Question: Can you do in excel please? 2. The Loviscek Co. is considering the purchase of a new machine. Financial projections for the investment are provided

Can you do in excel please?

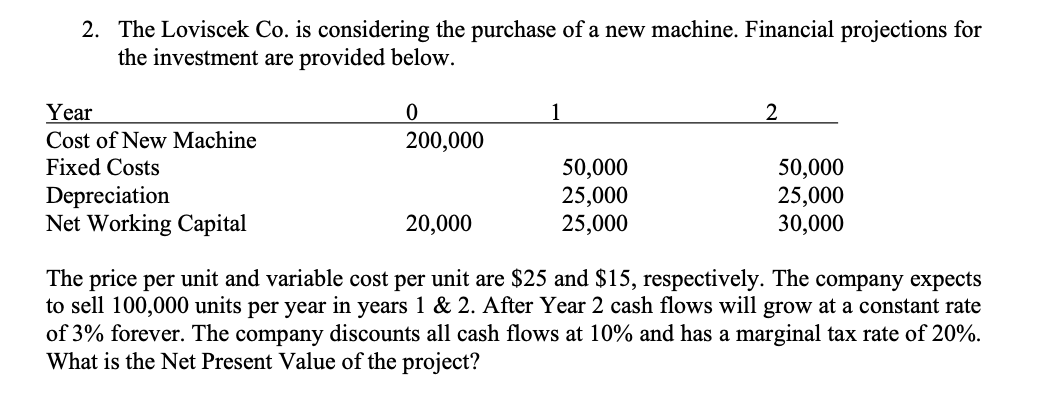

2. The Loviscek Co. is considering the purchase of a new machine. Financial projections for the investment are provided below. 2 0 200,000 Year Cost of New Machine Fixed Costs Depreciation Net Working Capital 50,000 25,000 25,000 50,000 25,000 30,000 20,000 The price per unit and variable cost per unit are $25 and $15, respectively. The company expects to sell 100,000 units per year in years 1 & 2. After Year 2 cash flows will grow at a constant rate of 3% forever. The company discounts all cash flows at 10% and has a marginal tax rate of 20%. What is the Net Present Value of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts