Question: can you answer this. HINT- To solve this problem, remember to compute the taxable income, and use it to compute the income tax. Don't forget

can you answer this. HINT- To solve this problem, remember to compute the taxable income, and use it to compute the income tax. Don't forget the credit children if it is applicable.

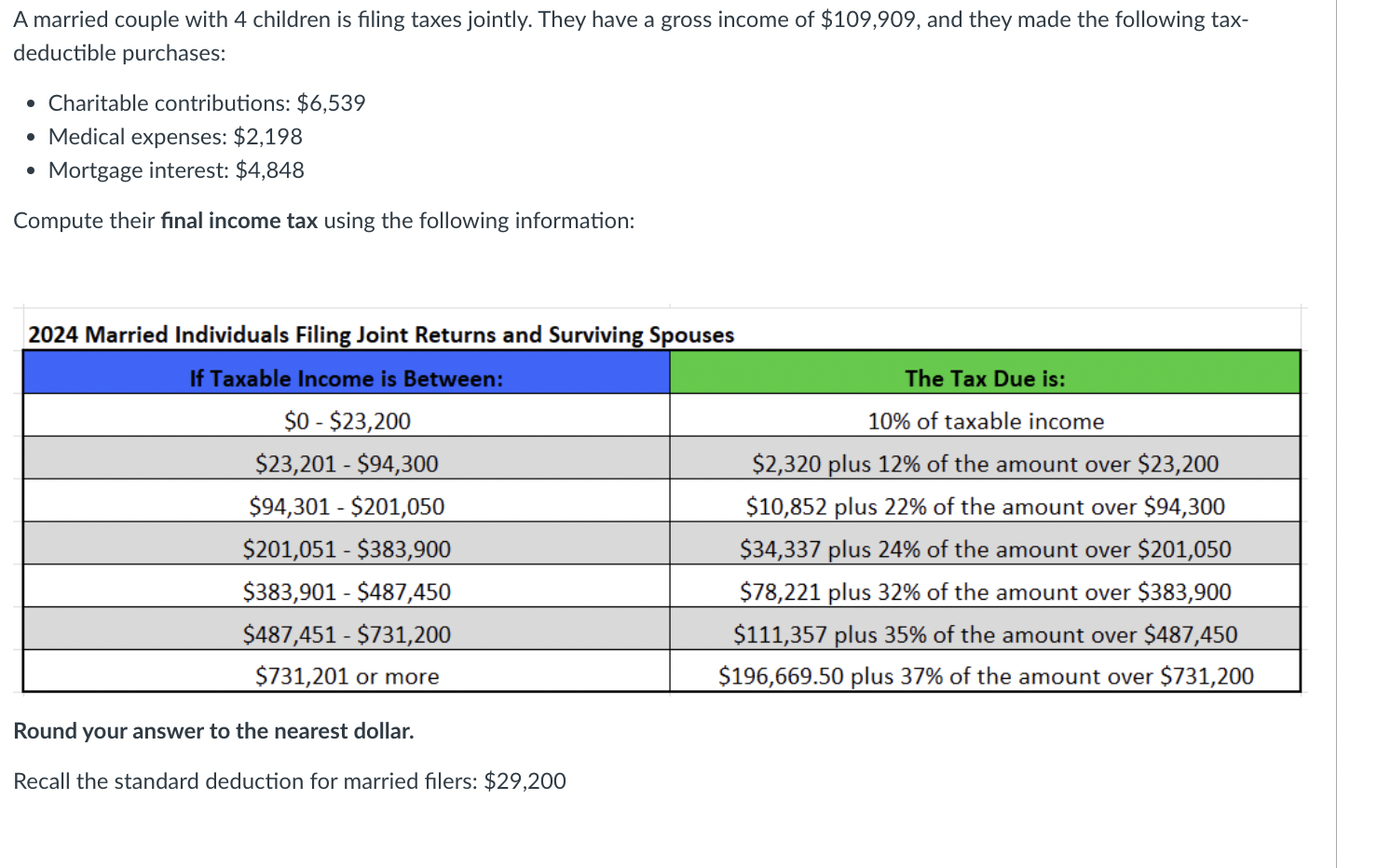

A married couple with 4 children is filing taxes jointly. They have a gross income of $109,909, and they made the following tax- deductible purchases: s Charitable contributions: $6,539 Medical expenses: $2,198 * Mortgage interest: $4,848 Compute their final income tax using the following information: 2024 Married Individuals Filing Joint Returns and Surviving Spouses S0 -$23,200 10% of taxable income $23,201 - 594,300 $2,320 plus 12% of the amount over $23,200 $94,301 - $201,050 $10,852 plus 22% of the amount over $94,300 $383,901 - $487,450 $78,221 plus 32% of the amount over $383,900 $487,451 - $731,200 $111,357 plus 35% of the amount over $487,450 $731,201 or more $196,669.50 plus 37% of the amount over $731,200 Round your answer to the nearest dollar. $201,051 - $383,900 $34,337 plus 24% of the amount over $201,050 Recall the standard deduction for married filers: $29,200