Question: Can you answer part B. 2 12 92% + 2 Investment and Capital Stock (15 points) When disuessing the business cycles, and introducing the IS

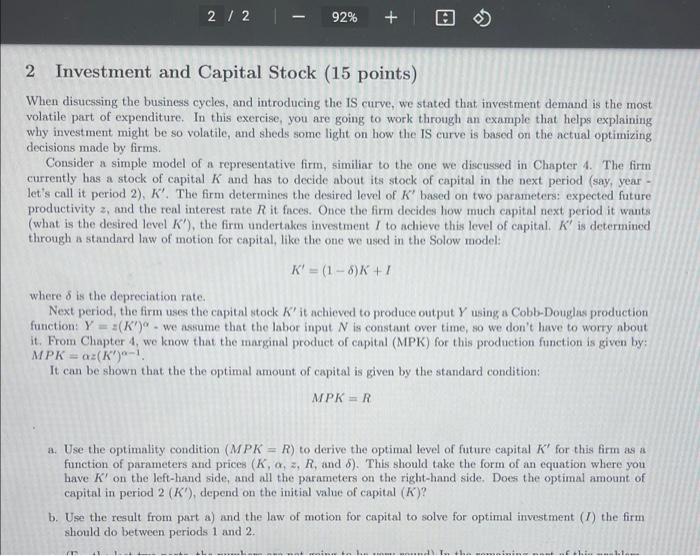

2 12 92% + 2 Investment and Capital Stock (15 points) When disuessing the business cycles, and introducing the IS curve, we stated that investment demand is the most volatile part of expenditure. In this exercise, you are going to work through an example that helps explaining why investment might be so volatile, and sheds some light on how the IS curve is based on the actual optimizing decisions made by firms. Consider a simple model of a representative firm, similar to the one we discussed in Chapter 4. The firm currently has a stock of capital K and has to decide about its stock of capital in the next period (say, year - let's call it period 2), K'. The firm determines the desired level of K' based on two parameters: expected future productivity z, and the real interest rate Rit faces. Once the firm decides how much capital next period it wants (what is the desired level K), the firm undertakes investment I to achieve this level of capital. K' is determined through a standard Inw of motion for capital, like the one we used in the Solow model: K' = (1 - 8)K+ where 8 is the depreciation rate. Next period, the firm uses the capital stock K' it achieved to produce output Y using a Cobb-Douglas production function: Y = (K) . we assume that the labor input N is constant over time, so we don't have to worry about it. From Chapter 4, we know that the marginal product of capital (MPK) for this production function is given by: MPK = az(K)-! It can be shown that the the optimal amount of capital is given by the standard condition: MPK = R a. Use the optimality condition (MPK = R) to derive the optimal level of future capital K' for this firm as a function of parameters and prices (K, 0, 2, R, and 6). This should take the form of an equation where you have K' on the left-hand side, and all the parameters on the right-hand side. Does the optimal amount of capital in period 2 (K), depend on the initial value of capital (K)? b. Use the result from part a) and the law of motion for capital to solve for optimal investment (1) the firm should do between periods 1 and 2 2 12 92% + 2 Investment and Capital Stock (15 points) When disuessing the business cycles, and introducing the IS curve, we stated that investment demand is the most volatile part of expenditure. In this exercise, you are going to work through an example that helps explaining why investment might be so volatile, and sheds some light on how the IS curve is based on the actual optimizing decisions made by firms. Consider a simple model of a representative firm, similar to the one we discussed in Chapter 4. The firm currently has a stock of capital K and has to decide about its stock of capital in the next period (say, year - let's call it period 2), K'. The firm determines the desired level of K' based on two parameters: expected future productivity z, and the real interest rate Rit faces. Once the firm decides how much capital next period it wants (what is the desired level K), the firm undertakes investment I to achieve this level of capital. K' is determined through a standard Inw of motion for capital, like the one we used in the Solow model: K' = (1 - 8)K+ where 8 is the depreciation rate. Next period, the firm uses the capital stock K' it achieved to produce output Y using a Cobb-Douglas production function: Y = (K) . we assume that the labor input N is constant over time, so we don't have to worry about it. From Chapter 4, we know that the marginal product of capital (MPK) for this production function is given by: MPK = az(K)-! It can be shown that the the optimal amount of capital is given by the standard condition: MPK = R a. Use the optimality condition (MPK = R) to derive the optimal level of future capital K' for this firm as a function of parameters and prices (K, 0, 2, R, and 6). This should take the form of an equation where you have K' on the left-hand side, and all the parameters on the right-hand side. Does the optimal amount of capital in period 2 (K), depend on the initial value of capital (K)? b. Use the result from part a) and the law of motion for capital to solve for optimal investment (1) the firm should do between periods 1 and 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts