Question: can you answer the first question? Q4a. What is the TOTAL. delta of your 10 short CAILL position? (2 points) Q4b. How many shares do

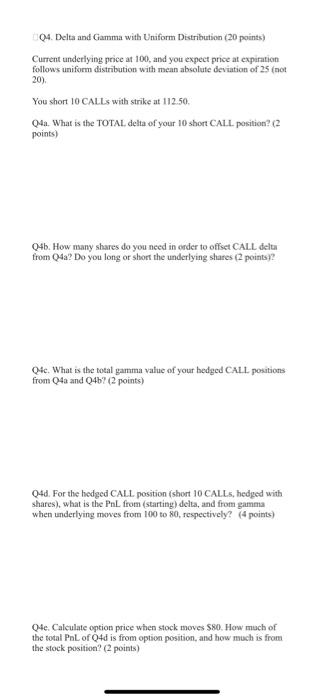

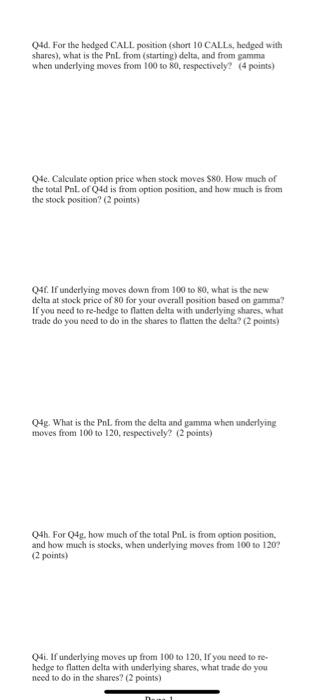

Q4a. What is the TOTAL. delta of your 10 short CAILL position? (2 points) Q4b. How many shares do you need in order to offset CALL delua from Q4a? Do you long or short the underlying shares (2 points)? Q4e. What is the total gamma value of your bedged CAl. positions from Q4a and Q4b ? (2 points) Q4d. For the hedged CALL position (short 10 CALL.5, hedged with shares), what is the PnL from (starting) delta, and from gamma when underlying moves from 100 to 80 , respectively? (4 points) Q4e. Calculate option price when stock moves $80. How much of the total PnL of Q4d is from option position, and how much is from the stock position? (2 points) Q4d. For the hedged CAL.L position (shoot 10 CAL.Ls, hedged with shares), what is the PnL from (starting) delta, and from gamma when underlying moves from 100 to 80 , respectively? (4 points) Q4e. Calculate option price when stock moves $80. How much of the total PnL. of Q4d is from option position, and how much is from the stock position? (2 points) Q4f. If underlying moves down from 100 to 80 , what is the new delta at siock price of 80 for yoar overall position based on gamma? If you need to re-hedge to flatten delta with underlying shares, what trade do you need to do in the shares to flatten the dela? (2 points) Q4g. What is the PnL from the delta and gamma when underlying moves from 100 to 120 , fespectively? (2 points) Q4h. For Q4g, how much of the total PnL is from option position, and how much is stocks, when underlying moves from 100 to 120 ? (2 points) Q4L. If underlying moves up from 100 to 120 , If you need to rehedge to flatten delta with underlying shares, what trade do you need to do in the shares? (2 points) Q4a. What is the TOTAL. delta of your 10 short CAILL position? (2 points) Q4b. How many shares do you need in order to offset CALL delua from Q4a? Do you long or short the underlying shares (2 points)? Q4e. What is the total gamma value of your bedged CAl. positions from Q4a and Q4b ? (2 points) Q4d. For the hedged CALL position (short 10 CALL.5, hedged with shares), what is the PnL from (starting) delta, and from gamma when underlying moves from 100 to 80 , respectively? (4 points) Q4e. Calculate option price when stock moves $80. How much of the total PnL of Q4d is from option position, and how much is from the stock position? (2 points) Q4d. For the hedged CAL.L position (shoot 10 CAL.Ls, hedged with shares), what is the PnL from (starting) delta, and from gamma when underlying moves from 100 to 80 , respectively? (4 points) Q4e. Calculate option price when stock moves $80. How much of the total PnL. of Q4d is from option position, and how much is from the stock position? (2 points) Q4f. If underlying moves down from 100 to 80 , what is the new delta at siock price of 80 for yoar overall position based on gamma? If you need to re-hedge to flatten delta with underlying shares, what trade do you need to do in the shares to flatten the dela? (2 points) Q4g. What is the PnL from the delta and gamma when underlying moves from 100 to 120 , fespectively? (2 points) Q4h. For Q4g, how much of the total PnL is from option position, and how much is stocks, when underlying moves from 100 to 120 ? (2 points) Q4L. If underlying moves up from 100 to 120 , If you need to rehedge to flatten delta with underlying shares, what trade do you need to do in the shares? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts