Question: Case Study Please answer all the questions New Product Co is considering launching a new product. Relevant financial information includes: Selling price (current price terms)

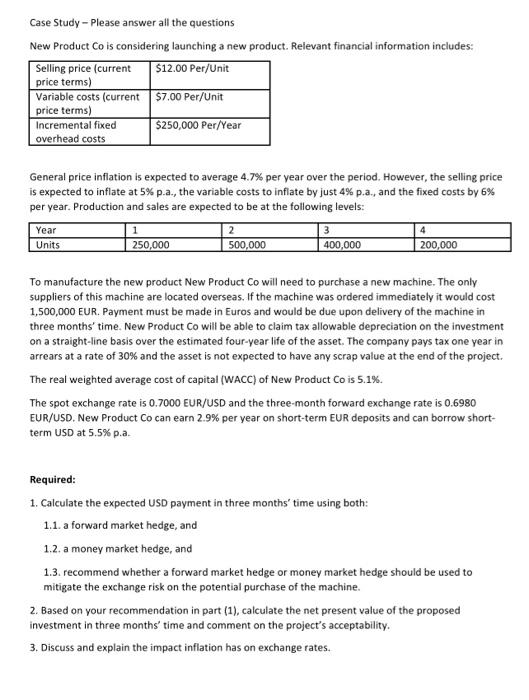

Case Study - Please answer all the questions New Product Co is considering launching a new product. Relevant financial information includes: Selling price (current $12.00 Per/Unit price terms) Variable costs (current $7.00 Per/Unit price terms) Incremental fixed $250,000 Per/Year overhead costs General price inflation is expected to average 4.7% per year over the period. However, the selling price is expected to inflate at 5% p.a., the variable costs to inflate by just 4% p.a., and the fixed costs by 6% per year. Production and sales are expected to be at the following levels: 3 4 400,000 200,000 Year Units 1 250,000 2 500,000 To manufacture the new product New Product Co will need to purchase a new machine. The only suppliers of this machine are located overseas. If the machine was ordered immediately it would cost 1,500,000 EUR. Payment must be made in Euros and would be due upon delivery of the machine in three months' time. New Product Co will be able to claim tax allowable depreciation on the investment on a straight-line basis over the estimated four-year life of the asset. The company pays tax one year in arrears at a rate of 30% and the asset is not expected to have any scrap value at the end of the project. The real weighted average cost of capital (WACC) of New Product Co is 5.1%. The spot exchange rate is 0.7000 EUR/USD and the three month forward exchange rate is 0.6980 EUR/USD. New Product Co can earn 2.9% per year on short-term EUR deposits and can borrow short- term USD at 5.5% p.a. Required: 1. Calculate the expected USD payment in three months' time using both: 1.1. a forward market hedge, and 1.2. a money market hedge, and 1.3. recommend whether a forward market hedge or money market hedge should be used to mitigate the exchange risk on the potential purchase of the machine. 2. Based on your recommendation in part (1), calculate the net present value of the proposed investment in three months' time and comment on the project's acceptability. 3. Discuss and explain the impact inflation has on exchange rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts