Question: can you explain how to get the answer without excel and with a financial calculator 4. (20 pts) You are planning on acquiring a machine

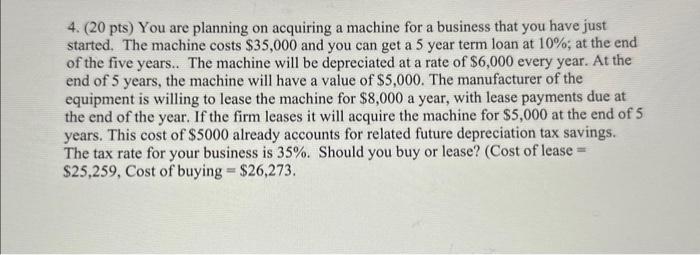

4. (20 pts) You are planning on acquiring a machine for a business that you have just started. The machine costs $35,000 and you can get a 5 year term loan at 10%; at the end of the five years.. The machine will be depreciated at a rate of $6,000 every year. At the end of 5 years, the machine will have a value of $5,000. The manufacturer of the equipment is willing to lease the machine for $8,000 a year, with lease payments due at the end of the year. If the firm leases it will acquire the machine for $5,000 at the end of 5 years. This cost of $5000 already accounts for related future depreciation tax savings. The tax rate for your business is 35%. Should you buy or lease? (Cost of lease = $25,259, Cost of buying =$26,273

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts