Question: Can you answer Question 12 and 13 A) A stock with an annual standard deviation of 30 percent currently sells for $67. The risk-free rate

Can you answer Question 12 and 13

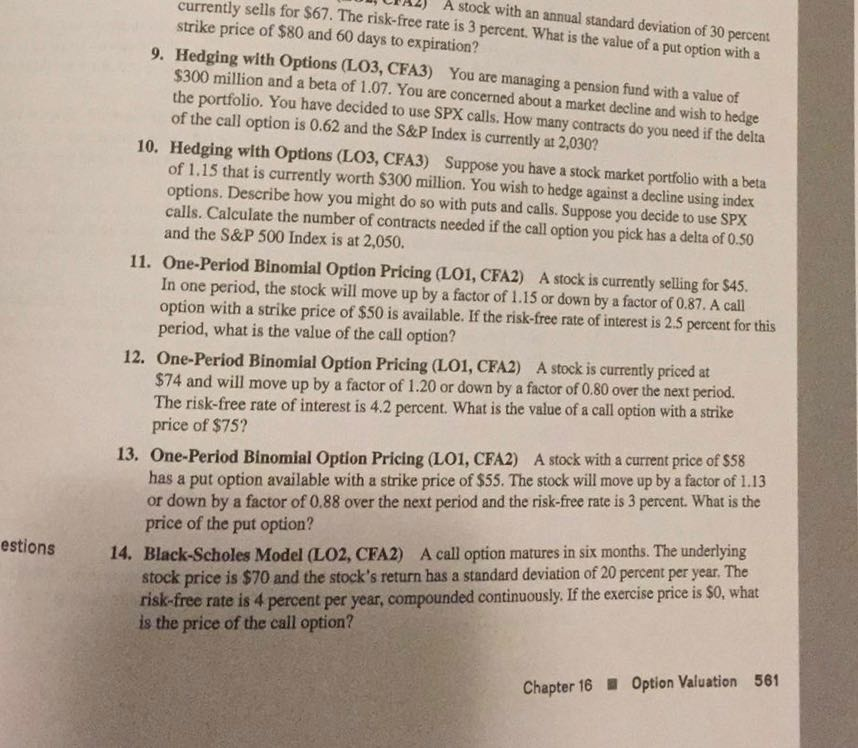

A) A stock with an annual standard deviation of 30 percent currently sells for $67. The risk-free rate is 3 percent. What is the value of a put option with a strike price of $80 and 60 days to expiration? 9. Hedging with Options (LO3, CFA3) You are managing a pension fund with a value of $300 million and a beta of 1.07. You are concerned about a market decline and wish to hedge the portfolio. You have decided to use SPX calls. How many contracts do you need if the delta of the call option is 0.62 and the S&P Index is currently at 2,030? Hedging with Options (LO3, CFA3) of 1.15 that is currently worth $300 million. You wish to hedge against a decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the number of contracts needed if the call option you pick has a delta of 0.50 and the S&P 500 Index is at 2,050. 10. Suppose you have a stock market portfolio with a beta 11. One-Period Binomial Option Pricing (LO1, CFA2) A stock is currently selling for S45. In one period, the stock will move up by a factor of 1.15 or down by a factor of 0.87. A call option with a strike price of $50 is available. If the risk-free rate of interest is 2.5 percent for this period, what is the value of the call option? 12. One-Period Binomial Option Pricing (L01, CFA2) A stock is currently priced at $74 and will move up by a factor of 1.20 or down by a factor of 0.80 over the next period. The risk-free rate of interest is 4.2 percent. What is the value of a call option with a strike price of $75? One-Period Binomial Option Pricing (L01, CFA2) has a put option available with a strike price of $55. The stock will move up by a factor of 1.13 or down by a factor of 0.88 over the next period and the risk-free rate is 3 percent. What is the A stock with a current price of $58 13. price of the put option? stock price is $70 and the stock's return has a standard deviation of 20 percent per year. The risk-free rate is 4 percent per year, compounded continuously. If the exercise price is SO, what is the price of the call option? estions 14. Black-Scholes Model (LO2, CFA2) A call option matures in six months. The underlying Chapter 16 Option Valuation 56 A) A stock with an annual standard deviation of 30 percent currently sells for $67. The risk-free rate is 3 percent. What is the value of a put option with a strike price of $80 and 60 days to expiration? 9. Hedging with Options (LO3, CFA3) You are managing a pension fund with a value of $300 million and a beta of 1.07. You are concerned about a market decline and wish to hedge the portfolio. You have decided to use SPX calls. How many contracts do you need if the delta of the call option is 0.62 and the S&P Index is currently at 2,030? Hedging with Options (LO3, CFA3) of 1.15 that is currently worth $300 million. You wish to hedge against a decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the number of contracts needed if the call option you pick has a delta of 0.50 and the S&P 500 Index is at 2,050. 10. Suppose you have a stock market portfolio with a beta 11. One-Period Binomial Option Pricing (LO1, CFA2) A stock is currently selling for S45. In one period, the stock will move up by a factor of 1.15 or down by a factor of 0.87. A call option with a strike price of $50 is available. If the risk-free rate of interest is 2.5 percent for this period, what is the value of the call option? 12. One-Period Binomial Option Pricing (L01, CFA2) A stock is currently priced at $74 and will move up by a factor of 1.20 or down by a factor of 0.80 over the next period. The risk-free rate of interest is 4.2 percent. What is the value of a call option with a strike price of $75? One-Period Binomial Option Pricing (L01, CFA2) has a put option available with a strike price of $55. The stock will move up by a factor of 1.13 or down by a factor of 0.88 over the next period and the risk-free rate is 3 percent. What is the A stock with a current price of $58 13. price of the put option? stock price is $70 and the stock's return has a standard deviation of 20 percent per year. The risk-free rate is 4 percent per year, compounded continuously. If the exercise price is SO, what is the price of the call option? estions 14. Black-Scholes Model (LO2, CFA2) A call option matures in six months. The underlying Chapter 16 Option Valuation 56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts