Question: Can you explain how to find the correct answer with solutions? Problem 1 (Computation of Proceeds from Discounting of Notes Receivable) On July 1, 2020,

Can you explain how to find the correct answer with solutions?

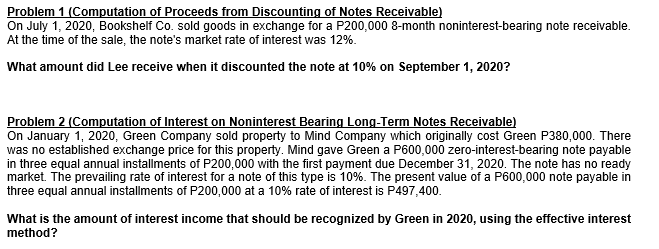

Problem 1 (Computation of Proceeds from Discounting of Notes Receivable) On July 1, 2020, Bookshelf Co. sold goods in exchange for a P200,000 8-month noninterest-bearing note receivable. At the time of the sale, the note's market rate of interest was 12%. What amount did Lee receive when it discounted the note at 10% on September 1, 2020? Problem 2 (Computation of Interest on Noninterest Bearing Long-Term Notes Receivable) On January 1, 2020, Green Company sold property to Mind Company which originally cost Green P380,000. There was no established exchange price for this property. Mind gave Green a P600,000 zero-interest-bearing note payable in three equal annual installments of P200,000 with the first payment due December 31, 2020. The note has no ready market. The prevailing rate of interest for a note of this type is 10%. The present value of a P600,000 note payable in three equal annual installments of P200,000 at a 10% rate of interest is P497,400. What is the amount of interest income that should be recognized by Green in 2020, using the effective interest method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts