Question: Can you answer this for me please QUESTION THREE The Pro Rata Corporation has 10m shares issued, over the next year is 4%, with the

Can you answer this for me please

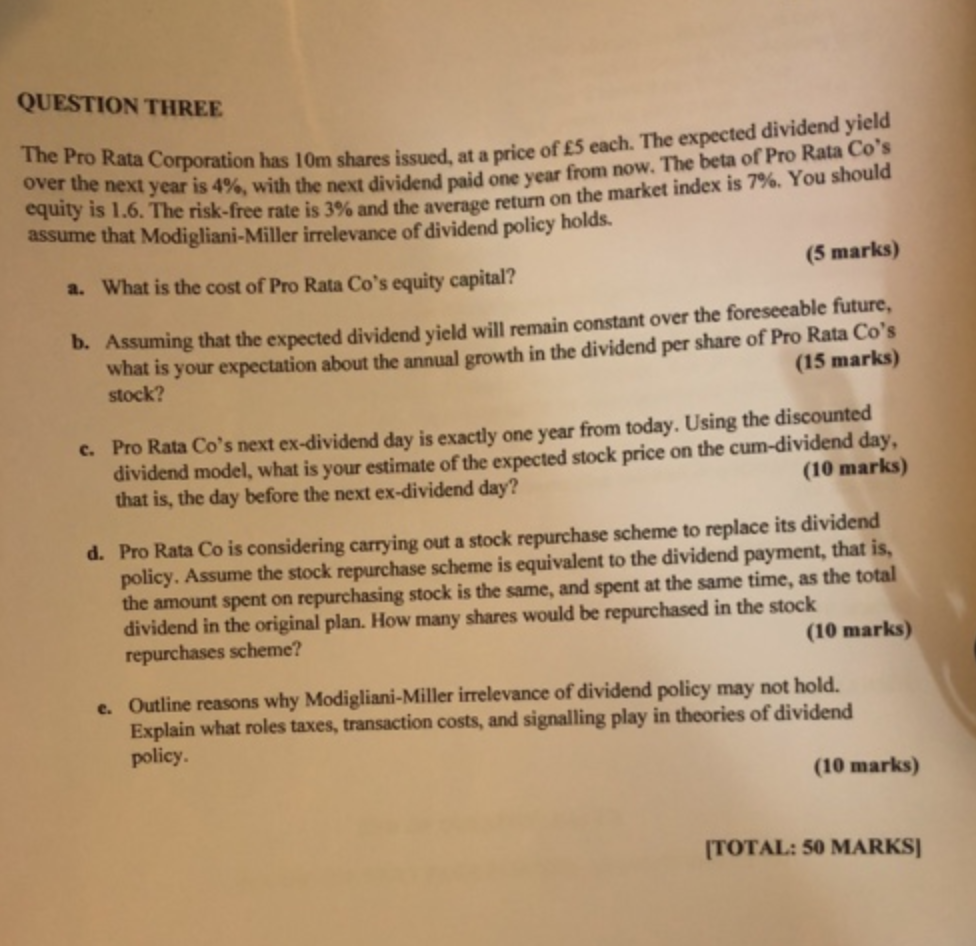

QUESTION THREE The Pro Rata Corporation has 10m shares issued, over the next year is 4%, with the next dividend paid equity is 1.6. The risk-free rate is 3% and the average return of assume that Modigliani-Miller irrelevance of dividend policy holas. ares issued, at a price of 5 each. The expected dividend yield in the next dividend paid one year from now. The beta of Pro Rata Co's IS 3% and the average return on the market index is 7%. You should (5 marks) a. What is the cost of Pro Rata Co's equity capital? assuming that the expected dividend yield will remain constant over the foreseeable future, what is your expectation about the annual growth in the dividend per share of Pro Rata Co's stock? (15 marks) c. Pro Rata Co's next ex-dividend day is exactly one year from today. Using the discounted dividend model, what is your estimate of the expected stock price on the cum-dividend day, that is, the day before the next ex-dividend day? (10 marks) d. Pro Rata Co is considering carrying out a stock repurchase scheme to replace its dividend policy. Assume the stock repurchase scheme is equivalent to the dividend payment, that is, the amount spent on repurchasing stock is the same, and spent at the same time, as the total dividend in the original plan. How many shares would be repurchased in the stock repurchases scheme? (10 marks) Outline reasons why Modigliani-Miller irrelevance of dividend policy may not hold. Explain what roles taxes, transaction costs, and signalling play in theories of dividend policy (10 marks) [TOTAL: 50 MARKSI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts