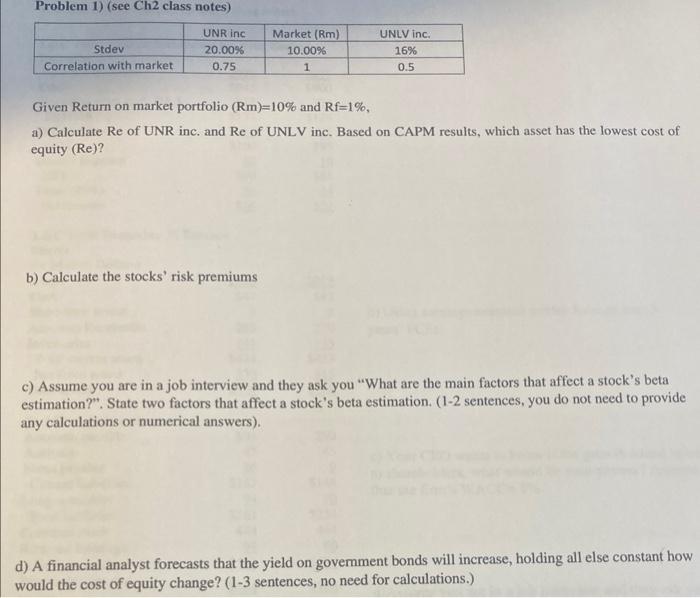

Question: Problem 1) (see Ch2 class notes) Stdev Correlation with market UNR inc 20.00% 0.75 Market (Rm) 10.00% 1 UNLV inc. 16% 0.5 Given Return on

Problem 1) (see Ch2 class notes) Stdev Correlation with market UNR inc 20.00% 0.75 Market (Rm) 10.00% 1 UNLV inc. 16% 0.5 Given Return on market portfolio (Rm)=10% and Rf=1%, a) Calculate Re of UNR inc. and Re of UNLV inc. Based on CAPM results, which asset has the lowest cost of equity (Re)? b) Calculate the stocks' risk premiums c) Assume you are in a job interview and they ask you "What are the main factors that affect a stock's beta estimation?". State two factors that affect a stock's beta estimation. (1-2 sentences, you do not need to provide any calculations or numerical answers). d) A financial analyst forecasts that the yield on government bonds will increase, holding all else constant how would the cost of equity change? (1-3 sentences, no need for calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts