Question: please help with part 2 cos Soure Compary documments. the stock price of all offshore drillers during that time (see Exhibit 4). As he considered

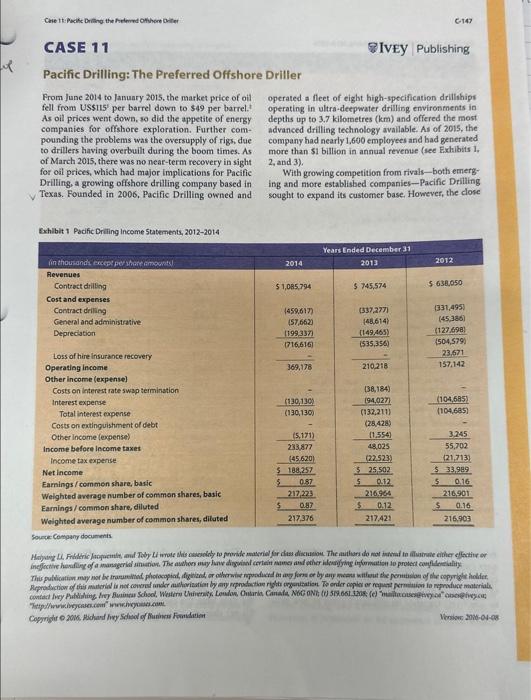

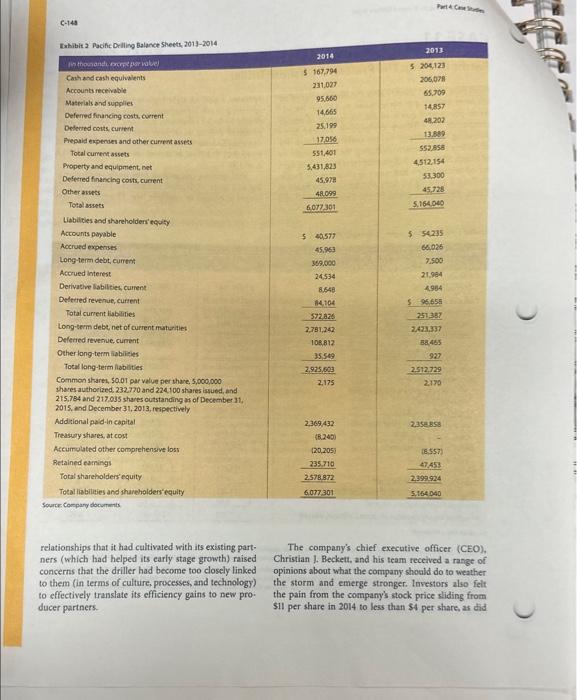

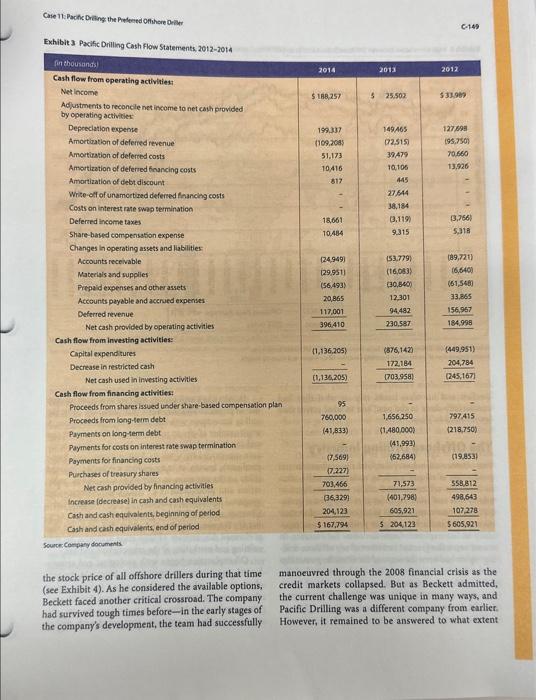

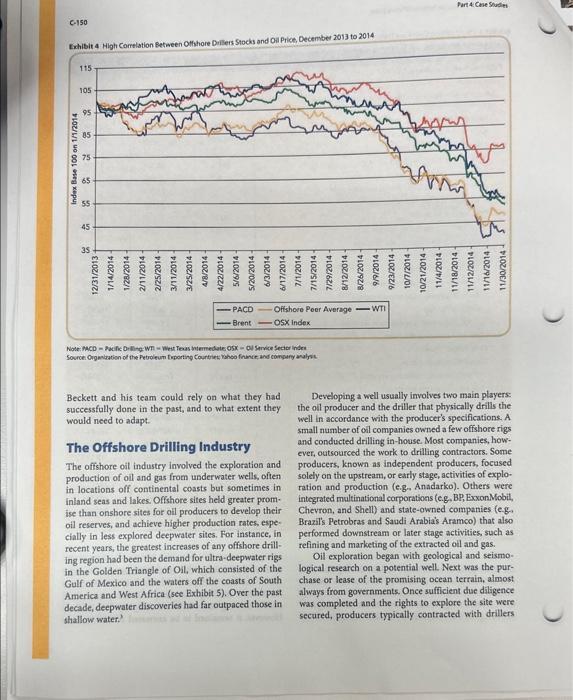

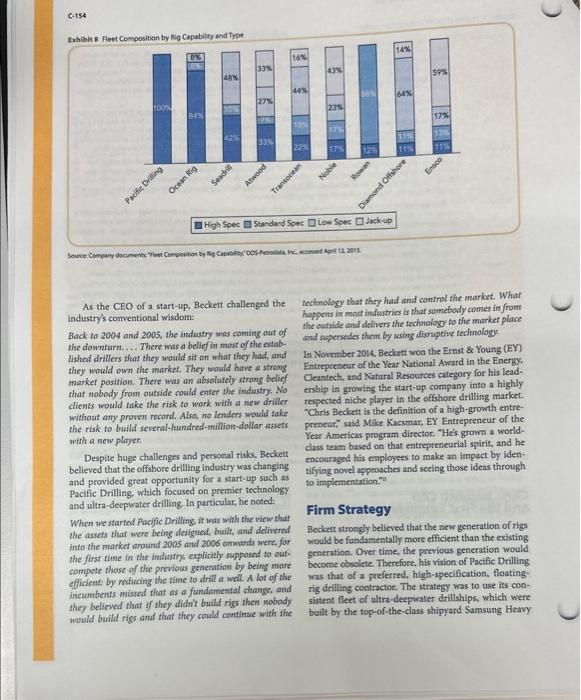

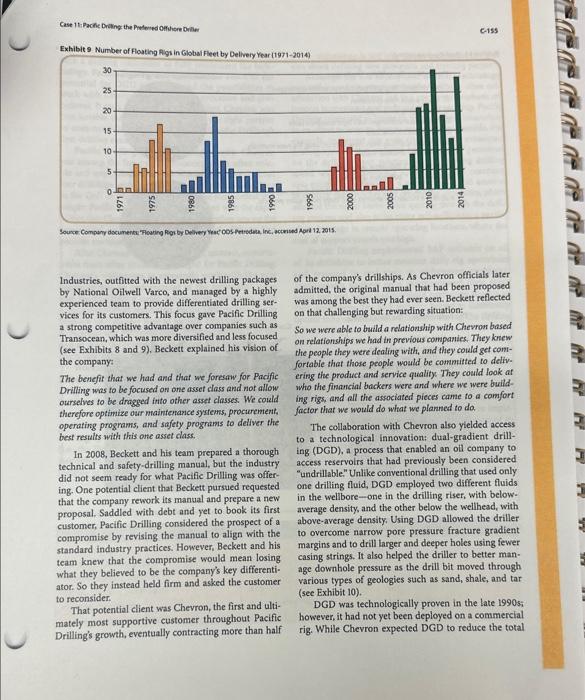

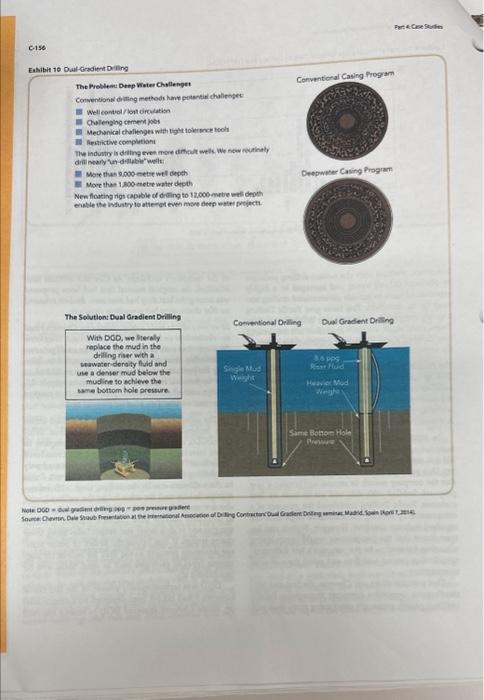

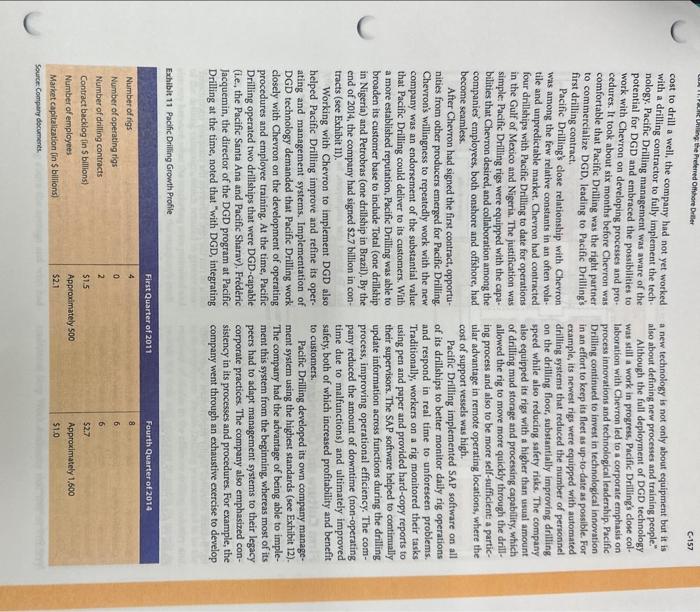

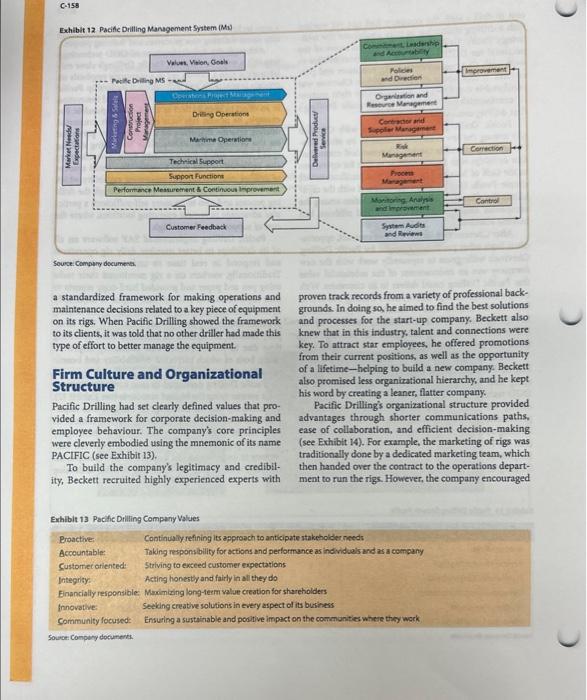

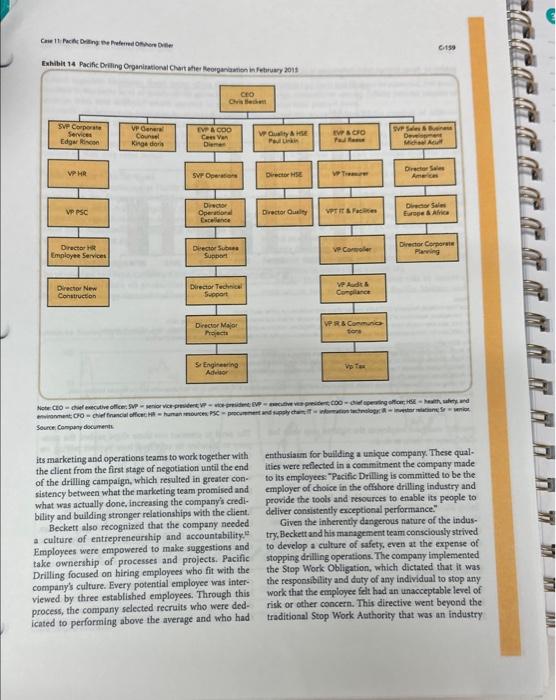

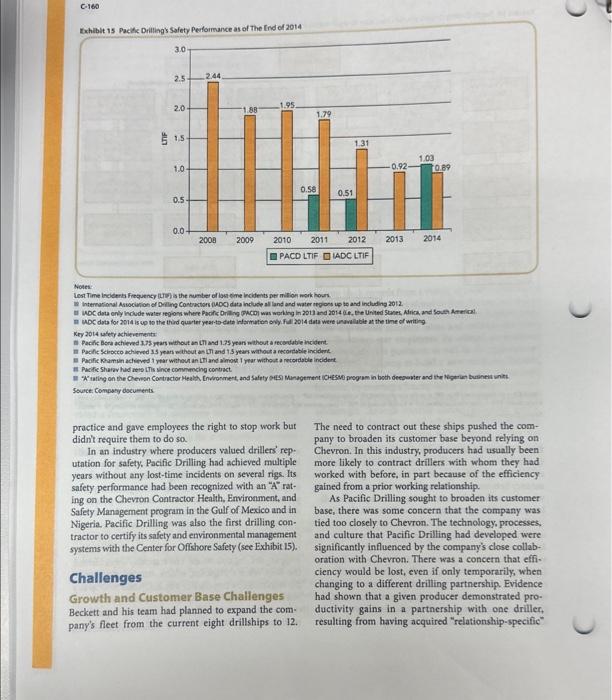

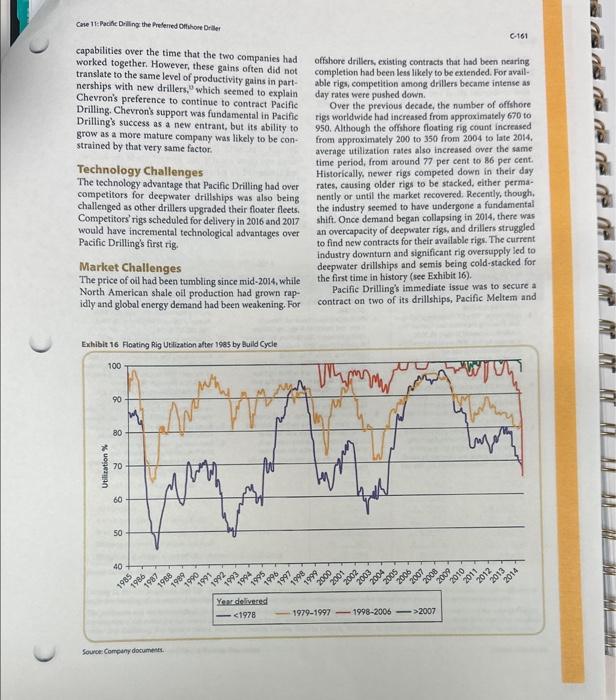

cos Soure Compary documments. the stock price of all offshore drillers during that time (see Exhibit 4). As he considered the available options, Beckett faced another critical crossroad. The company had survived tough times before-in the early stages of the company's development, the team had successfully manoeuvred through the 2008 financial crisis as the credit markets collapsed. But as Beckett admitted, the current challenge was unique in many ways, and Pacific Drilling was a different company from earlier. However, it remained to be answered to what extent Source. Compary documints relationships that it had cultivated with its existing partners (which had helped its early stage growth) raised concerns that the driller had become too closely linked to them (in terms of culture, processes, and technology) to effectively translate its efficiency gains to new pro. ducer partnets. The company's chief executive officer (CEO), Christian 1. Beckett, and his team received a range of opinions about what the company shocald do to weather the storm and emerge stronger. Investors also felt the pain from the company's stock price sliding from $11 per share in 2014 to less than $4 per share, as did The guideline for a written paper is as follows. 1. Introduction - Strategic Profile and Case Analysis Purpose II. Situation Analysis a. General environmental analysis - focused on fiture b. Industry analysis c. Competitor analysis d. Internal analysis III. Identification of Environmental Opportunities and Threats and Firm Strengths and Weaknesses (SWOT Analysis) IV. Strategy Formulation a. Strategic alternatives - the organization's strategy b. Alternative evaluation - evaluation about the strategy c. Alternative choice - other possible strategies for the present and the future * If a case is outdated, you may want to add some recent information. Exhibit is Pacikc Driltings Safety Performance as of the Ind of 2014 Notes: Kery 20t4 utety achievements Soute: Compary dscuments practice and gave employees the right to stop work but didn't require them to do so. In an industry where producers valued drillers' rep. utation for safety. Pacifie Drilling had achieved multiple years without any lost-time incidents on several rigs. Its safety performance had been recognized with an " A " rating on the Chevron Contractor Health, Environment, and Safety Management program in the Gulf of Mexico and in Nigeria. Pacific Drilling was also the first drilling contractor to certify its safety and environmental management systems with the Center for Offshore Safety (see Exhibit 15). Challenges Growth and Customer Base Challenges Beckett and his team had planned to expand the company's fleet from the current eight drillships to 12. The need to contract out these ships pushed the company to broaden its customer base beyond relying on Chevron. In this industry, producers had usually been more likely to contract drillers with whom they had worked with before, in part because of the efficiency gained from a prior working relationship. As Pacific Drilling sought to broaden its customet base, there was some concern that the company was tied too closely to Chevron. The technology, processes. and culture that Pacific Drilling had developed were significantly influenced by the company's close collaboration with Chevron. There was a concern that eff. ciency would be lost, even if only temporarily, when changing to a different drilling partnership. Evidence had shown that a given producet demonstrated productivity gains in a partnership with one driller, resulting from having acquired "relationship-specific" The Frobleme Detp Woter Challempet Cotveneiond dising methods have poteretic challecket: Elillerging cernen wbs E. Mechanical chalkerges wath tigly tolersce tooks II Aestictive cooplationi D. More thas g.000-etre well depeh Deswoter Casing Frogram III More than 1 100 mete water depth New floating rigs capible of draing to 12,000 oveve ent depth The Solvtiont Dual Gradient Drilling With DCO, we herally repluce the mud in the diling niser with a seawater donsity fuld and vie a denier mud belew the mudine to schieve the sune bottom tole pressure. CASE 11 IVEy Publishing Pacific Drilling: The Preferred Offshore Driller From June 2014 to January 2015, the market price of oil fell from US\$15' per barrel down to $49 per barrel. As oil prices went down, so did the appetite of energy companies for offshore exploration. Further compounding the problems was the oversupply of rigs, due to drillers having overbuilt during the boom times. As of March 2015, there was no near-term recovery in sight for oil prices, which had major implications for Pacific Drilling, a growing offshore drilling company based in Texas. Founded in 2006, Pacific Drilling owned and operated a fleet of eight high-specification drillihips operating in ultra-deepwater drilling environenents in depths up to 3.7 kilometres (km) and offered the most advanced drilling technology avallable. As of 2015, the company had nearly 1,600 employees and bad generated more than $1 billion in annual revenue (see Exchibits 1 , 2, and 3 ). With growing competition from rivals-both emerging and more establisbed companies-Pacific Drilling sought to expand its customer base. However, the close Exhibit 1 Pacific Driting income Staternents, 2012-2014 Soucte Company documents Vondow min-04-98 Beckett and his team could rely on what they had successfully done in the past, and to what extent they would need to adapt. The Offshore Drilling Industry The offshore oil industry involved the exploration and production of oil and gas from underwater wells, often in locations off continental coasts but sometimes in inland seas and lakes. Offshore sites held greater promise than onshore sites for all producers to develop their oil reserves, and achieve higher production rates, espe. cially in less explored deepwater sites. For instance, in recent years, the greatest increases of any offshore drilling region had been the demand for ultra-deepwater rigs in the Golden Triangle of Oil, which consisted of the Gulf of Mexico and the waters off the coasts of South America and West Africa (see Exhibit 5). Over the past decade, deepwater discoveries had far outpaced those in shallow water? Developing a well usually involves two main players: the oil producer and the driller that physically drills the well in accordance with the producer's specifications. A small number of oll companies owned a few offshore rigs and conducted drilling in-house. Most companies, however, outsourced the work to drilling contractors. Some producers, known as independent producers, focused solely on the upstream, or early stage, activities of exploration and production (e.gn. Anadariko). Others were integrated maltinational corporations (e.g, BP, ExxonMobil, Chevron, and Shell) and state-owned companies (e.g-. Brazil's Petrobras and Saudi Arabia's Aramco) that also performed downstream or later stage activities, such as refining and marketing of the extracted oll and gas. Oil exploration began with geological and seismological research on a potential well. Next was the purchase or lease of the promising ocean terrain, almost always from governments. Once sufficient due diligence was completed and the rights to explore the site were secured, producers typically contracted with drillers contracts gasere thus orm rea. prior to the start of the contract. However, day rates also fluctuated with market conditions. Many factors could affect a producer's choice of driller. For example, national oil companies often held public tenders and chase drillers based on the rig's suitability and the day rate. International oil companies had been known to be much more reliant on existing relationships." Because relocating rigs was costly and time-consuming? producers seeking to develop wells in a certain region were more likely to contract a driller that already had the required type of rig ready in the area. In certain geographic locations, government regulation and local content criteria could be barriers to entry, thereby playing a significant role in the selection of a drilling contractos. Rigs that were not leased out were usually "stacked" (i.e., idle), or taken out of service, by the driller to minimize operating costs. A "hot-stacked" rig remained fully crewed, standing by, ready for work if a contract could be obtained, and the downtime was used for maintenance and repairs; a "warm-stacked" rig retained some of the crew and underwent a reduced level of maintenance and repairs; and a "cold-stacked" rig was completely vacated and its doors welded shut:" The offshore drilling industry rose and fell with oil prices (see Exhibit 4). The early 1970 s witnessed a spike in oil prices due to actions by the Organization of the Petroleum Exporting Countries (OPEC) that increased the supply of offshore rigs as drillers rushed to meet the increase in drilling demand. The industry later suffered an overcapacity of rigs when prices came back down during the mid-1970s.' Such cycles continued with the oil price spike in 1979, its collapse in early 1986, and its recovery in 1987. Ol prices remained depressed during the 1990s until 1998, due to the economic slowdown in Asia, then started climbing in the early 2000 s, which pushed utilization rates, and thereby day rates, to historical highs. The financial crisis that started in 2008 caused utilization rates and day rates to decline sharply again, as oil prices fell below $40 per barrel from their peak of $140 per barrel a year earlier." Players in the offshore drilling industry included both diversified drillers (e.g. Transocean, Seadrill, Ensco, Noble, Diamond, Rowan, and Atwood) and niche drillers (e.g., Ocean Rig). Larger, diversifled drillers had fleets that included rigs of various types and typically had a broader geographic presence (see Exhibit 7). As the CEO of a start-up, Beckett challenged the industry's conventional wisdom: Back to 2004 and 2005, the industry was coming out of the downtarn.... There was a belief in most of the eatallished drillers that they would sit on what they had, and they would own the market. They would have a strong markef pasition. There was an absoludely strong belief that nobody from outside could enter the industry. No clients would take the risk to work with a new driller without any proven reconl. Also, no lenders wotald take the risk to build several-hundred-million-dollar assets with a new player. Despite huge challenges and personal risks, Beckett believed that the offshore drilling industry was changing and provided great opportunity for a start-up such as Pacific Drilling, which focused on premier technology and ultra-decpwater drilling. In particular, he noted: When we started Pacific Drilitig if was with the wiew that the assets that were being designed, built, and delivered into the market anoraid 2005 and 2006 anmands were, for the first time in the industry, explicitly supposed to outcompete those of the previons generation by being more efficient: by redicing the time to drill a well. A lot of the incumbents missed that as a fiendanental change, and they believed that if they dian't build rigs then nobody would build rigs and that they could continue with the feclunology that they had and confrol the market. What happem it most indestries is that sometody comes in from the outsile and detivers the fechnology to the market place and supersedes them by using disruptive tedmology. In November 2014, Beckett won the Emst \& Young (EY) Entreperenear of the Year National Award in the Energy, Cleantech, and Natural Resources category for his leadership in growing the start-up company into a highly respected niche player in the offshore drilling market. "Chris Beckett is the definition of a high-growth entrepreneur, said Mike Kacsmar, EY Entrepreneur of the Year Americas program director. "Hs grown a world. class team based on that entrepreneurial spirit, and he encouraged his employees to make an impect by iden. tifying novel appoouches and secing those ideas through to implementation." Firm Strategy Beckett strongly believed that the new generation of rigs would be fundamentally more efficient than the existing generation. Over time, the previous generation would become obsolete. Therefore, his vision of Pacific Drilling was that of a preferred, high-specification. floating. rig drilling contractor. The strategy was to use its consistent fleet of ultra-deepwater drillships; which were built by the top-of-the-class shipyard Samsung Heavy Source Conpanty docimert: its marketing and operations teams to work together with the client from the first stage of negotiation until the end of the drilling campaign, which resulted in greater consistency between what the marketing team promised and what was actually done, increasing the company's credibdity and bullding stronger relationships with the client. Beckett also recognized that the company needed a culture of entreprencurihip and accountability." Employees were empowered to make suggestions and take ownership of processes and projects. Pacific Drilling focused on hiring employees who fit with the company's culture. Every potential employee was interviewed by three established employees. Through this process, the company selected recruits who were dedicated to performing above the average and who had enthusiaum for building a urique company. These qualities were refiected in a commitment the company made to its employees: "Pacific Detlling is committed to be the employer of choice in the offshore drilling industry and provide the toots and resources to enable its people to deliver consistently exceptional performance:" Given the inherently dangerous nature of the industry, Beckett and his management team conscioushy strived to develop a culture of safety, even at the expense of stopping drilling operations. The company implemented the Stop Work Obligation, which dictated that it was the responsibility and duty of any individual to stop any work that the employee felt had an unacceptable level of risk or other concern. This directive went beyond the traditional Stop Work Atuthority that was an industry a standardized framework for making operations and maintenance decisions related to a key piece of equipment on its rigs. When Pacific Drilling showed the framework to its clients, it was told that no other driller had made this type of effort to better manage the equipment. Firm Culture and Organizational Structure Pacific Drilling had set clearly defined values that provided a framework for corporate decision-making and employee behaviour. The company's core principles were cleverly embodied using the mnemonic of its name PACIFIC (see Exhibir 13). To build the company's legitimacy and credibility, Beckett recruited highly experienced experts with proven track records from a variety of professional backgrounds. In doing sa, he aimed to find the best solutions and processes for the start-up company. Beckett also knew that in this industry, talent and connections were key. To attract star employees, he offered promotions from their current positions, as well as the opportunity of a lifetime-helping to build a new company. Becikett also promised less organizational hierarchy, and he kept his word by creating a leaner, flatter company. Pacific Drilling's organizational structure provided advantages through shorter communications paths, ease of collaboration, and efficient decision-making (see Exhibit 14). For example, the marketing of rigs was traditionally done by a dedicated marketing team, which then handed over the contract to the operations department to run the rigs. However, the company encouraged Exhibit 13 Pacific Drilling Company Values Industries, outfitted with the newest drilling packages by National Oilwell Varco, and managed by a highly experienced team to provide differentiated drilling services for its customers. This focus gave Pacific Drilling a strong competitive advantage over companies such as Transocean, which was more diversified and less focused (see Exhibits 8 and 9), Beckett explained his viston of the company: The benefit that we had and that we foresaw for Pacific Drilling was to be focused on one asset class and not allow ourselves to be dragged into other asset classes. We could thercfore optimize our maintenarce systems, procurement, operating programs, and safety programs to deliver the best results with this one asset dass. In 2008, Beckett and his team prepared a thorough technical and sofety-drilling manual, but the industry did not seem ready for what Paciffe Drilling was offering. One potential client that Beckett pursued requested that the company rework its manual and prepare a new proposal. Saddied with debt and yet to book its first customer, Pacific Drilling considered the prospect of a compromise by revising the manual to align with the standard industry practices. However, Beckett and his team knew that the compromise would mean losing what they believed to be the company's key differentiator. So they instead held firm and asked the customer to reconsider. That potential client was Chevron, the first and ultimately most supportive customer throughout Pacific Drilling's growth, eventually contracting more than half of the company's drillstips. As Chevron officials later admitted, the original manual that had been proposed was among the best they had ever seen. Beckett reflected on that challenging but rewarding situation: So we were able to build a relationship with Cherron based on relationships we had in previous companies. They knew the people they were dealing with, and they could get comfortable that those people would be committed to delivering the product and service quality. They could look at who the financial backers were and where we were building rigs, and ell the associated pieces came to a camfort factor that we would do what we planned to do. The collaboration with Chevron also yielded access to a technological innovation: dual-gradient drilling (DGD), a process that enabled an oil company to access reservoirs that had previously been considered "undrillable." Unlike conventional drilling that used only one drilling fluid, DGD employed two different fluids in the wellbore-one in the drilling riser, with belowaverage density, and the other below the wellhead, with above-average density, Using DGD allowed the driller to overcome narrow pore pressure fracture gradient margins and to drill langer and deeper holes using fewer casing strings. It also helped the driller to better manage downhole pressure as the drill bit moved through various types of geologies such as sand, shale, and tar (sec Exhibit 10). DGD was technologically proven in the late 1990 si however, it had not yet been deployed on a commercial rig. While Chevron expected DGD to reduce the total cost to drill a well, the company had not yet worked with a drilling contractor to fully implement the tech. nology. Pacific Drilling management was aware of the potential for DGD and embraced the possibilities to work with Chevron on developing processes and pro. cedures. It took about six months before Cheyron was comfortable that Pacific Drilling was the right partner to commercialize DGD, leading to Pacific Drilling's first drilling contract. Pacific Drilling's close relationship with Chevron was among the few relative constants in an often vola. tile and unpredictable market. Chevron had contracted four drillships with Pacific Drilling to date for operations in the Gulf of Mexico and Nigeria. The justification was simple: Pacific Drilling rigs were equipped with the capabilities that Chevron desired, and collaboration among the companies' employees, both onshore and offshore, had become scamless. After Chevron had signed the first contract, opportunities from other producers emerged for Pacific Drilling. Chevron's willingness to repeatedly work with the new company was an endorsement of the substantial value that Pacific Drilling could deliver to its customers. With a more established reputation, Pacific Drilling was able to broaden its customer base to include Total (one drillship in Nigeria) and Petrobras (one drillship in Brazil). By the end of 2014 , the company had signed $2.7 billion in contracts (see Exhibit II). Working with Chevron to implement DGD also helped Pacific Drilling improve and refine its operating and management systems. Implementation of DGD technology demanded that Pacific Drilling work closely with Chevron on the development of operating procedures and employee training. At the time, Pacific Drilling operated two drillships that were DGD-capable (i.e, the Pacific Santa Ana and Pacific Sharav). Frederic Jacquemin, the director of the DGD program at Pacific Drilling at the time, noted that "with DGD, integrating a new technology is not only about equipment but it is also about defining new processes and training people." Although the full deployment of DGD technology was still a work in progress, Pacific Drilling's close collaboration with Chevron led to a corporate emphasis on process innovations and technological leadership. Pacific Drilling continued to invest in technological innovation in an effort to keep its fleet as up-to-date as possible. For example, its newest rigs were equipped with automated drilling systems that reduced the number of personnel on the drilling floor, substantially improving drilling speed while also reducing safety risks. The company also equipped its rigs with a higher than usual amount of drilling mud storage and processing capability, which allowed the rig to move more quickly through the drill. ing process and also to be more self-sufficient a particular advantage in remote operating locations, where the cost of support vessels was high. Pacific Drilling implemented SAP software on all of its drillships to better monitor daily rig operations and respond in real time to unforeseen problems. Traditionally, workers on a rig monitored their tasks using pen and paper and provided hard-copy reports to their supervisors. The SAP software helped to contirually update information across functions during the drilling process, improving operational efficiency. The company reduced the amount of downtime (non-operating time due to malfunctions) and ultimately improved safety, both of which increased profitability and benefit to customers. Pacific Drilling developed its own company management system using the highest standards (see Exhibit 12). The company had the advantage of being able to implement this system from the beginning, whereas most of its peers had to adapt management systems to their legacy corporate practices. The company also emphasized consistency in its processes and procedures. For example, the company went through an exhaustive exercise to develop Exhibit 11 Pacific Driling Growth Profile C-162 Pacific Mistral, that had been sitting idle. Because modem drillships had rarely been cold-stacked, keeping the crew on board was costly. The company was also concerned about two additional drillshipst Pacific Khamsin, which woald come off contract in late 2015, and Pacific Zonda, scheduled for delivery from the shipyard is late 2015 . Strategic Choices Pacific Drilling had come to a critical juncture, and important decisions had to be mode. As a more mature company, Pacific Drilling had been confronting a different competitive landscape. During the past year, very few new contracts had been awarded in the industry. Some of the company's peers were willing to bid significantly below market rates to win the few new jobs available. Looking forward, Pacific Drilling had a significant number of high-specification floating rigs available to be contracted. Although there bad been weak demand for very high-specification rigs, there had also been relatively limited supply, which supported the company's contracting prospects. Overcoming challenges had been nothing new for Beckett. Yet, with the challenging market environment and other constraints, Beckett made the follow. ing statement in a letter to employees: "Despite the weakening market, we expect further growth in 2015 . but we must continue to execute well on our growth plans and secure new contracts to deliver on this expectation:" NOTES 1. Af comency amouns are in USS unles. ofherwile specifind. 2 Brad Pumet, Why Cul Preei Keep FollingAnd Throwing the World inbe Tumbel" Vox Medi inc, updated laruary 23 , 2015. accessed hpel 2. 2016, www vercompole M276/0epos/ol-prices biting. 3 Deutsche Bank Markets Aesearch "What is Nere? Key Stats k fvern to Watch" OMirld Servicei Orenicle, June 23, 2014. 4. Aderick ha pyamid shoped structure above the rip foor where the crown block. monky bound, and racking board are supported. Dual dericls have two driling uniti on ore hull. 5. Drilers vivaly charge of produceri on a dally work rant, which varles depending on the location the type of rigand the market condions. For example, by March 2015, Pacific Deflingl anenge day nate was sssseon and Dumond Ollihoreh rate wa $450.000 6. zamon Casders-Meranell Kenneth Corts, and lateph Mctlroy, The Ollshov Buinew Sthool 2010. Aralable bom lvey Publahing product no. TwSA. 7. According to Causerus Masanels Corts. and Uction moring a jack-up rig from the Gulf of Mexico to the North Sea look about a momh, and mobilysion alone cort between $2 mision and \$S milfion. eoclutive of day rates. a. As a cost-reduction step, a cold stacked. ig is often stered in a harbout, thicpyard. or devignated offihore atea becase is contracting peripects look bleak. it wal be out of service for extended periods of time and may not be actively marketed. 9. Robert B. Bvily and tutz kian, on and the Macrecconomy since the 1900s ? Joumblof fconomic Feripnetives ith na. 4 [Fall 2004 115-104, 10. Cabdetus-Matanell, Corts, and Melifoy. ea.ch. 11. finus Young Clabal Uimited. "Chen Beckett, cEO ef Pacife Driting Named EY Eneveprener. of the Year-2014 Natienal Energx, Cesontech and Natural Resources Mward Wimec? November 15, 2014, accised Aprit 12, 2005. Pacflo Orling-National-finergy-AmartWiner. 12. Eased on information from the cempany Ueda and Public Relatlond department. 13. Pyan Kellogo, Vearning by Driling: imerime learting and Relatienship Persitence in the Teress Clloasch" Questerly Exhibit 7 Profies of Pacific Drilings compethoes Transocean Seadrill Transecean operated the largest feet in the offshore drilling industry with 85 riga (15 jack-ups, 39 vemi-submers/bies. Which was the second urgest in the induatry, it had an opeiational presence in the waters of the United Seasec, Nocway. the United Kingdom. Weas. Arica, Brazil South Ean Ava, and Australis. Over the past five yeath, the corripary had delivered operasing megins of about 22 per cent which was below the industry average The comparys strategy was to upgrade its feet and divest its non-core asseti. one of the youngest feets in the industy, The comparys market capitaliation was 55,9 bilion. Oner the past five years. the compary had also had the second highest operating magins in the industry at about 40 per cent. It had an opera. tional presence in the waters of the United States, Mexica, Norway, Brasis. West Africa, the Middle Eat, and Aila Paific. its strategy was to maintain its technology advantage by continuing to imvest heaviy in fiet renewal and growth. Enseo Ensco operated 74 rigs (46 jack-uph, 18 seml-submetsibies aod 10 dralishipal with an average age of 19.6 years, The. compary's market capitaltation of 57,1 billion was the largest in the industry, and geretased merage operating margios of 40 percent oves the prevous five years it had an operations presence in the waters of the United Stated. Brazil the Mediterranean, the Middle East. Africa, Europe, and Asia Pacific. Its strategy was to update its Feet, invest in employee training and maintain is diverse geographic presence. Noble Noble operated 39 rigs (19 jock-upa, 11 semi-submersibles, sod nine dithships) with an averagi age of 15.8 years, which made it the second oldest flect in the industry. The companys matket capitallzation was 54,4 bilicen. It had a diverse operational presence with rigs operasing in the waters of the United States, Brasl, Merica, the United Kingdom, the Middie East, Africa, and Australia. The company pefformed just below the industry average, delivering ogerating margins of around 27 per cent over the previous five years, its strategy was to update is fleet, invest in employee training, and maintain its diverse geographic presence. Damond Damond operated 41 rigs (six jack-ups, 30 semi-submersibles, and five drillships) with an werage age of 30.4 years, which made it the oldest feet in the industry. The compary's market capitalization was 55.3 billion. Over the previous fre years, the company delivered operating margins of about 31 per cent, which was in line with the industry averageThe company had a very low level of debt relative to its size and in comparbon to its peers. At the same time, lis older rigs enabled the compary to be very competitive on rig pricing. The company strategy was to maintain its attmetive pricing and its financisi strength. and Malaysia The company generated average operating margins of about 23 per cent over the previous five years. The compary's strategy Socus was to maintain is diverse geographic presence, be more cost-effective, and execute better: Atwood operated 14 rigs (fve jack ups five semi-submersibles, and four drillshipsi with an average age of 9.5 yeass. The compary's market capitalieation was S1.9 billon it had an international presence, with rigs h the waters of the Unitied States. Australis, Equatorial Gulnes, and Thalland. The company achieved the highest operating margins in the industry over the previous five years at about 44 per cent, its strategy was to continue growing while emaintaining its operational efficlency. Ocean Rig Ocean Pig operated 13 rigs and focused on drilling in detper waters (two semi-submers bles and 11 deillshipri) with an acean rog operated is rigs and focused on driling in detper waters (two semi-submersbles and 13 years. The company's market capitailization was 51.2 billion. it had a tig presence in the waters of Brazl, Angola, Norway, and lreland. Its operating margins were at the industry average of appeximately 30 per cent. The company's strategic focus was to grow its fleet of high specifation drilling rigs and to broaden its geographic reach. Chris Beckett: CEO and the First Employee With the initial purchase of a drillship under construction, Pacific Drilling was founded in 2006 as a subsidiary of Tanker Pacific, one of the largest tanker fleet owners in the world. After ordering a second rig in 2007, the company transferred its rigs to a joint venture with 5050 ownership with Transocean. In 2008, Pacific Drilling expanded its activities beyond the joint venture to include four ultra-deepwater drillships, which had been constructed in South Korea at Samsung Heavy Industries, one of the three largest shipyards in the world. At the same time, Beckett was approached by Idan Ofer, an Israell tycoon and the principal of Tanker Pacific. Ofer asked Beckett to be the company's first employee and to lead the development of Pacific Drilling as CEO. Beckett, a 2002 MBA graduate from Rice University in Texas, had previously been the head of corporate planning at Transocean, a strategy consultant at McKinsey, and the U.S. land seismic manager at Schlumberger

Step by Step Solution

There are 3 Steps involved in it

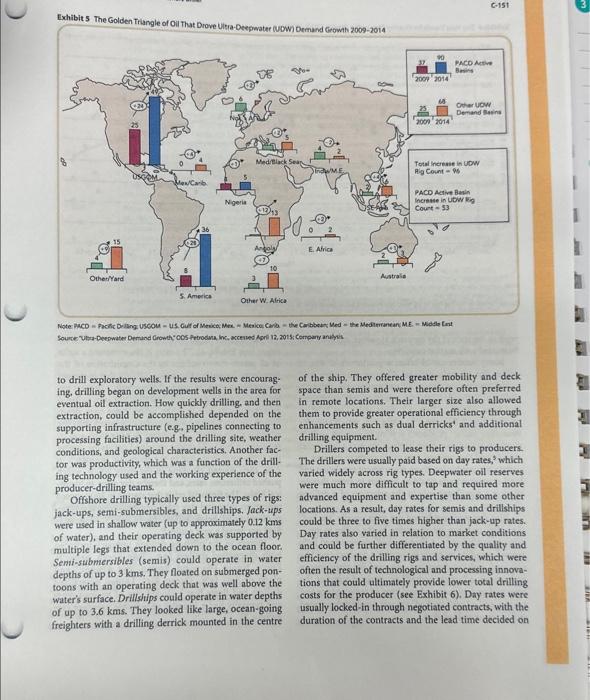

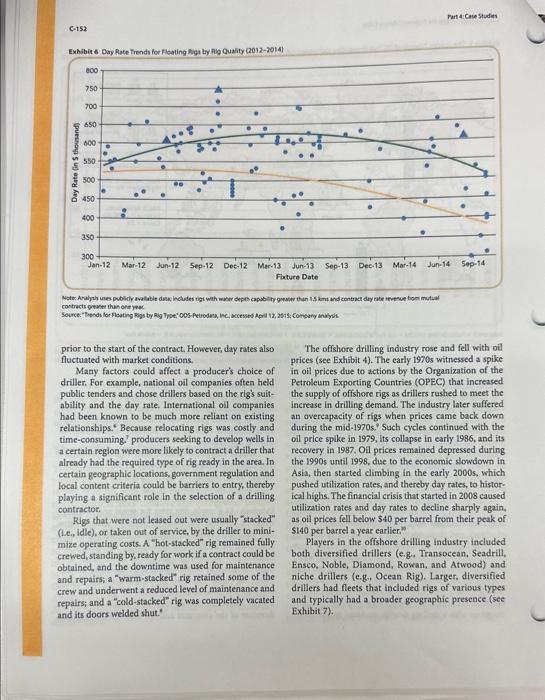

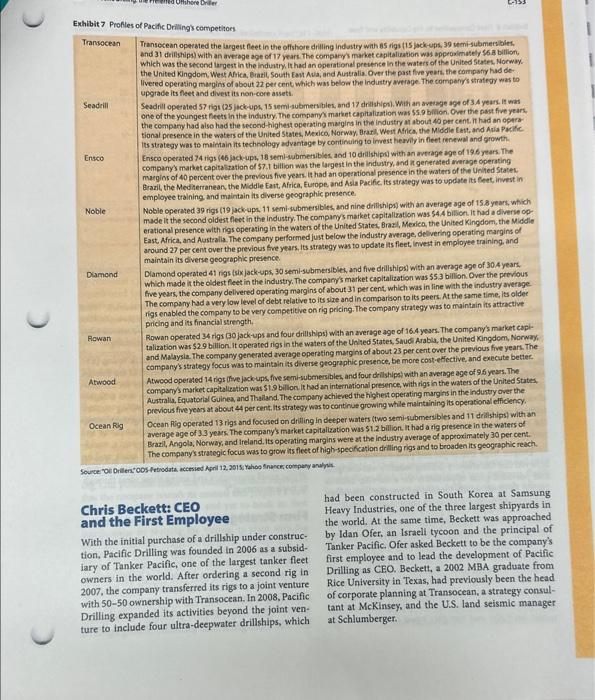

Get step-by-step solutions from verified subject matter experts