Question: Can you calculate and then format into a binomial tree? A stock price is currently $35. Over each three-month interval, it is expected to go

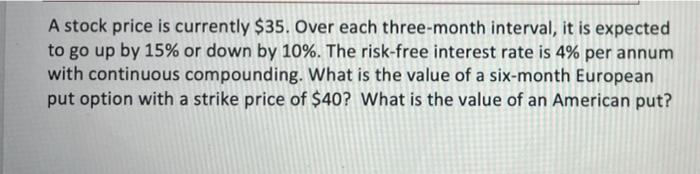

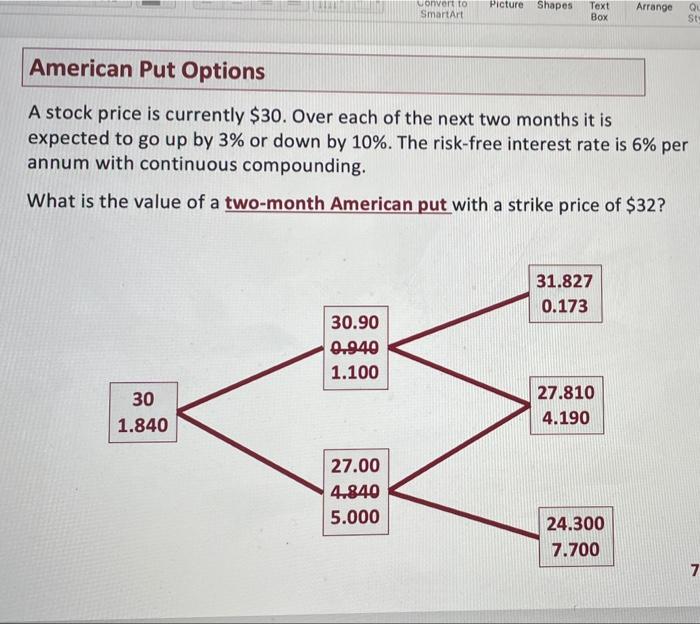

A stock price is currently $35. Over each three-month interval, it is expected to go up by 15% or down by 10%. The risk-free interest rate is 4% per annum with continuous compounding. What is the value of a six-month European put option with a strike price of $40? What is the value of an American put? Wonvert to SmartArt Picture Shapes Text Box Arrange QU St. American Put Options A stock price is currently $30. Over each of the next two months it is expected to go up by 3% or down by 10%. The risk-free interest rate is 6% per annum with continuous compounding. What is the value of a two-month American put with a strike price of $32? 31.827 0.173 30.90 0.949 1.100 30 1.840 27.810 4.190 27.00 4.840 5.000 24.300 7.700 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts