Question: Please answer all questions! Thank you for your time! ( Individual or component costs of capital ) Compute the cost of the following : a.A

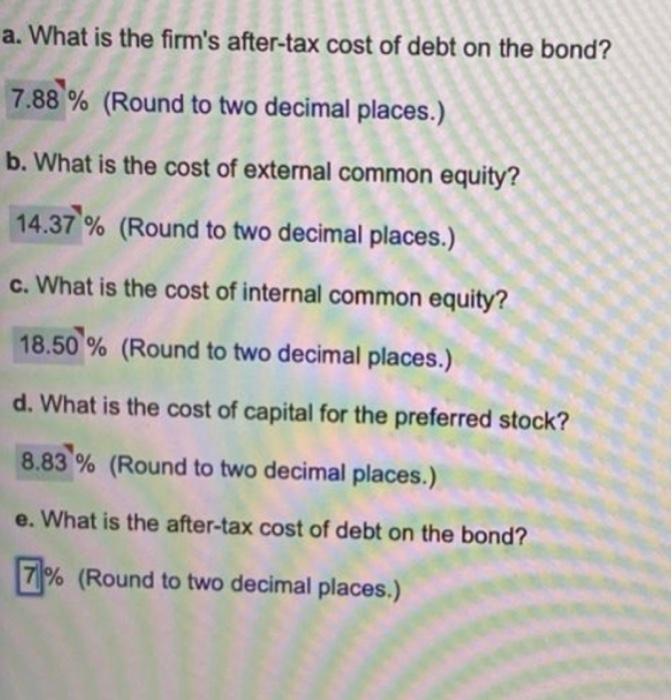

indo component of Compute the cost of the folowing Atend that has 51.000 per on and of coupon it rate of 14 percent. A www have a los con perche 31.106 mart The band to years. There are 30 per margra 2 percent 1. Aww vida 11.30 dvddo The power of the visit, and is por are have grown at a 12 percent year. This growhole expected to continue to the the com mantine a condarrige rute of 30 percent. The price of this kinow 126. but percentation or .. wwwcomo out when the current market price of the common sok a $46. The expected in this coming wear shodde $3.00 inomasing water almal growhale of tt percent. The corporate A preferred to paying addendo perceron a $120 per visitarowiis offered in ons will be 11 percent of the current price of 164 ..And ingyel Dere har tation, but before using for the moral corporate of 25 percort Wolfer words, 8 percent to the equat erot proces from the bord i prin cash fous principal and interes a. What is the firm's after-tax cost of debt on the bond? 7.88% (Round to two decimal places.) b. What is the cost of external common equity? 14.37 % (Round to two decimal places.) c. What is the cost of internal common equity? 18.50 % (Round to two decimal places.) d. What is the cost of capital for the preferred stock? 8.83 % (Round to two decimal places.) e. What is the after-tax cost of debt on the bond? 7% (Round to two decimal places.) 1 a. What is the firm's after-tax cost of debt on the bond? 7.88% (Round to two decimal places.) b. What is the cost of external common equity? 14.37 % (Round to two decimal places.) c. What is the cost of internal common equity? 18.50 % (Round to two decimal places.) d. What is the cost of capital for the preferred stock? 8.83 % (Round to two decimal places.) e. What is the after-tax cost of debt on the bond? 7% (Round to two decimal places.) 1 indo component of Compute the cost of the folowing Atend that has 51.000 per on and of coupon it rate of 14 percent. A www have a los con perche 31.106 mart The band to years. There are 30 per margra 2 percent 1. Aww vida 11.30 dvddo The power of the visit, and is por are have grown at a 12 percent year. This growhole expected to continue to the the com mantine a condarrige rute of 30 percent. The price of this kinow 126. but percentation or .. wwwcomo out when the current market price of the common sok a $46. The expected in this coming wear shodde $3.00 inomasing water almal growhale of tt percent. The corporate A preferred to paying addendo perceron a $120 per visitarowiis offered in ons will be 11 percent of the current price of 164 ..And ingyel Dere har tation, but before using for the moral corporate of 25 percort Wolfer words, 8 percent to the equat erot proces from the bord i prin cash fous principal and interes a. What is the firm's after-tax cost of debt on the bond? 7.88% (Round to two decimal places.) b. What is the cost of external common equity? 14.37 % (Round to two decimal places.) c. What is the cost of internal common equity? 18.50 % (Round to two decimal places.) d. What is the cost of capital for the preferred stock? 8.83 % (Round to two decimal places.) e. What is the after-tax cost of debt on the bond? 7% (Round to two decimal places.) 1 a. What is the firm's after-tax cost of debt on the bond? 7.88% (Round to two decimal places.) b. What is the cost of external common equity? 14.37 % (Round to two decimal places.) c. What is the cost of internal common equity? 18.50 % (Round to two decimal places.) d. What is the cost of capital for the preferred stock? 8.83 % (Round to two decimal places.) e. What is the after-tax cost of debt on the bond? 7% (Round to two decimal places.) 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts