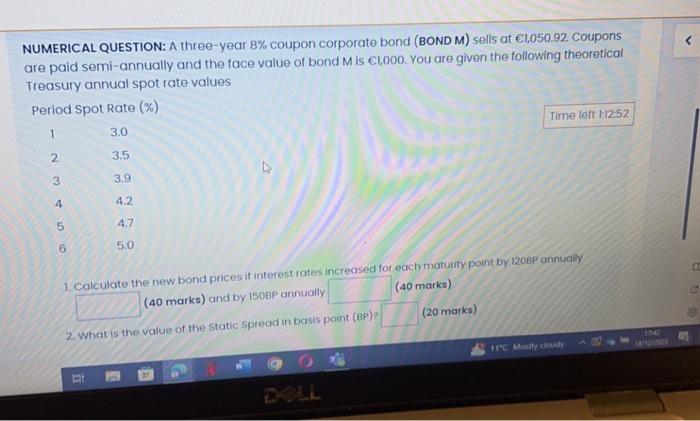

Question: can you answer question 1 and 2 please NUMERICAL QUESTION: A three-year 8% coupon corporate bond (BOND M) sells at 1,050.92 Coupons are paid semi-annually

NUMERICAL QUESTION: A three-year 8\% coupon corporate bond (BOND M) sells at 1,050.92 Coupons are paid semi-annually and the face value of bond M is Cl,000. You are given the following theoretical Treasury annual spot rate values 1. Calculate the new bond prices if interest rates increased for ech maturity point by 120 ap annually (40 marks) and by 1508P annually ( 40 marks) 2. What is the value of the static spread in basis point (BP). (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts