Question: Can you answer this question? C & https://ilearn.mq.edu.au/mod/quiz/attempt.php?attempt=9040743&cmid=6272784&page=2 y units / ACCG8126_FHFYR_2021_ALL_U|ACCG8126 Corporate Accounting 2021 51 / Exam Period Assessments Session 1 2021 / Final

Can you answer this question?

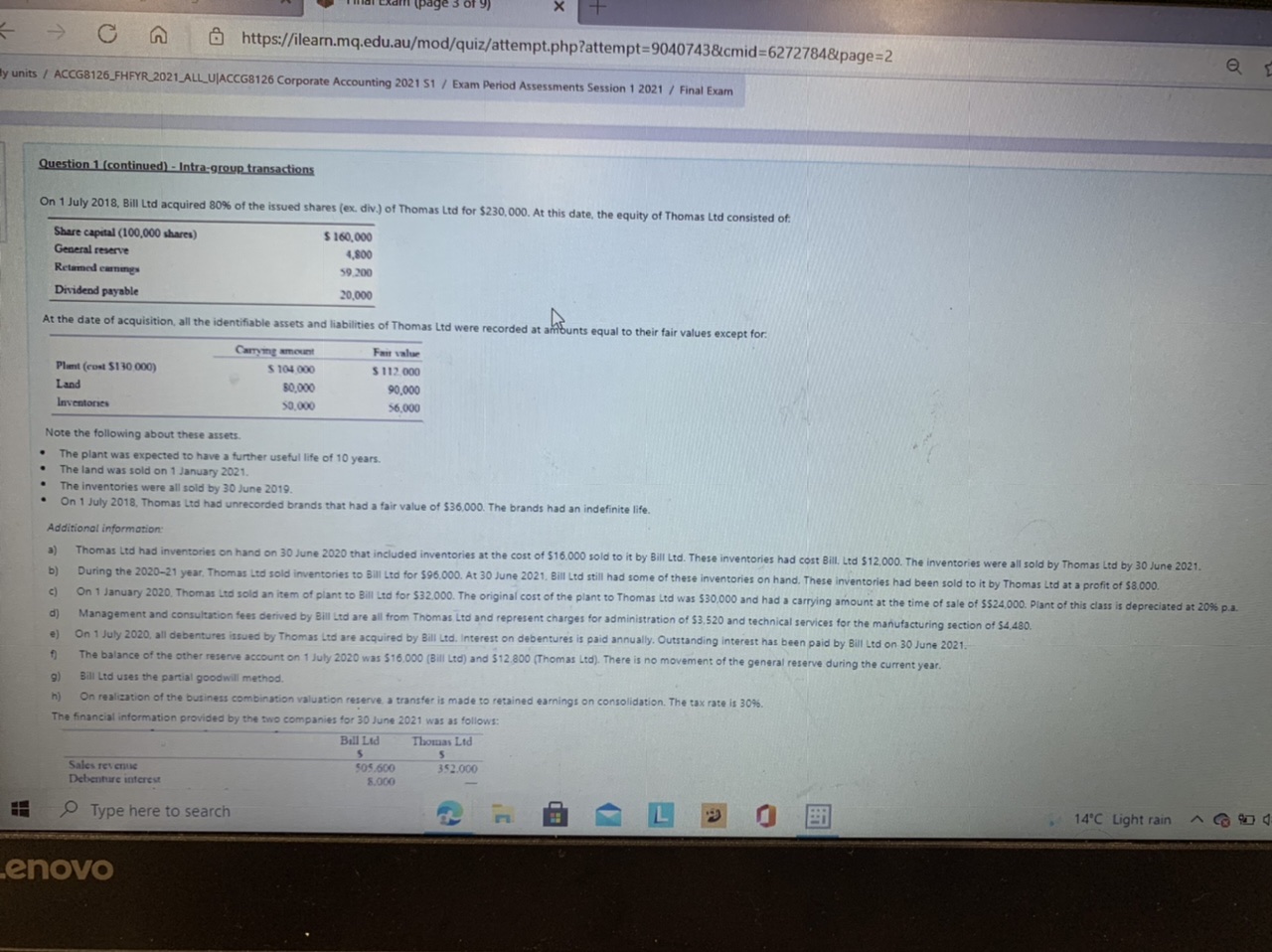

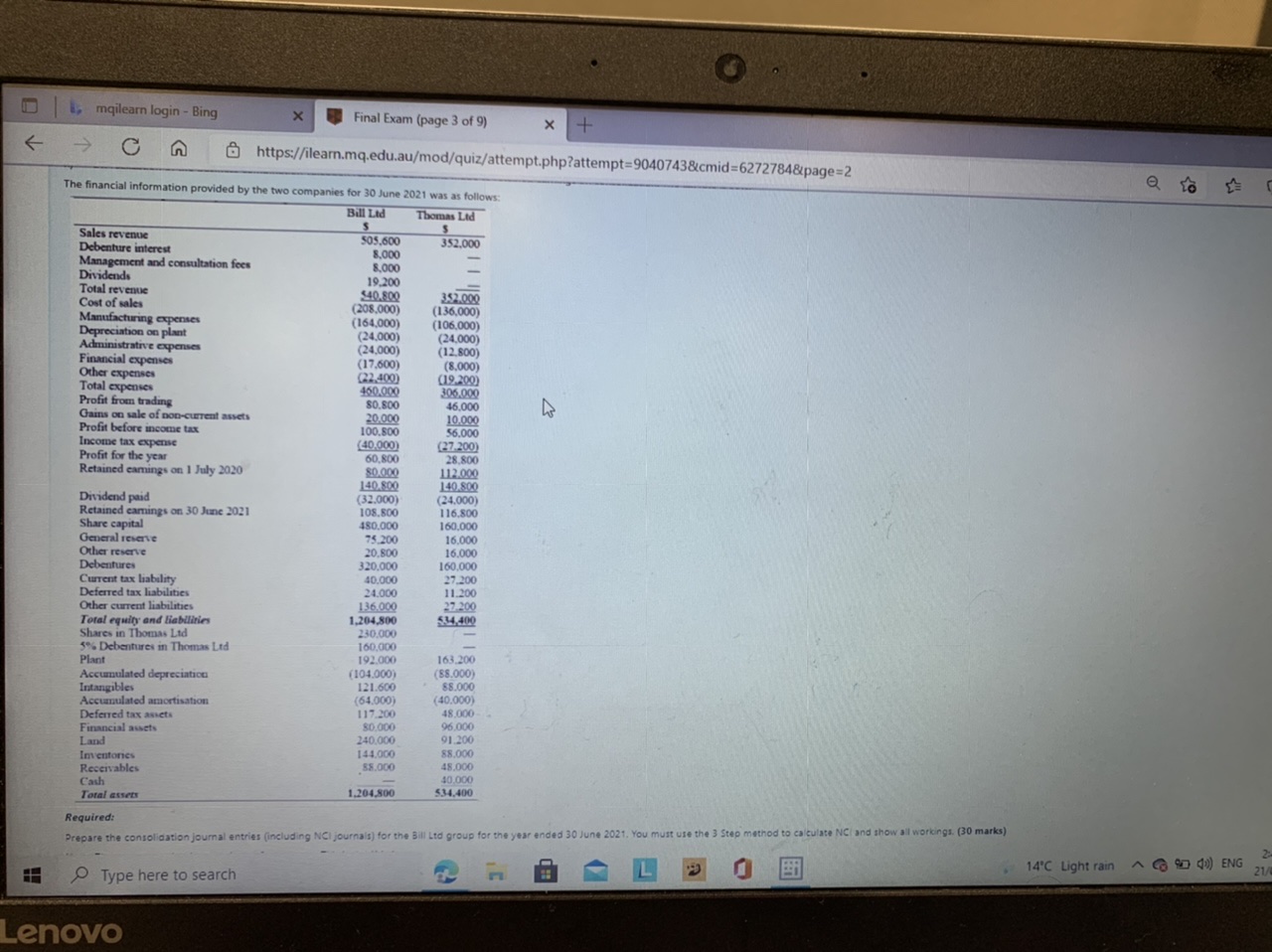

C & https://ilearn.mq.edu.au/mod/quiz/attempt.php?attempt=9040743&cmid=6272784&page=2 y units / ACCG8126_FHFYR_2021_ALL_U|ACCG8126 Corporate Accounting 2021 51 / Exam Period Assessments Session 1 2021 / Final Exam Question 1 (continued) - Intra-group transactions On 1 July 2018, Bill Ltd acquired 80% of the issued shares (ex. div.) of Thomas Ltd for $230,000. At this date, the equity of Thomas Led consisted of. Share capital (100,000 shares) $ 160,000 General reserve 4,800 Retamed earnings 59.200 Dividend payable 20,00 At the date of acquisition, all the identifiable assets and liabilities of Thomas Lid were recorded at amounts equal to their fair values except for Carrying amount Fair value Plant (cost $130 000) $ 104 000 $ 112 000 Land 50.000 90.000 Inventories 50.000 56.000 Note the following about these assets. The plant was expected to have a further useful life of 10 years. The land was sold on 1 January 2021. The inventories were all sold by 30 June 2019. On 1 July 2018, Thomas Ltd had unrecorded brands that had a fair value of $36,000. The brands had an indefinite life. Additional information Thomas Ltd had invent ries on hand on 30 June 2020 that included inventories at the cost of $16,000 sold to it by Bill Led. These inventories had cost Bill. Led $12,000. The inventories were all sold by Thomas Led by 30 June 2021. b) During the 2020-21 year. Thomas Ltd sold inventories to Bill Lid for $96,000. At 30 June 2021. Bill Led still had some of these inventories on hand. These inventories had been sold to it by Thomas Led at a profit of $8.000. C) On 1 January 2020. Thomas Led sold an item of plant to Bill Lid for $32.000. The original cost of the plant to Thomas Led was $30,000 and had a carrying amount at the time of sale of $524,000. Plant of this class is depreciated at 20% p.a. Manageme ultation fees derived by Bill Ltd are all from Thomas Ltd and represent charges for administration of $3,520 and technical services for the manufacturing section of $4,480. On 1 July 2020, all debentures issued by Thomas Ltd are acquired by Bill Led. Interest on debentures is paid annually. Outstanding interest has been paid by Bill Led on 30 June 2021. The balance of the other reserve account on 1 July 2020 was $16.000 (Bill Ltd) and $12.800 (Thomas Ltd). There is no movement of the general reserve during the current year. 9) Bill Ltd uses the partial goodwill method. h) On realization of the business com ation reserve, a transfer is made to retained earnings on consolidation. The tax rate is 309%. The financial information provided by the two companies for 30 June 2021 was as follows: Bill Lid Thomas Lid 5 5 Sales revenue 505.600 352.000 Debenture interest 8.000 Type here to search n L 14'C Light rain ~ enovo, mqilearn login - Bing X Final Exam (page 3 of 9) X + https://ilearn.mq.edu.au/mod/quiz/attempt.php?attempt=9040743&cmid=6272784&page=2 Q to The financial information provided by the two companies for 30 June 2021 was as follows: Bill Led Thomas Lid Sales revenue 505.600 Debenture interest 352,000 8,000 Management and consultation fees 8,000 Dividends 19.200 Total revenue $40.800 Cost of sales 352.000 (208,000) Manufacturing expenses (136,000) (164,000) (106,000) Depreciation on plant (24,000) (24,000) Administrative expense (24,000) (12,800) Financial expenses (17.600) (8,000) Other expenses (22.400) (19.200) Total expenses 460.000 306.000 Profit from trading 80.800 46.000 Gains on sale of non-current assets 20.000 10.000 Profit before income tax 100.800 56.000 Income tax expense (40.000) (27.200) Profit for the year 60.800 28,800 Retained earnings on 1 July 2020 80.000 112.000 140.800 140.800 Dividend paid (32.000) (24,000) Retained earnings on 30 June 2021 108.500 116,800 Share capital 480.000 160,000 General reserve 75.200 16,000 Other reserve 20.800 16,000 Debentures 320.000 160,000 Current tax liability 40.000 27.200 Deferred tax liabilities 24.000 11.200 Other current liabilities 136.000 27.200 Total equity and liabilities 1,204,800 $34,400 Shares in Thomas Lid 230.000 5% Debentures in Thomas Led 160.000 Plant 192.000 163.200 Accumulated depreciation 104.000) 86.000) Intangibles 121.600 68.000 Accumulated amortisation (64,000) 40.000) Deferred tax assets 117.200 48,000- Financial assets 80.000 96,000 Land 240.000 91.200 Inventories 144,000 $8.000 Receivables 88.000 48,000 Cash 40,000 Total assets 1.204,800 $34.400 Required: Prepare the consolidation journal entries (including NCI journals) for the Bill Lid group for the year ended 30 June 2021. You must use the 3 Step method to calculate NC and show all workings. (30 marks) 14'C Light rain ~ ( 4) ENG 21 Type here to search Lenovo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts