Question: can you please provide a full solution a) In the Miller and Modigliani world without taxes, a leveraged firm with $50 million in debt and

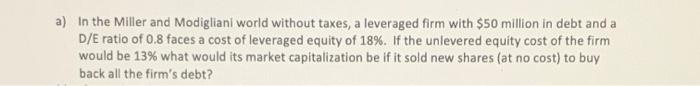

a) In the Miller and Modigliani world without taxes, a leveraged firm with $50 million in debt and a D/E ratio of 0.8 faces a cost of leveraged equity of 18%. If the unlevered equity cost of the firm would be 13% what would its market capitalization be if it sold new shares (at no cost) to buy back all the firm's debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts