Question: can you answer only b please a) In the Miller and Modigliani world without taxes, a leveraged firm with $50 million in debt and a

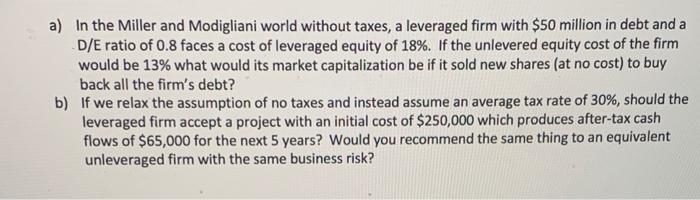

a) In the Miller and Modigliani world without taxes, a leveraged firm with $50 million in debt and a D/E ratio of 0.8 faces a cost of leveraged equity of 18%. If the unlevered equity cost of the firm would be 13% what would its market capitalization be if it sold new shares (at no cost) to buy back all the firm's debt? b) If we relax the assumption of no taxes and instead assume an average tax rate of 30%, should the leveraged firm accept a project with an initial cost of $250,000 which produces after-tax cash flows of $65,000 for the next 5 years? Would you recommend the same thing to an equivalent unleveraged firm with the same business risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts