated in the world, was considered to have the dollar as its functional currency. Once that company listed its shares in a U.S. equity market, the dollarization of its capital costs became even more accepted. But what was the cost of capital in dollar terms-for a Brazilian business? Brazil has a long history of bouts with high inflation economic instability, and currency devaluations and depreciations depending on the regime de jure) One of the leading indicators of the global market's opinion of Brazilian country risk was the sovereign spread, the additional yield or cost of dollar funds that the Brazilian government had to pay on global markets over and above that which the U.S. Treasury paid to borrow dollar funds. As illustrated in Exhibit B. the Brazilian sovereign spread had been both high and volatile over the past decade 3 The spread was sometimes as low as 400 basis points (4.0%), as in recent years, or as high as 2.400 basis points (24%), during the 2002 financial crisis in which the real was first devalued then floated. And that was merely the cost of debt for the government of Brazil How was this sovereign spread reflected in the cost of debt and equity for a Brazilian company like Petrobrs? One approach to the estimation of Petrobras cost of debt in US dollar terms (kd $) was to build it up the government of Brazil's cons of dollar funds adjusted for a private corporate credit spread 1. How do you estimate the cost of capital for a multinational enterprise in a global industry which is based in an emerging market? 2. Why do you think Petrobras's cost of capital is so high? Are there better ways of calculating its weighted average cost of capital? 3. How does the investor perception of the relative attractiveness of Brazil affect the calculation of Petrobras's cost of capital? 4. Is the cost of capital really a relevant factor in the competitiveness and strategy of a company like Petrobras

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts